Just a few years ago, DeFi protocols were experiments. In early 2026, the picture is completely different. Aave manages $75 billion in deposits. Uniswap has processed over $4 trillion in trades. Lido now secures nearly a quarter of all staked Ethereum. And the entire DeFi market is projected to reach $238.54 billion in 2026, according to the Mordor Intelligence report.

That’s exactly why we shouldn’t fall behind and should try to get the most out of decentralized finance (DeFi). This article looks at the best DeFi protocols in 2026 that offer strong earning opportunities and show fast technological progress.

What does a strong DeFi protocol look like in 2026?

What does a strong DeFi protocol actually mean in 2026? Today, strength is measured by how well a protocol works as a real financial product.

First, it must earn real revenue. That means users pay fees because the protocol solves a real need like lending, swapping, or managing risk.

Security is non-negotiable. A strong protocol has audits, safe smart contracts, and no history of major exploits. One serious hack can erase years of trust overnight.

Next comes TVL and liquidity. TVL shows how much capital users trust the protocol with. But the key is activity - how regularly people are borrowing, trading, and staking. Healthy volume matters more than locked but idle funds.

Then there’s the product moat. Does it offer something hard to copy? Faster execution, or better capital efficiency? If not, competitors will catch up.

Finally, look at resilience and development. Can it handle market crashes? Are developers actively maintaining a code, and governance participants still engaged?

Top DeFi protocols to watch

Based on the criteria above, we’ve created this list of the most promising DeFi platforms to track in 2026. Here is a summary table of them.

Aave

Aave started in 2017 as a simple peer-to-peer lending project called ETHLend. It gradually evolved into the biggest lending protocol in DeFi. Its markets are used not only by individuals, but also by funds, DAOs, and even other protocols as their main source of capital.

At the end of 2025, Aave founder Stani Kulechov shared the “Aave Will Win: 2026 Master Plan” on X. He said Aave will launch V4 to unify liquidity across chains and make the protocol safer and more efficient, expand institutional tools and launch a mobile app for retail users.

“The protocol is now comparable in size to the top 50 banks in the U.S., which is the world’s financial hub.” — Stani Kulechov

Besides, in Jan 2026, Aave raised the limit for PT-sUSDe, a principal token, to $800 million on its Plasma layer, which means more capital can flow into this market and liquidity is getting stronger.

In the screenshot above, a Reddit user shares a positive experience with Aave.

Lido

Lido appeared in 2020, when Ethereum staking was complex and illiquid. At that time, if you staked ETH, you had to lock it and wait, with no way to use it elsewhere. Lido solved this by giving users a liquid token in return for their staked ETH, which could still be traded or used in DeFi. It made Lido the dominant Ethereum staking provider.

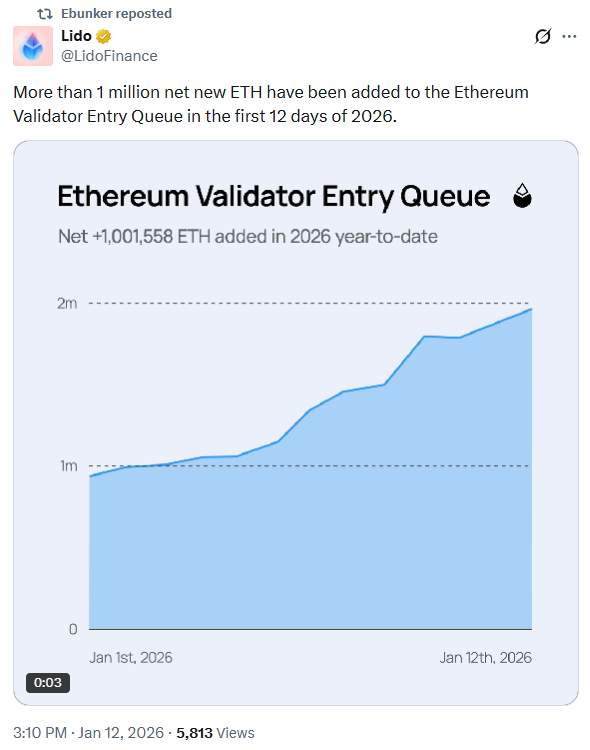

CryptoRank reports that Lido recorded over 1 million net new ETH added to Ethereum's validator queue in early 2026.

Lido released the “GOOSE-3” proposal that outlines 2026 goals to evolve into a full DeFi platform with expanded staking and Lido Earn for power users.

