A new CoinShares analysis has reopened debate about quantum computing and Bitcoin security, but the report frames the issue as a long-term engineering challenge rather than an imminent crisis. The discussion centers on whether theoretical advances could weaken cryptographic protections that underpin the network and how investors should interpret that possibility.

The report argues that concerns remain valid but distant. It states that practical risks can be addressed through preparation and protocol upgrades. Institutional investors, it adds, must distinguish speculation from evidence-based analysis when evaluating exposure to quantum developments.

Bitcoin’s cryptography faces theoretical pressure, not immediate danger

Bitcoin relies on elliptic-curve cryptography for transaction authorization and SHA-256 hashing for mining and address protection. These mechanisms ensure that private keys remain infeasible to derive from public ones with classical computing methods. Quantum algorithms introduce specific concerns. Shor’s algorithm could theoretically solve the discrete logarithm problem, while Grover’s algorithm could reduce the effective strength of symmetric hashes.

The CoinShares report explains that such developments would not dismantle Bitcoin’s foundations. Quantum systems cannot alter the fixed 21 million supply cap or bypass proof-of-work validation. Mining economics would also remain uncertain even with quantum hardware, since automatic difficulty adjustment regulates block production.

Christopher Bendiksen, Bitcoin Research Lead at CoinShares, said the threat requires a scale that current technology does not approach.

