Japanese bitcoin treasury firm Metaplanet reaffirmed its plan to accumulate more BTC even as the asset dropped toward $60,000 on Friday. The company signaled no change in its strategy despite a sharp decline in both crypto prices and its own stock performance.

CEO Simon Gerovich addressed shareholders in a post on X and acknowledged current pressure on the company.

"We are fully aware that, given the recent stock price trends, our shareholders continue to face a challenging situation," he wrote. He added that the firm would stay committed to its roadmap. "We will steadily continue to accumulate Bitcoin, expand revenue, and prepare for the next phase of growth."

Bitcoin traded around $60,000 before bouncing back to the $63,000 range. This was one of a larger drop that saw the asset lose almost half of its value since it peaked in October 2025.

Stock pressure grows as crypto holdings sit in the red

Metaplanet’s shares fell during trading, with declines reported between about 5% and 8% depending on the session. The stock closed down 5.56% at 340 yen on the Tokyo Stock Exchange. Over a six-month period, the stock dropped more than 63.4%.

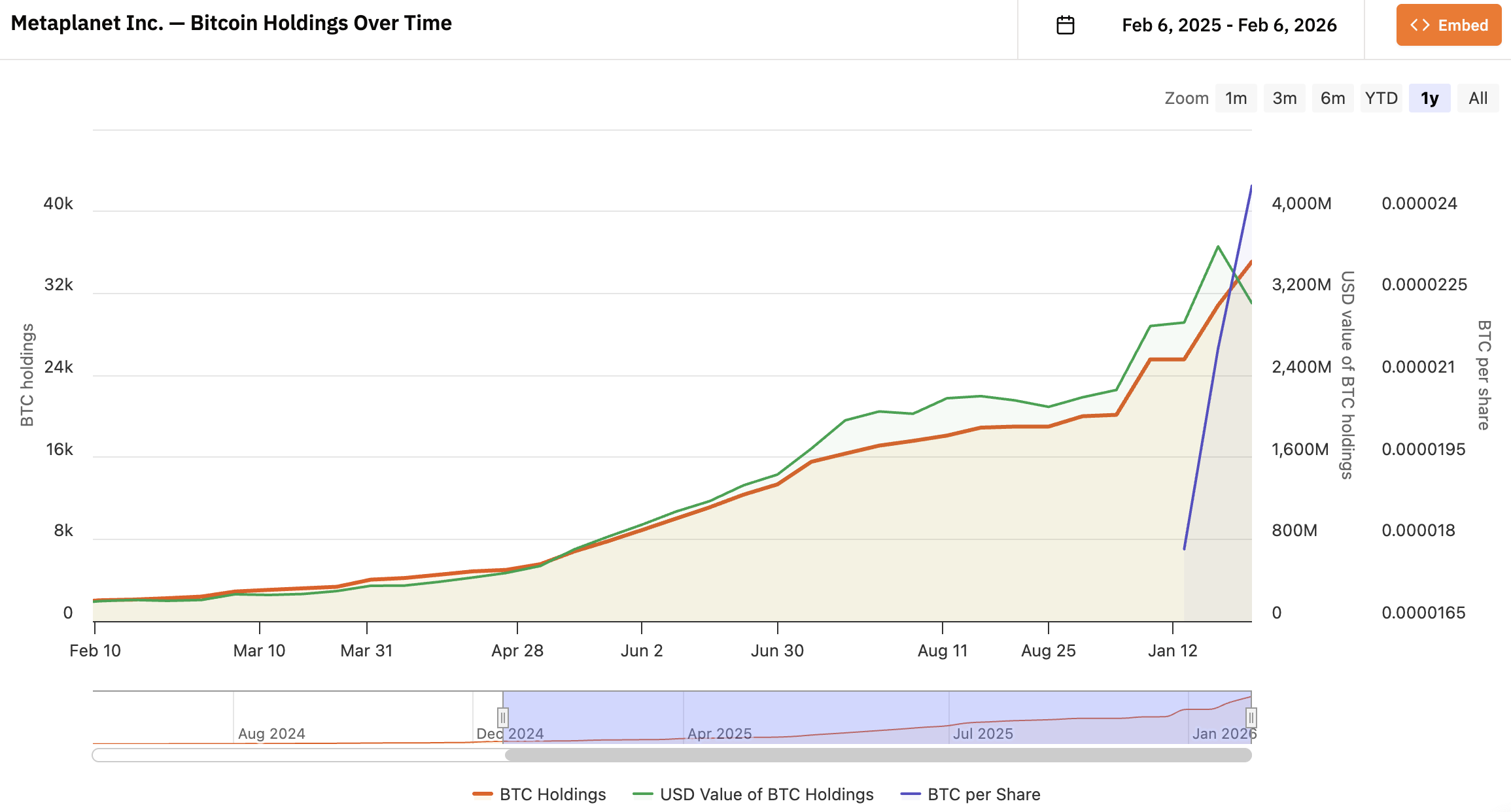

The company’s bitcoin reserves sit below acquisition cost. Metaplanet holds 35,102 BTC, according to BitcoinTreasuries.NET. Its average purchase price stands near $107,716 per coin, which places the treasury at a sizable unrealized loss under current market conditions.

The firm acquired roughly $451 million worth of bitcoin during the final quarter of 2025. The strategy mirrors a long-term treasury approach rather than short-term market timing.