EigenLayer

EigenLayer introduced the idea of restaking. Normally, when you stake ETH, it only secures Ethereum. With EigenLayer, that same staked ETH can also secure other protocols, and you earn extra yield for providing that security. That means one source of security now protects many systems.

This lowers the cost for new protocols, because they don’t need to build their own security from scratch. But it also increases risk, because if something goes wrong in any protocol you restake into, your ETH can be slashed.

EigenLayer's foundation proposed changing how EIGEN rewards work so they are directly linked to AVS security and EigenCloud activity.

Uniswap

Uniswap basically invented the modern DeFi exchange model. Instead of order books and matching buyers with sellers, it uses automated market makers and liquidity pools. Prices are set by a mathematical formula, and trades happen against a pool of liquidity, not against another person.

At the end of 2025, Uniswap launched a Hook Incubator to support developers in building safer and more efficient trading features. In parallel, a major governance proposal was approved with over 125 million votes, allowing Uniswap to collect fees, burn UNI tokens, and scale the protocol long term.

Hyperliquid

Hyperliquid is relatively new, but it became famous because it solved one of DeFi’s biggest problems: speed and usability. Traditional on-chain trading feels slow, with wallet popups, confirmations, and fragmented liquidity.

Orders on Hyperliquid are placed instantly, the order book is deep, and the experience is smooth, but everything still runs on-chain. It shows that DeFi can finally compete with centralized exchanges on performance.

Hyperliquid’s developers shared emotionally on X how its ecosystem is growing, with hundreds of teams now building on HyperEVM after its 2025 launch.

Reddit users say Hyperliquid is fast and smooth for trading, but liquidity is still limited for smaller pairs.

Curve

Almost every DeFi protocol relies on stablecoins. Lending, yield strategies, DAOs, and treasuries constantly move stablecoins around.

Curve focused on stablecoin trading with minimal slippage. Curve is where this happens cheaply and efficiently, without large losses on swaps. Its new revenue-sharing model pays governance holders directly.

Curve Finance said that growing stablecoin markets in 2026 depend on having deep liquidity that anyone can access without special permission. The founders also proposed funding development teams through 2026 to continue building features like LlamaLend V2 and FXSwap.

Spark

Spark is an extension of MakerDAO’s monetary system. MakerDAO issues DAI, and Spark decides how that DAI is lent out into DeFi and institutional markets. In simple terms, Spark connects money creation with money lending. The result is very cheap and stable borrowing in DAI, backed directly by MakerDAO’s balance sheet. Spark is basically the “bank” of the DAI ecosystem.

