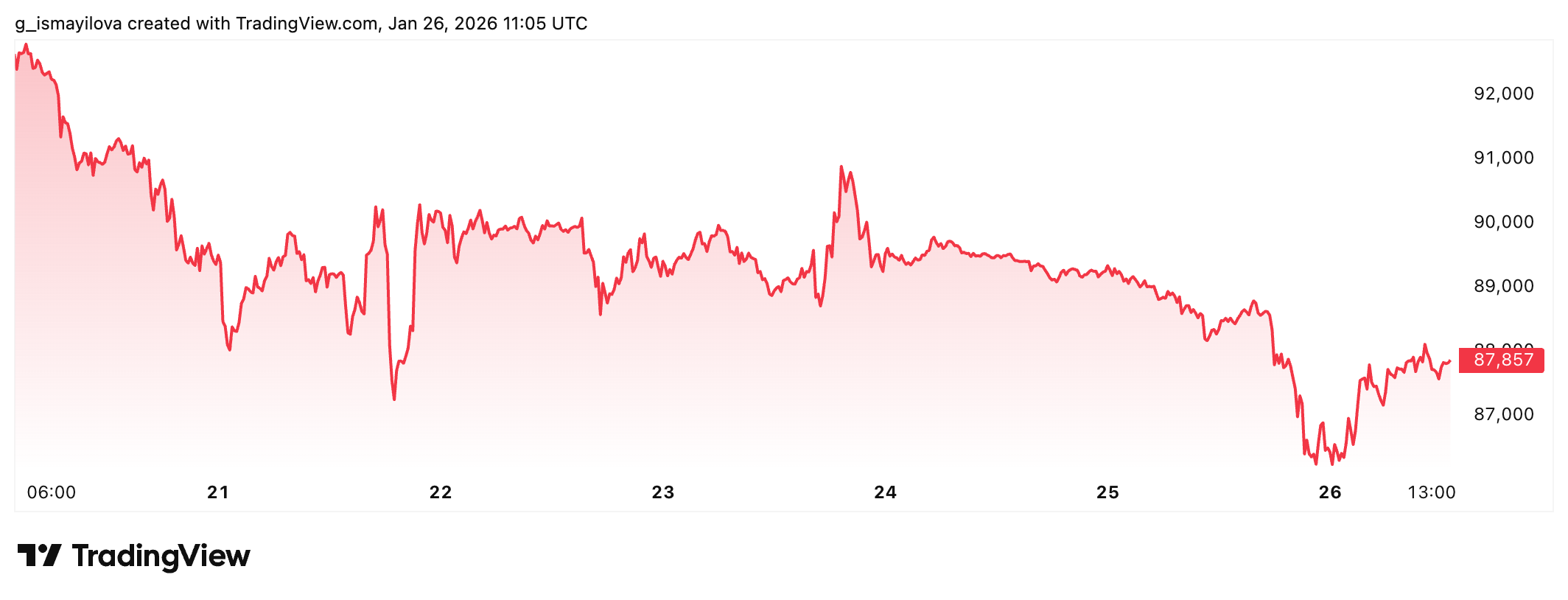

Bitcoin extended its recent pullback late Sunday as broader risk-off sentiment spread across global markets. The world’s largest cryptocurrency fell 2.87% over 24 hours to $86,074, while Ethereum dropped 6.17% to $2,787, according to The TradingView data. The decline coincided with rising macro uncertainty rather than asset-specific developments, analysts said.

Rick Maeda, research associate at Presto Research, attributed the move to external forces.

“The move in crypto to start the week was driven by a broad macro risk-off impulse rather than crypto-specific news,” Maeda said in the statement.

He cited mounting concerns around a potential US government shutdown as the dominant pressure point. “Crypto was not immune,” he added.

Polymarket data showed shutdown probability near 75% as legislative tensions intensified in Congress, according to Associated Press reporting. The standoff followed disputes over Department of Homeland Security funding and renewed memories of prior shutdown disruptions.

Liquidity constraints overshadow volatility concerns

Institutional investors have adapted to Bitcoin’s volatility over time. Volatility remains measurable and hedgeable through futures and options. Execution risk presents a different challenge. Large funds cannot hedge the market impact of size when liquidity thins and order books fail to absorb trades at predictable costs.

Liquidity differs from headline volume. It reflects the market’s ability to process trades without excessive slippage. Market structure experts frame liquidity as layered rather than singular, spanning spot order books, derivatives positioning, ETF mechanics, and stablecoin settlement rails.

Kaiko research often relies on 1% market depth as a core metric, which measures available liquidity within 1% of the mid price. When that depth contracts, identical trade sizes produce larger price movements. Kaiko has also warned about liquidity concentration across venues, where aggregate volume appears strong while usable depth deteriorates.

Derivatives and ETFs transmit stress into spot markets

As spot liquidity tightens, derivatives markets gain influence. Perpetual swaps and futures concentrate leverage. Elevated funding rates or a stretched futures basis often signal crowded positioning. When prices move against those positions, forced liquidations follow.

Liquidations execute as market orders. Thin spot books magnify their impact. This feedback loop can accelerate downside moves, as seen during recent sessions.

Bitcoin exchange-traded funds add another liquidity layer. ETF shares trade on secondary markets, while authorized participants create or redeem shares in the primary market. Under balanced conditions, this structure absorbs demand without stressing spot exchanges.

SoSoValue data showed US spot Bitcoin ETFs recorded about $1.33 billion in net outflows during the week ending Jan. 23, the worst performance since February 2025. Liu described institutional behavior as selective.

“While broad outflows from spot Bitcoin ETFs signal risk-off sentiment, selective buying in infrastructure and industry leaders, like ARK’s Coinbase purchases, suggests long-term conviction remains.”

Ark Invest disclosed purchases of Coinbase, Bullish, and Circle shares. Maeda cautioned against extrapolation, noting that ARK has consistently favored crypto equities across cycles.

Stablecoins shape where liquidity can function

Stablecoins form the final liquidity rail. Institutions require reliable cash mobility across venues and margin systems. A significant share of crypto trading still routes through stablecoin pairs and collateral frameworks.

Liquidity often concentrates on venues that some institutions cannot access due to regulatory or operational limits. This mismatch creates markets that appear deep in aggregate while remaining costly for regulated participants.

Policy decisions increasingly shape stablecoin availability and settlement pathways. Liquidity therefore, reflects governance constraints as much as market-making activity.

CME gap highlights weekend execution risk

CME Bitcoin futures reopened near $86,560 after closing around $89,500 on the prior session, leaving a downside gap of $2,940. The move reflected weekend selling during hours when CME markets remained closed.

Such gaps form when spot markets trade continuously while futures pause. Sharp weekend moves reopen as visible discontinuities. This gap ranked among the largest seen this month.

Short-term technical focus now centers on support between $86,000 and $88,000. A move above $95,000 would suggest improving momentum. Sustained weakness could expose lower $80,000 levels.

Longer-term projections remain divided. Grayscale has pointed to potential highs in early 2026. Binance founder Changpeng Zhao has described 2026 as a possible breakout year. Regulatory developments such as the proposed CLARITY Act may shape capital access and volatility patterns ahead.

For now, liquidity conditions rather than price narratives define institutional posture.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.