Exposure concentrated in legacy addresses

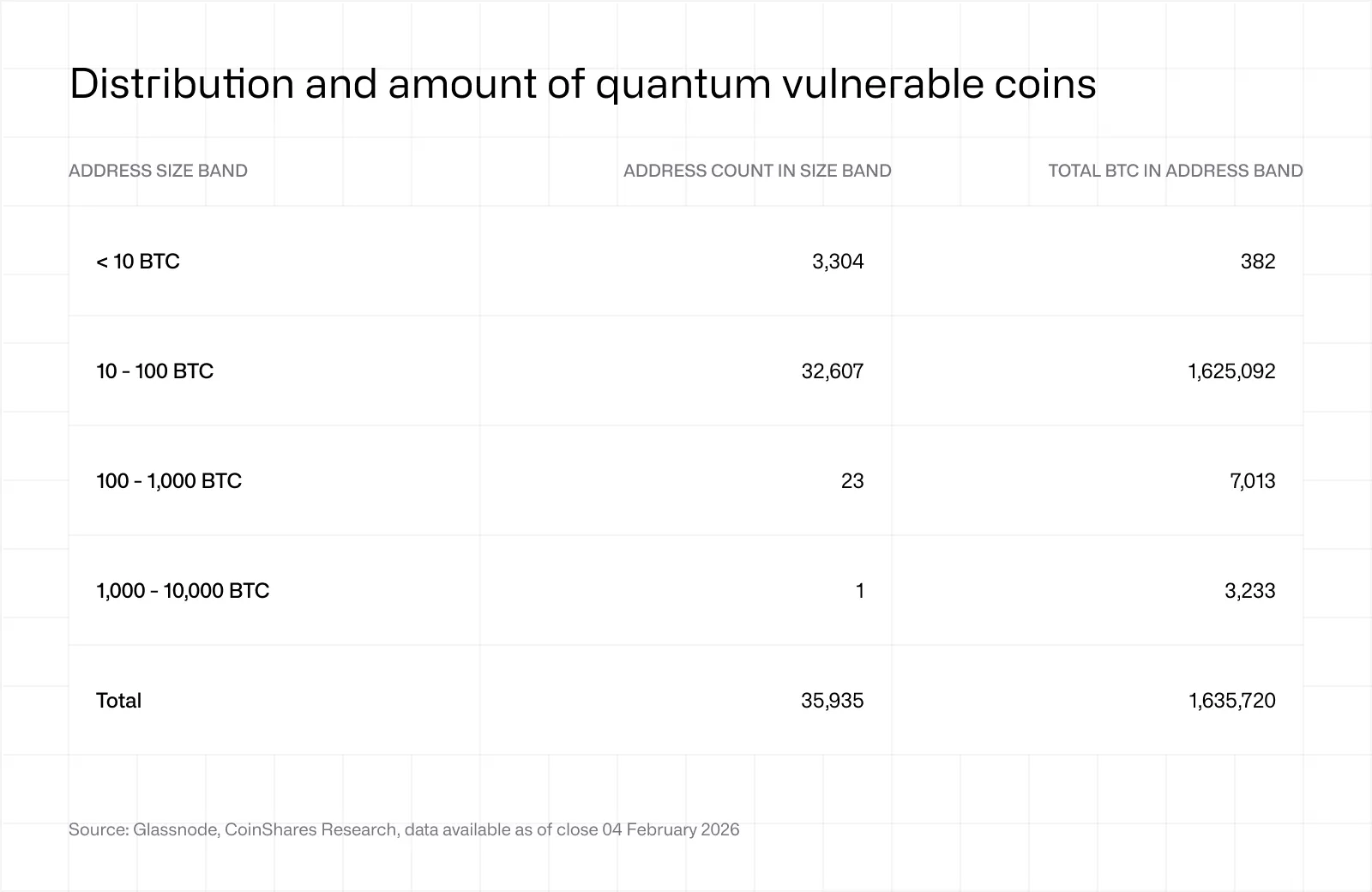

The analysis places the main vulnerability in older Pay-to-Public-Key addresses, where public keys already appear on-chain. About 1.6 million BTC sit in such outputs, close to 8% of supply. The report narrows practical risk further. It estimates that only about 10,200 BTC could face rapid compromise that might influence liquidity.

“The remaining ~1.6 million all sit in 32,607 individual, ~50 btc UTXOs, that would take millennia to unlock even in the most outlandishly optimistic scenarios of technological progression in quantum computing,” Bendiksen stated.

Modern address formats such as Pay-to-Public-Key-Hash and Pay-to-Script-Hash hide public keys until funds move. This design reduces exposure and allows owners to migrate assets if new threats appear. Claims that a quarter of supply stands at risk often include temporary or mitigable scenarios, such as reused exchange addresses.

Timeline remains measured, not urgent

The report stresses that quantum hardware capable of breaking Bitcoin cryptography would require millions of stable qubits with fault tolerance. Current machines operate far below that level. Researchers cited by CoinShares note that reversing a public key within one day would require performance orders of magnitude beyond existing systems.

Cybersecurity firm Ledger CTO Charles Guillemet told CoinShares:

“To break current asymmetric cryptography, one would need something in the order of millions of qubits. Willow, Google’s current computer, is 105 qubits. And as soon as you add one more qubit, it becomes exponentially more difficult to maintain the coherence system”.

Estimates place cryptographically relevant quantum systems in the 2030s or later. Long-term exposures such as legacy addresses could face slow attacks over years. Short-term exposures, such as keys visible in the mempool, would require computation within minutes, a capability far outside present projections.

Market implications remain contained

CoinShares describes the potential market effect as limited. Even if vulnerable coins entered circulation quickly, the volume would resemble routine large trades. The distribution across thousands of addresses would slow exploitation and limit sudden shocks.

“For the perceivable future, market implications appear limited,” Bendiksen added. “The greater concern is preserving Bitcoin’s immutability and neutrality, which could be jeopardised by premature protocol changes.”

The report also warns against aggressive interventions such as forced hard forks or coin burns. These actions could introduce software flaws, undermine decentralization, and challenge property rights. Developers could adopt post-quantum signatures through soft forks when technology matures, which would allow voluntary migration without disruption.

Cryptographer Dr. Adam Back told CoinShares:

“Bitcoin can adopt post-quantum signatures. Schnorr signatures [a technical implementation from a previous upgrade] paved the way for more upgrades, and Bitcoin can continue evolving defensively”.

Investor positioning reflects mixed sentiment

Market participants show divergent reactions. Some institutions now factor quantum risk into portfolio decisions. Bloomberg reported that strategist Christopher Wood reduced a 10% Bitcoin allocation in Jefferies’ model portfolio and shifted capital toward gold and mining equities amid concerns about future quantum advances.

Developers and blockchain firms also discuss preparation paths. Coinbase, Ethereum, and Optimism have outlined post-quantum readiness efforts. Debate continues within the Bitcoin ecosystem. Some figures describe the threat as distant, while others frame it as a catalyst for earlier upgrades.

Capriole Investments founder Charles Edwards emphasized urgency in public remarks.

“$50K not that far away now. I was serious when I said last year that price would need to go lower to incentivize proper attention to Bitcoin quantum security. This is the first promising progress we have seen to date,” he said.

Long-term engineering challenge defines the outlook

CoinShares presents quantum risk as a foreseeable technical hurdle rather than a systemic crisis. Bitcoin’s design allows gradual upgrades, voluntary migration of funds, and defensive evolution. The debate now centers on timing, governance, and the balance between caution and innovation.

The report concludes that institutional investors should evaluate fundamentals alongside technological developments. Bitcoin’s resilience rests on adaptability and a long horizon for security upgrades, not on the absence of future threats.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.