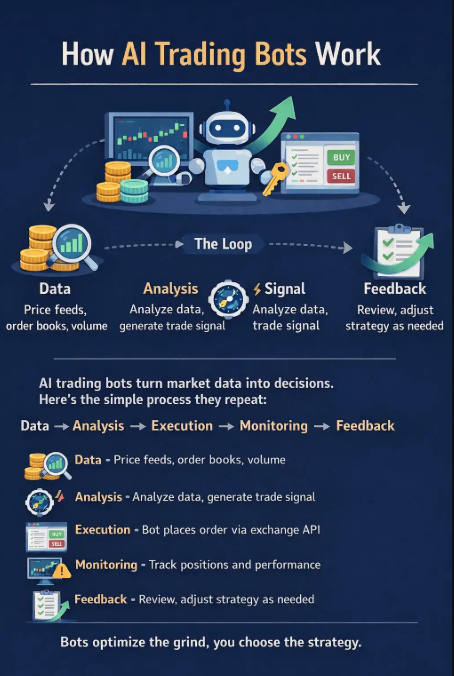

Tired of staring at charts and second-guessing every stop loss and take profit? Then, trading bots can become your rescue. Around the clock, they take your strategy, and execute it automatically, so you don’t have to babysit every single price move.

But it’s not that simple; you can’t just turn a bot on and let it run forever. When the trend of a coin or the overall market changes, you need to review the bot and adjust its settings.

In this article, we’ll learn in detail what trading bots are, how they work, and why they need supervision. We’ll also break down the 7 best crypto trading bots and highlight the risks.

What is a crypto trading bot?

A crypto trading bot is a software tool that automatically buys and sells cryptocurrencies based on rules you define. For example, you can set a bot to buy Bitcoin after a 2% drop within five minutes and sell at a 1.5% profit. It connects to an exchange through an API and handles the execution.

Bots solve one of the biggest problems in trading — emotions. How many traders were wiped out by impulsive decisions on the night of October 10th alone?

Difference between AI crypto bots and Automated crypto bots

When you search on Google for “best crypto trading bots” and “best AI crypto trading bots,” you usually see exactly the same platforms in both rankings. It confuses users.

In reality, most “crypto trading bots” are automated trading bots. They automate a strategy that you define or choose.

AI crypto trading bots, in turn, use machine learning to try to predict how a coin might move. Based on that analysis, they decide when to start trading and whether a setup even exists. Truly autonomous AI bots are still rare and mostly experimental.

What makes it confusing is that many platforms mix these two ideas. In most cases, it either means a small AI feature inside a classic automated bot or simply a marketing label, not a bot that truly makes its own trading decisions.

So in the ranking below, you’ll see both automated bots and platforms experimenting with AI, but most of today’s trading still runs on automation, not real artificial intelligence.

What main types of automated trading bots exist?

Inside automated trading bots, there are several classic types that appear most often:

- DCA bot (dollar-cost averaging) buys in small portions over time instead of all at once to average the entry price.

- Signal bot turns TradingView alerts into real trades. TradingView gives the signal, and the bot executes it instantly.

- Grid bot works best in sideways markets. It repeatedly buys low and sells high inside a fixed price range.

- Arbitrage bot looks for price differences between exchanges or markets. Users profits from small gaps by buying cheaper and selling higher.

- Scalping bot makes many very fast trades. It aims for small profits from short-term price movements.

Best trading bots comparative table

The list of top crypto trading bots for 2026 was created based on criteria such as ease of use, feature set, backtesting capabilities, number of integrated exchanges, pricing policy, and the reputation of each platform.

Before analyzing each one individually, here is their comparative table with the main categories.

Below you can find an overview of each trading bot and some user feedback.

3Commas

3Commas is an automated crypto trading platform that has been around since 2017. The platform has more than 2 million registered traders.

The interface can feel overloaded at first, but once you get used to it, you’ll see a wide range of bots and settings that work well for both beginners and experienced traders. Among their main bots are DCA Bot, Signal Bot, and Grid Bot.

Some more features worth attention:

- SmartTrade allows traders to automate and simplify short trades.

- The built-in Terminal enables quick manual trades for scalping or rapid setups across any connected exchange.

- Paper trading can help test strategies without risking real money.

- Backtesting lets you evaluate any strategy against historical data before deploying it live.

Truspilot user Mr Hoath found 3Commas great for automated trading across multiple exchanges and appreciated the backtesting and bot control.

