Crypto markets opened the week with subdued momentum after a $700 billion selloff erased gains across digital assets days earlier. Total market capitalization hovered near $2.45 trillion over the weekend, the lowest level since November 2024. Bitcoin recovered to around $71,000 after dropping close to $60,000 on Friday, yet the asset remains about 44% below its all-time high. Ether returned above $2,100 but still sits roughly 58% below its August peak. Most altcoins posted minor rebounds yet remained heavily depressed after last week’s liquidation wave.

The macro calendar now shapes sentiment across crypto trading desks. Several U.S. economic releases and central bank signals will determine liquidity expectations and risk appetite. Traders treat these data points as catalysts that can trigger rapid price swings across Bitcoin and altcoins.

Labor and inflation data set tone for crypto sentiment

The week’s economic schedule includes December retail sales, January employment data, jobless claims, and the January Consumer Price Index. The Kobeissi Letter listed these releases as the primary events likely to move markets, alongside multiple Federal Reserve speaker appearances and continued data disruptions tied to the partial U.S. government shutdown.

Key Events This Week:

— The Kobeissi Letter (@KobeissiLetter) February 8, 2026

1. December Retail Sales data - Monday

2. January Jobs Report - Wednesday

3. Initial Jobless Claims data - Thursday

4. January Existing Home Sales data - Thursday

5. January CPI Inflation data - Friday

6. 5 Fed speaker events this week

More government…

Employment figures stand at the center of market expectations. Forecasts suggest modest payroll growth after December’s gain, while revisions to earlier data could reshape the outlook for monetary policy. Federal Reserve Chair Jerome Powell previously stated that official data may have overstated job growth by as much as 60,000 jobs per month since April. That context raises the stakes for new figures and revisions.

Jim Cramer emphasized the importance of the labor data in comments on CNBC.

"There’s a lot going on next week, but the most important thing, believe it or not, is the Labor Department’s nonfarm payroll report on Wednesday," he said. "If that comes in soft, it means the Fed can keep cutting rates, and that’s great news for the stock market itself."

