A fat-finger payout error at South Korean exchange Bithumb mistakenly credited users with bitcoin during a promotion, briefly distorting prices on the platform and prompting a regulatory review.

The incident occurred on Feb. 6 during a routine rewards event intended to credit users with roughly 2,000 Korean won, or about $1.40.

Instead, due to an internal unit-setting error, the system issued rewards in bitcoin.

As a result, approximately 620,000 BTC, valued at around $44 billion at the time were mistakenly credited across hundreds of accounts, with some users briefly receiving balances of thousands of bitcoin. The exchange emphasized that the incident was operational in nature and not the result of hacking or external interference.

Exchange response and regulatory scrutiny

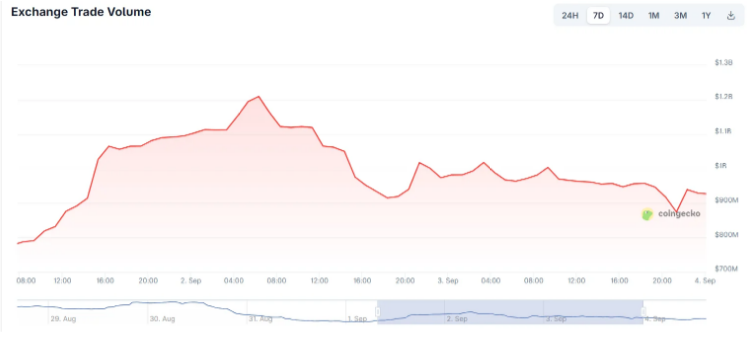

Bithumb said it identified the error quickly and restricted trading and withdrawals for 695 affected accounts within 35 minutes. The unexpected balances triggered sharp but localized volatility.

Bitcoin prices on Bithumb’s BTC/KRW market fell as much as 17%, briefly dropping to around 81.1 million won before rebounding later in the session.

They recovered 99.7% of the mistakenly credited bitcoin. Roughly 125 BTC, worth about $9 million, could not be retrieved after some recipients sold or transferred the assets before restrictions were imposed. The exchange said it covered the shortfall using its own funds and that all customer balances were fully restored by Feb. 7.

Local media reported that Exchange Business Division Vice President Hwang Seung-wook acknowledged the incident's weaknesses in an internal email.

“The fact that a single error in setting an event reward unit can destabilize an entire crypto exchange demonstrates the current state of our systems,” Hwang wrote, adding that the focus would be on improving processes rather than assigning individual blame.

South Korea’s Financial Services Commission confirmed it has opened a review of Bithumb’s operational controls, as regulators reportedly conducted on-site inspections and demanded documentation on internal payment permissions and oversight frameworks.

Fat-finger errors return to focus

“Fat-finger” errors, operational mistakes caused by misconfigured systems or human input, have long affected traditional financial markets and are increasingly visible in crypto where transactions settle instantly and reversals are limited.

Peter Kwon, partner and head of law firm RPC’s Korea desk, in his comments for HodlFM, provided some angle to the incident, noting the importance of robust internal verification mechanisms.

“When systems process volumes that exceed actual holdings, it highlights the need for strong controls and clear segregation between customer assets and company holdings,” Kwon said.

Disputes and investigations partner at RPC, Jonathan Crompton, supported this with:

“Fat-finger errors expose weak systems and controls and can cause losses to customers,”

Users are increasingly willing to pursue claims against exchanges for system failures, “such errors can move markets and expose exchanges to regulatory and legal pressure.” he added.

Regulators imposed close to $6 billion in fines on crypto firms 2023 year alone, primarily over anti-money laundering lapses and insufficient customer checks, marking the first time penalties across crypto.

In traditional finance, regulators have imposed fines of up to $85 million for similar incidents, and crypto markets are now drawing closer scrutiny.

Errors extend beyond exchanges

In 2025, stablecoin issuer Paxos mistakenly minted roughly 300 trillion PYUSD on Ethereum during an internal transfer. The excess tokens were burned shortly after, and Paxos said customer funds were not affected. At the time, PYUSD’s actual circulating supply was about $2.6 billion.

Policy Director at Better Markets and ex-Chief of Staff to former SEC Chair Gary Gensler, Amanda Fischer commented on this:

“If someone with a fat finger error can increase the total supply of a stablecoin by a factor of 120,000, then perhaps regulators should proceed cautiously with granting that firm with a national bank charter and keys to the payment system,”

Exchanges have faced similar incidents before.

In 2021, BlockFi mistakenly credited customers with Bitcoin instead of stablecoin rewards during a promotion, temporarily placing hundreds of BTC into user accounts before reversing the balances. That same year, Crypto.com transferred $10.5 million to a customer in place of a routine refund, later recovering the funds through legal action.

Binance, the world’s largest crypto exchange, pleaded guilty to Bank Secrecy Act violations and operating without a money-transmitter license. The company was hit with a $4 billion fine, and CEO Changpeng Zhao resigned.

Controls under scrutiny

Some platforms already apply hard stops designed to block transactions that exceed available assets.

Kraken, for example, uses a “fat finger” warning on its professional trading platform that flags orders expected to cause 3% or more slippage. Traders must manually confirm such orders before execution, adding a friction layer intended to prevent accidental market disruption.

South Korea’s largest exchange, Upbit, said it blocks distributions that exceed actual holdings and continuously reconciles internal ledgers with on-chain wallets through a proprietary proof-of-reserves system. Event rewards are paid only from pre-secured assets and require multi-layer approval.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.