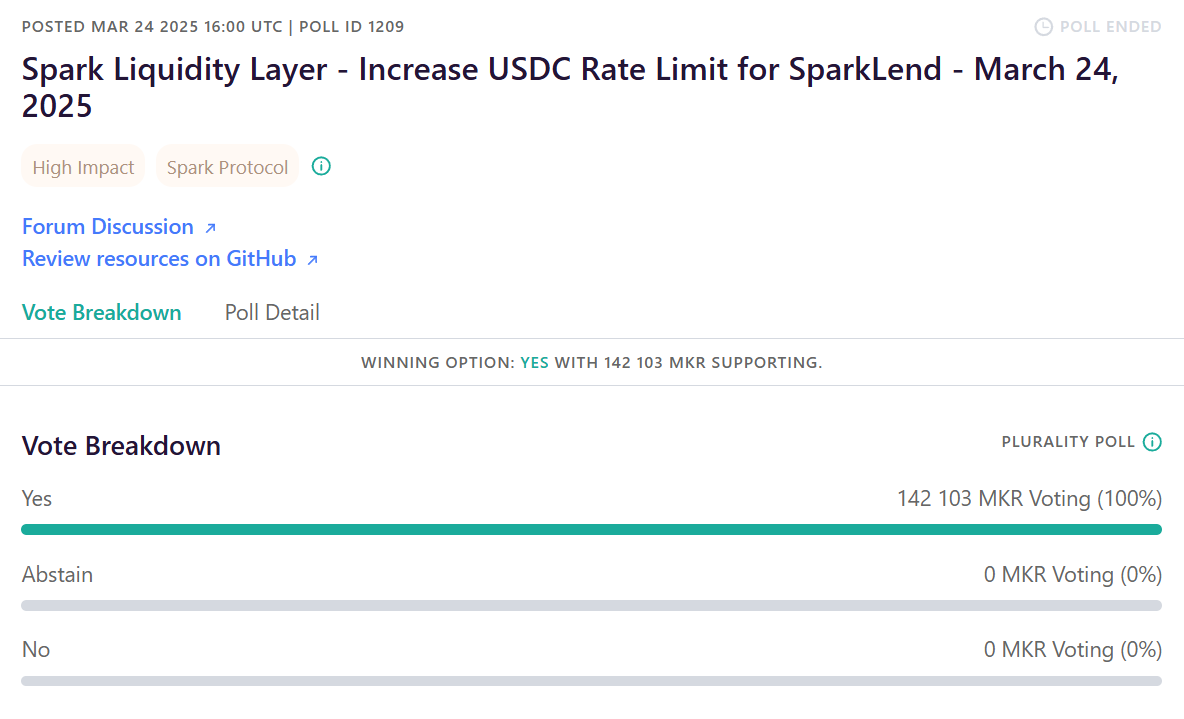

Spark saw governance approve USDC deposit cap increases for liquidity growth. This positions Spark for bullish EMA breakouts in 2026.

Pendle

Pendle created a new way to trade yield. It splits an asset into two parts: the principal and the future income. One token represents ownership of the asset, the other represents the yield it will generate. This makes yield tradable.

If you want fixed returns, you can sell your yield now. If you want to speculate, you can buy yield cheaply and bet that interest rates will rise. It turns future income into a market.

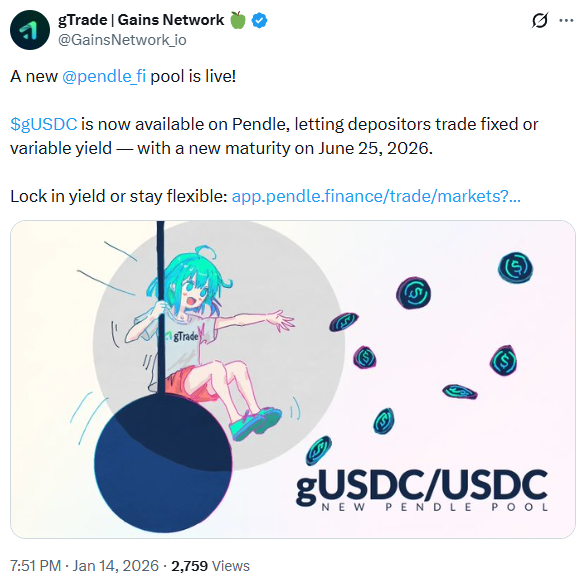

Pendle launched a gUSDC pool with June 2026 maturity for fixed/variable yield trading. Bullish sentiment grows on yield tokenization, with 2026 price forecasts up to $2.36 amid TVL gains.

Risks and challenges facing DeFi protocols

DeFi is stronger in 2026, but it isn’t risk-free. The big question is: where can things still go wrong?

- Smart contract failure. A smart contract is code that controls money. If the logic is wrong, funds can be drained. In January 2026, TrueBit lost $26 million because of a flaw in how its pricing curve worked, according to CryptoPotato.

Even with audits and AI, complex design flaws still slip through. And once a contract is live, fixing it isn’t easy. That’s why pre-launch security matters so much.

- Regulatory whiplash. There is still no clear global rulebook for DeFi. One country may treat a protocol as legal infrastructure, another as an unregistered financial service. Aave and Uniswap have avoided major damage so far, but sudden policy changes can shift the market overnight.

- Liquidation. When prices crash, automated liquidations can trigger chain reactions across lending platforms. This hits borrowers, liquidity providers, and the market itself.

Unlike banks, DeFi has no central backstop. If something collapses, there is no authority that steps in to save the system. The code just executes.

- Bad price feed. Oracles are services that send real-world prices into DeFi protocols. Smart contracts themselves cannot “see” market prices, so they depend on oracles like Chainlink.

Oracles are not often wrong in normal conditions. But problems can happen when markets move extremely fast and liquidity dries up.

Then, a protocol can think an asset is cheaper or more expensive than it really is, which can cause unfair liquidations or bad trades. It’s rare, but when it happens, the damage can be large.

- Slow governance. As protocols grow, decision-making becomes slower because there are more stakeholders, more money is at risk, and changes need more discussion and audits.

At the same time, large holders (“whales”) can concentrate power. This can result in important upgrades being delayed or decisions reflecting the interests of a small group rather than the whole DeFi ecosystem.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice. HODL FM strongly recommends contacting a qualified industry professional.