Bitcoin endured one of its most dramatic sell-offs in years on Thursday, breaking through major support zones and triggering widespread liquidations across derivatives markets. The world’s largest cryptocurrency fell toward the $62,000 range during the slide and at one point traded near $60,255, marking a 15-month low, according to data from TradingView.

The drop represents a drawdown of more than 50% from the October 2025 all-time high above $126,000. That peak now sits roughly $63,000 above current levels. The magnitude places the move among Bitcoin’s most severe corrections, exceeding declines recorded around the FTX collapse.

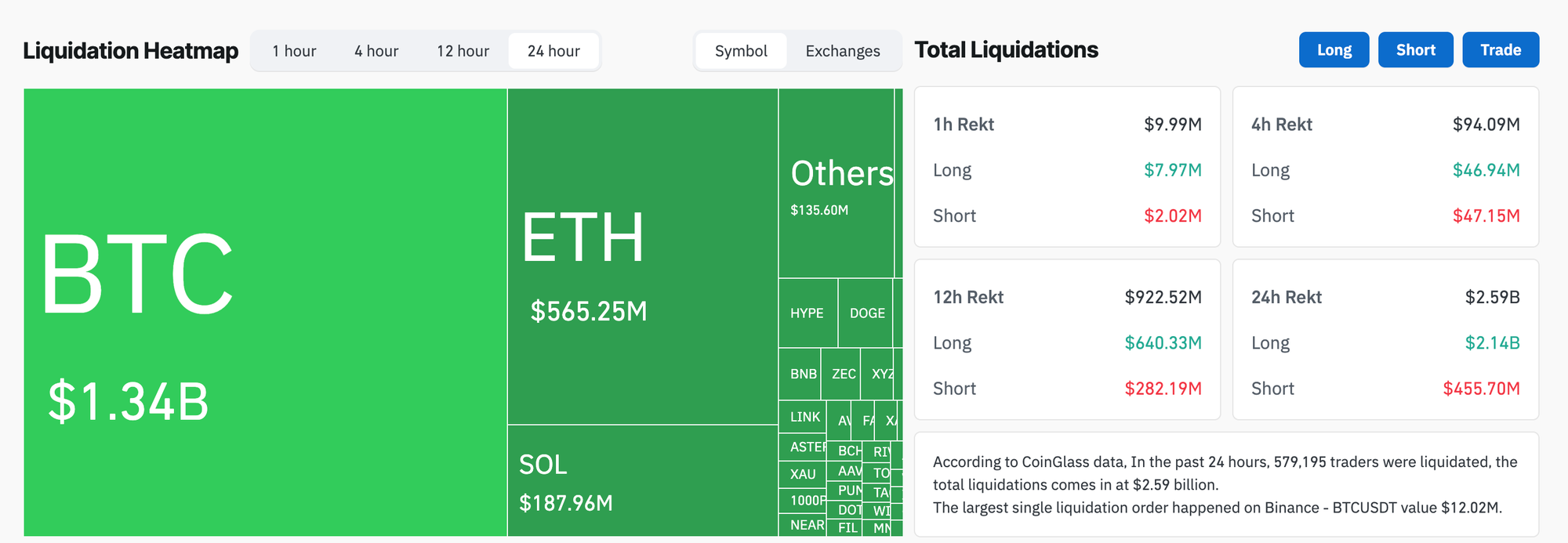

Market pressure intensified across exchanges as leveraged positions unwound. Coinglass data shows more than $2.59 billion in liquidations across one day, including $2.14 billion from long bets.

Bitcoin traded around $64,000 at the time of writing, after a volatile session that included a brief recovery from the $60,000 area.

Fear gauge collapses to Terra-era levels

Sentiment deteriorated sharply across the crypto market. The Crypto Fear and Greed Index fell to 9 this week, its lowest level in 42 months and comparable to readings during the Terra Luna collapse in 2022. CMC data shows another reading near 5, also in extreme fear territory.