Metaplanet plans to raise as much as $137 million through common shares and stock acquisition rights. The capital would support additional bitcoin purchases and debt reduction. Shareholder reaction remained cautious after the announcement.

*Notice Regarding Issuance of New Shares and 25th Series Stock Acquisition Rights through Third-Party Allotment* pic.twitter.com/upB0YnvaXT

— Metaplanet Inc. (@Metaplanet) January 29, 2026

Corporate bitcoin treasuries face mounting losses

Metaplanet’s position reflects broader pressure across corporate crypto treasuries. Strategy, the largest public holder of bitcoin, reported a $12.6 billion net loss for the fourth quarter of 2025 as BTC traded below its average purchase price of $76,052. Strategy purchased another 855 BTC earlier this week, worth about $75 million.

Michael Saylor stated that the firm would continue buying bitcoin and dismissed liquidation concerns. Strategy CEO Phong Le noted that BTC would need to fall near $8,000 before becoming a threat to its position.

Ethereum-focused treasury firms also carry losses. Bitmine holds about 1.17 million ETH while reporting more than $8.25 billion in unrealized losses.

Market stress deepens as sentiment deteriorates

Bitcoin trades about 50% below its all-time high of $126,080 from October 2025. The Crypto Fear & Greed Index dropped to levels last seen during the Terra Luna collapse in May 2022, which marked one of the market’s most severe confidence shocks.

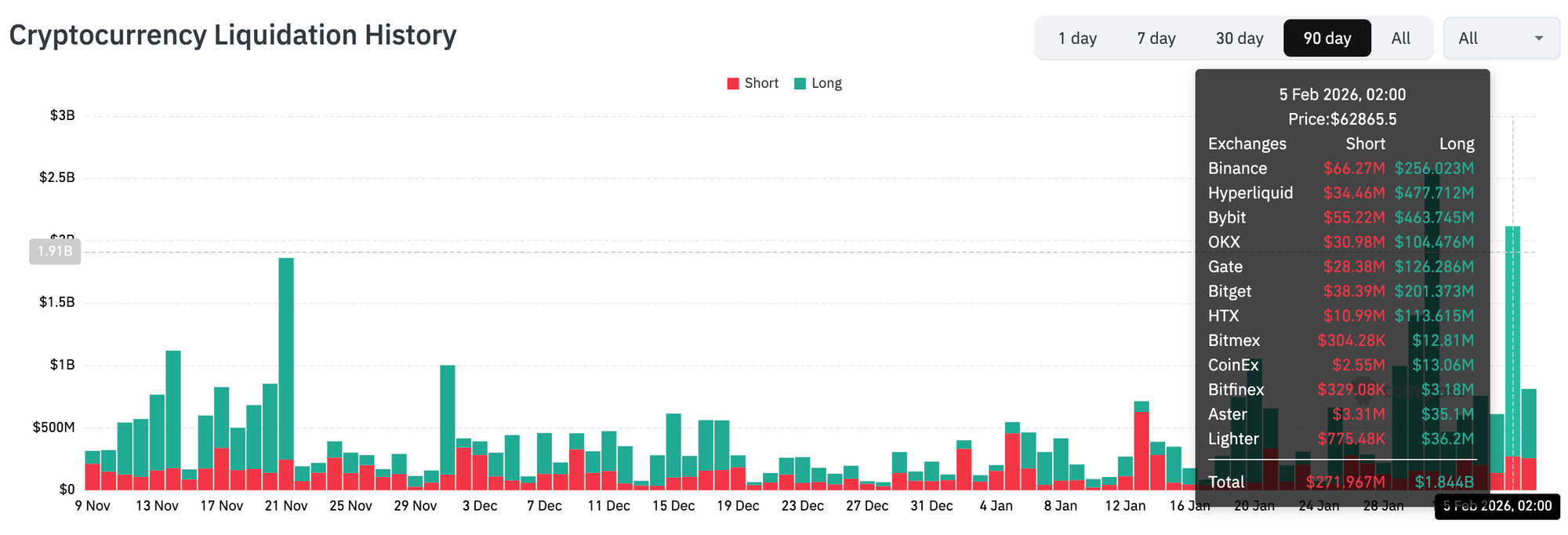

Coinglass data shows $1.844 billion in crypto long liquidations on Thursday. Forced selling and volatility reshaped positioning across the market.

Polymarket data indicates that 72% of participants expect bitcoin to fall below $55,000 in the near term. The prediction reflects heightened bearish sentiment after weeks of price declines.

Strategy remains unchanged despite losses

Gerovich reiterated that Metaplanet would not alter its bitcoin-first approach despite pressure on shareholders and balance sheet performance.

"There is no change to Metaplanet’s strategy. We will steadily continue to accumulate Bitcoin, expand revenue and prepare for the next phase of growth," he wrote.

The company ranks among the top public bitcoin treasury firms globally, behind Strategy, MARA Holdings, and Twenty One Capital. Its accumulation model mirrors a long-term conviction strategy shared by several institutional holders.

Market conditions remain difficult for treasury firms whose balance sheets track crypto price movements. Losses on paper continue to grow as BTC trades below acquisition averages. Capital raises and continued accumulation signal that Metaplanet views the downturn as a phase rather than a structural shift.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that, despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.