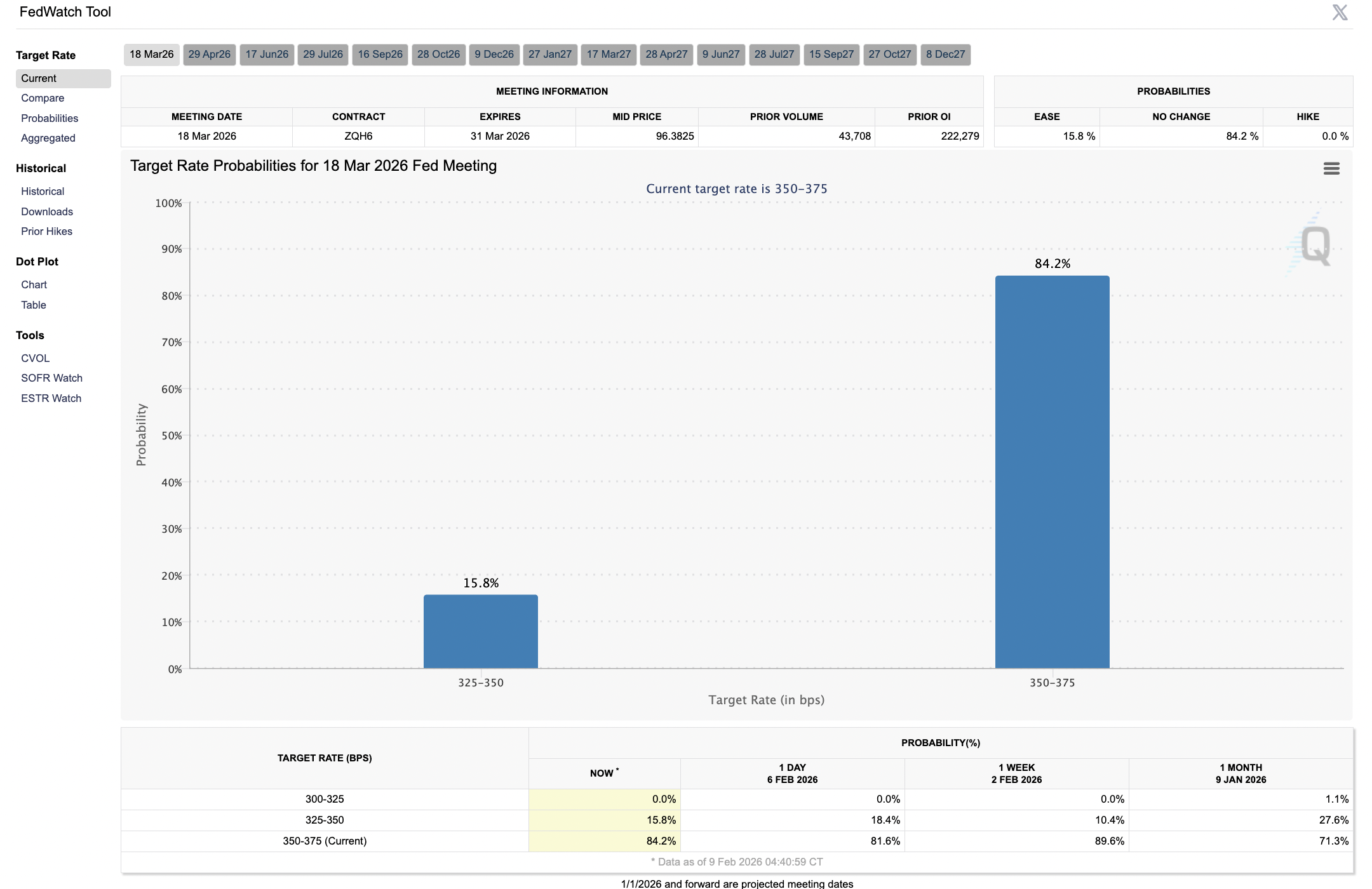

Interest rate expectations influence crypto performance through liquidity conditions. Markets have treated weaker employment signals as a potential trigger for policy easing, which tends to support speculative assets. Stronger data can reinforce a higher-rate outlook and pressure digital assets.

Inflation data seen as decisive trigger

January CPI data arrives at the end of the week and may set the direction for risk assets. Inflation trends guide expectations for Federal Reserve policy and shape demand for bitcoin as a macro hedge. Cooler readings in recent months supported risk assets by weakening the higher-rate narrative.

Kyle Chasse addressed the stakes in a public remark.

"If data comes in hot, rates will likely stay higher, and risk assets may struggle. If data cools, rate cut expectations could return, and markets may breathe. This week will tell us what comes next."

This week is the pulse of the economy.

— Kyle Chassé 🐸 (@Kylechasse) February 9, 2026

We saw a small recovery over the weekend.

But weekend moves rarely decide trend.

This week will bring us an idea of the real signal.

Retail sales and CPI will show if consumers are strong and if inflation stays hot.

Jobs data will show… pic.twitter.com/6BQJ7tsRcF

Crypto markets react quickly to shifts in inflation outlook because rate policy affects leverage, capital flows, and institutional positioning. Treasury yield changes often translate into immediate price pressure across bitcoin and altcoins.

Jobless claims and Fed signals add uncertainty

Initial jobless claims later in the week will provide another test for market stability. Recent spikes have coincided with volatility across crypto markets. Rising claims are interpreted by traders as an early signal of economic stress, prompting defensive positioning. Deteriorating labor data is viewed as a pathway toward easier policy and renewed liquidity.

Federal Reserve communications also carry weight. Appearances by governors and regional presidents may shape expectations around rate cuts and financial conditions. Crypto markets have reacted strongly to central bank commentary in recent months as traders look for confirmation of policy direction.

A scheduled appearance by Federal Reserve Governor Stephen Miran has drawn attention due to his public stance on stablecoins and monetary policy.

Market structure reflects fragile recovery

Crypto assets attempt stabilization after last week’s selloff. Bitcoin holds a range above $70,000 while ether struggles to regain momentum. Altcoins remain under pressure, which reflects a market structure dominated by macro sentiment rather than sector-specific catalysts.

Traders now treat economic releases as the main drivers of short-term direction. Liquidity expectations, inflation signals, and labor data shape positioning across derivatives and spot markets. Price action reflects uncertainty rather than conviction.

Gold and silver rallied at the same time as crypto volatility increased. Gold returned to $5,000 per ounce and silver moved back toward $80 per ounce. That divergence highlights investor caution and a shift toward defensive assets during macro stress.

Week ahead tests crypto resilience

The coming days will test whether digital assets can regain stability after a major drawdown. Market participants will assess each economic release for signals on interest rates, liquidity, and growth conditions. Crypto sentiment remains closely tied to macro narratives rather than internal industry developments.

Bitcoin’s price trajectory now depends on whether macro data supports easing expectations or reinforces tighter policy. Inflation, employment, and central bank communication stand as the primary drivers for the week. Traders prepare for sharp moves in either direction as markets process each release.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.