Terra Luna, whose algorithmic stablecoin lost its dollar peg in May 2022, triggered one of the market’s deepest confidence shocks. Current sentiment now mirrors that period as investors react to falling prices and macro pressure.

Tim Sun, senior researcher at HashKey Group, said in the statement:

"Looking back at this drawdown, it vividly reflects a core reality: in an environment where broad liquidity has not expanded meaningfully, global assets are being governed by the same tightening financing conditions and risk-aversion logic."

Derivatives unwind and ETF activity amplify volatility

Bitcoin’s retreat followed a sharp move from above $90,000 just eight days earlier. The decline erased nearly half of its peak value while aggregated open interest in Bitcoin futures fell to $21.96 billion, a 15-month low, according to CryptoQuant.

Options markets show a defensive stance. Bitcoin’s 7-day and 30-day 25-delta skew dropped below -28 and -24, which signals strong demand for downside protection.

Crypto-linked equities fell alongside digital assets. Shares of Riot Platforms and MARA Holdings posted double-digit losses, while Coinbase and Robinhood also declined sharply. Strategy ($MSTR) dropped more than 15% ahead of earnings.

BlackRock’s iShares Bitcoin Trust (IBIT) recorded about $10 billion in trading volume, a daily record, even as its price dropped 13%.

$IBIT just crushed its daily volume record with $10b worth of shares traded as its price fell 13%, second worst daily price drop since it launched. Brutal. pic.twitter.com/HxMDl9fxbW

— Eric Balchunas (@EricBalchunas) February 5, 2026

Parker White, COO and CIO at DeFi Development Corp., said the activity could reflect an options-driven liquidation tied to institutional positioning.

He wrote on X:

"I have no hard evidence here, just some hunches and bread crumbs, but it does seem very plausible."

Competing theories emerge behind the selloff

Traders and market participants proposed several explanations for the scale of the move. Some pointed to macro tightening, currency pressures, and a rising U.S. Dollar Index, which climbed from 95.205 on January 27 to 97.685. That increase followed turmoil in Japanese government bonds and concerns around the yen carry trade.

Others focused on potential large sellers. Crypto trader Flood wrote on X that the decline felt "forced" and "indiscriminate," raising the possibility of sovereign selling or an exchange balance sheet event.

By far the most vicious selling I’ve seen in Crypto, feels forced, indiscriminate.

— Flood (@ThinkingUSD) February 6, 2026

Few theories:

- Secret Sovereign dumping $10B+ (Saudi/UAE/Russia/China)

- Exchange blowup, or Exchange that had tens of billions of dollars of Bitcoin on the balance sheet forced to sell for…

Pantera Capital general partner Franklin Bi suggested a large Asia-based player could sit behind the selling pressure. He described a chain of leverage, carry trade unwinds, and failed attempts to recover losses in metals markets before forced liquidation accelerated.

Security concerns also entered the discussion. Charles Edwards of Capriole said on X:

"$50K not that far away now. I was serious when I said last year that price would need to go lower to incentivize proper attention to Bitcoin quantum security. This is the first promising progress we have seen to date."

Market structure shifts toward defensive positioning

Bitcoin recorded one of its sharpest trading periods in more than three years, with a roughly 14% single-day drop comparable to moves during the 2022 crash. Liquidity appeared thin across major venues and intraday swings replaced the orderly dip-buying that defined earlier months.

Vincent Liu, CIO at Kronos Research, said in the statement:

"Bitcoin's sharp drop looks like a perfect storm: forced liquidations from over-leveraged longs, ETF/institutional outflows, and a broader risk-off macro backdrop."

Institutional flows also shifted. Spot Bitcoin ETFs recorded more than $800 million in outflows across two days, according to SoSoValue data.

Liu said Bitcoin must hold the $58,000 to $60,000 range for stability:

"A rebound is possible starting from stabilizing price action and positive news catalysts, but it will take time to confirm once the dust settles."

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.