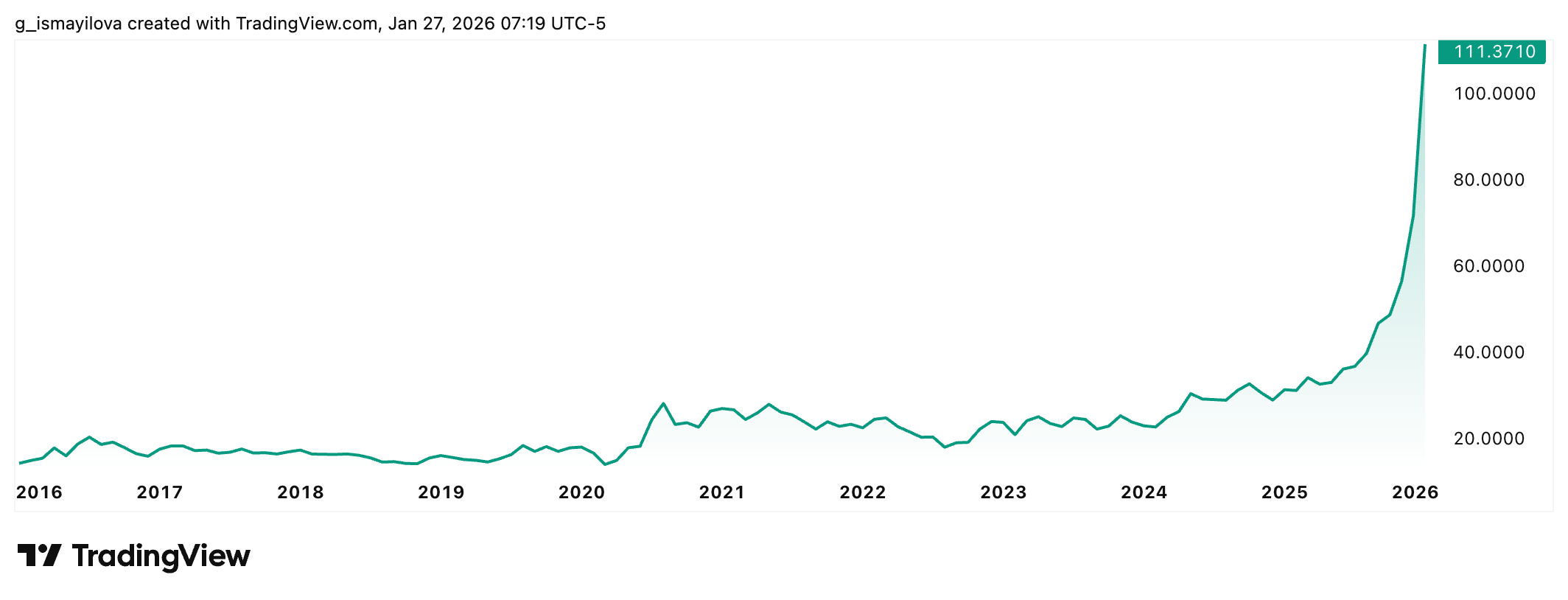

Silver surged to a record high on Monday, briefly reaching $117 per troy ounce before retreating toward $105 by late U.S. trading, according to the TradingView data. The rally has now surpassed bitcoin’s gains since the peak of the crypto cycle in late 2017.

At the end of 2017, silver traded near $17 per ounce. Despite Monday’s pullback, the metal has risen roughly 517% over this period. By comparison, bitcoin, which peaked near $20,000 at the same time and currently trades around $87,700, gained approximately 500% over the same stretch. Gold also hit a record, trading at $5,107 per ounce, up roughly 300% since 2017.

Trading volumes surged across precious metals markets, with silver-linked exchange-traded funds seeing unprecedented turnover. The iShares Silver Trust recorded more than $32 billion in volume on Monday.

Momentum trade collides with milestone bias

Analysts say psychological price thresholds and momentum trading are driving the surge. Nic Puckrin, co-founder of Coin Bureau, said,

“This morning, investors are reckoning with a new reality as gold hits $5,000 for the first time in history, while silver has topped $100. Behavioural investing theory tells us investors have a bias toward such milestones, and that's likely amplifying the move.”

Puckrin added that structural demand for silver linked to the AI build-out supports prices. Industrial metals such as copper and silver are integral to data centers, semiconductors, and power grids. He also noted that a weaker U.S. dollar, down more than 15% from its 2022 peak, has supported the rally.

The rally in precious metals contrasts sharply with crypto markets. Bitcoin retreated toward $87,000 over the weekend, as risk-off sentiment weighed on digital assets.

Gold hits new highs as geopolitical concerns persist

Gold rose slightly on Tuesday, hovering just below the $5,100 per-ounce level after reaching $5,110.50 on Monday. Market participants cited geopolitical uncertainty and trade tensions as drivers of safe-haven demand. Zain Vawda, analyst at MarketPulse by OANDA, explained,

“The constant back and forth by President Trump and the U.S. administration, coupled with growing concerns around a military operation in Iran, are unlikely to curb safe-haven demand anytime soon.”

Analysts at Deutsche Bank and Societe Generale forecast gold could reach $6,000 per ounce in 2026, signaling potential for further gains.

Silver’s parabolic rally faces potential reversal

Market experts warned that silver’s rapid ascent could trigger sharp corrections. Mike McGlone, Senior Commodity Strategist at Bloomberg Intelligence, said,

“I think silver will put in a high this year to last for years. When price shifts at such high velocity, deficits reverse.”

Rhona O’Connell, Head of Market Analysis at StoneX, said,

“Silver is in the midst of a self-propelled frenzy. When it starts coming off, it could be as precipitous as the rise — the near-vertical movements we are seeing now.”

She noted that supply constraints, particularly the fact that only 28% of silver comes from primary mines, will limit the market’s ability to quickly adjust.

O’Connell emphasized that while $100 per ounce has already challenged expectations, further gains toward $150 appear unlikely.

“Consumers have been chasing the market, so when that stops, we could easily see a recoil. When it goes, it could be calamitous,” she said.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.