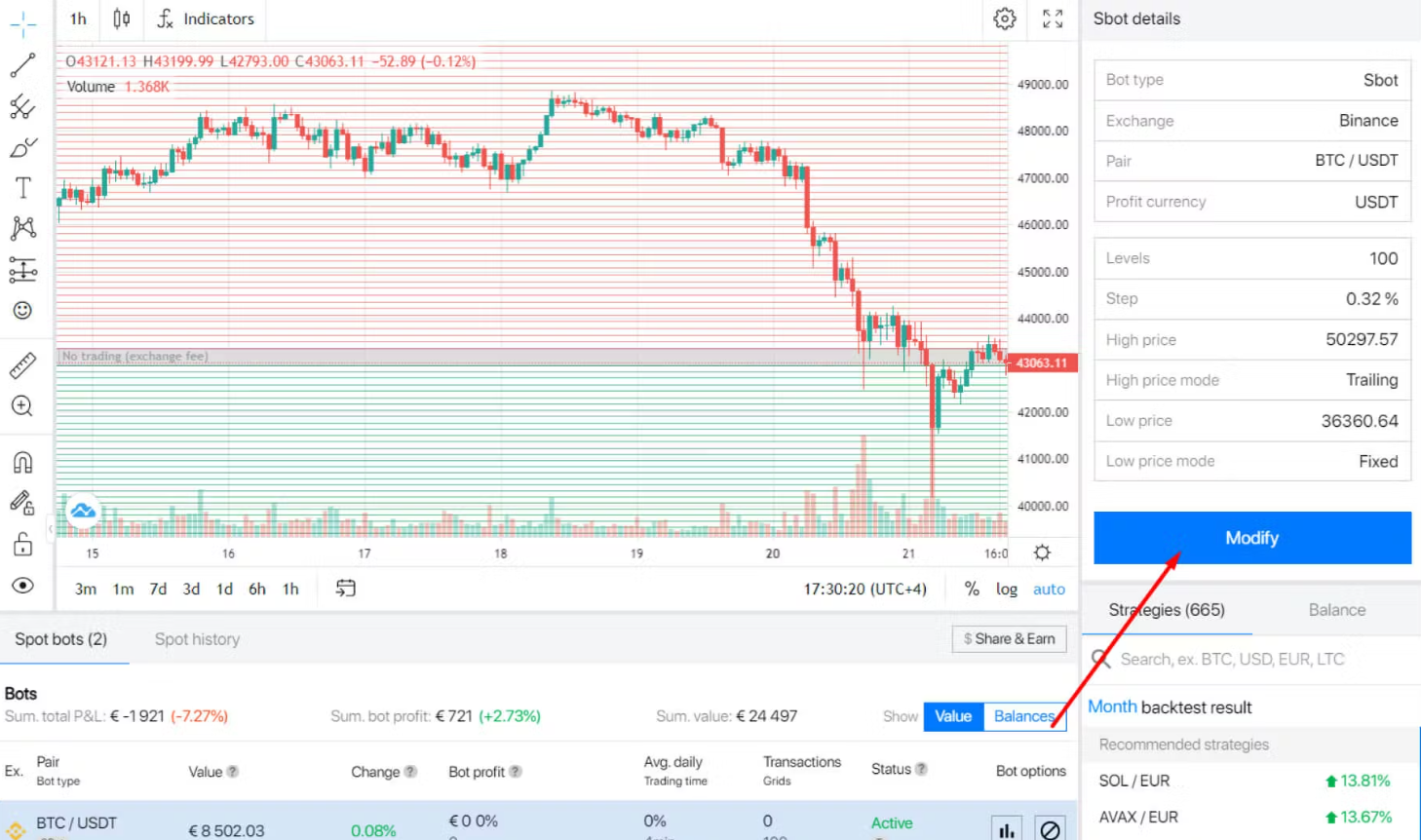

Bitsgap

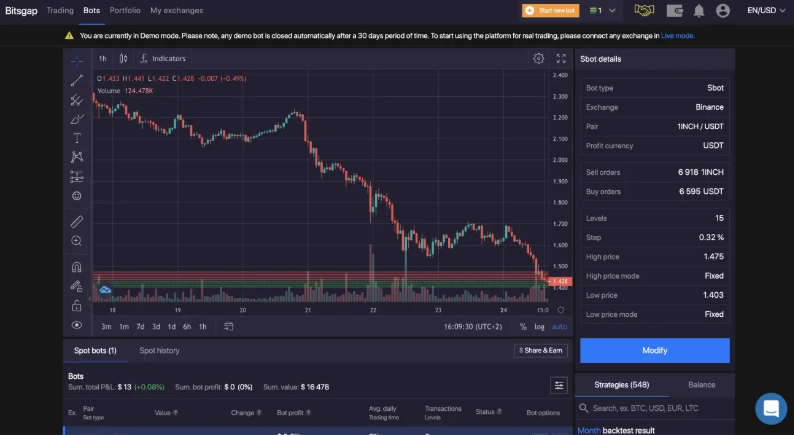

Bitsgap is an all-in-one crypto trading platform, meaning it combines trading bots, a manual trading terminal, portfolio tracking, charting, and backtesting tools in a single interface. It offers six automated trading bots: GRID, DCA, LOOP, DCA Futures, COMBO, and BTD Bot.

The service connects to 16+ leading exchanges. Over 4.7 million bots have been launched in total.

At Trustpilot, users shared it had delivered steady gains and felt like a legit platform.

Coinrule

Coinrule is an automation platform that allows users to create and run trading bots across 20+ major exchanges. The platform supports not only crypto, but also stocks, and ETFs markets.

Coinrule trading bot is built with military-grade security and encryption. Users can choose from more than 300 trading bots.

Users noted that Coinrule’s support was “really fantastic” and that the platform is smooth and able to scan markets to apply strategies dynamically.

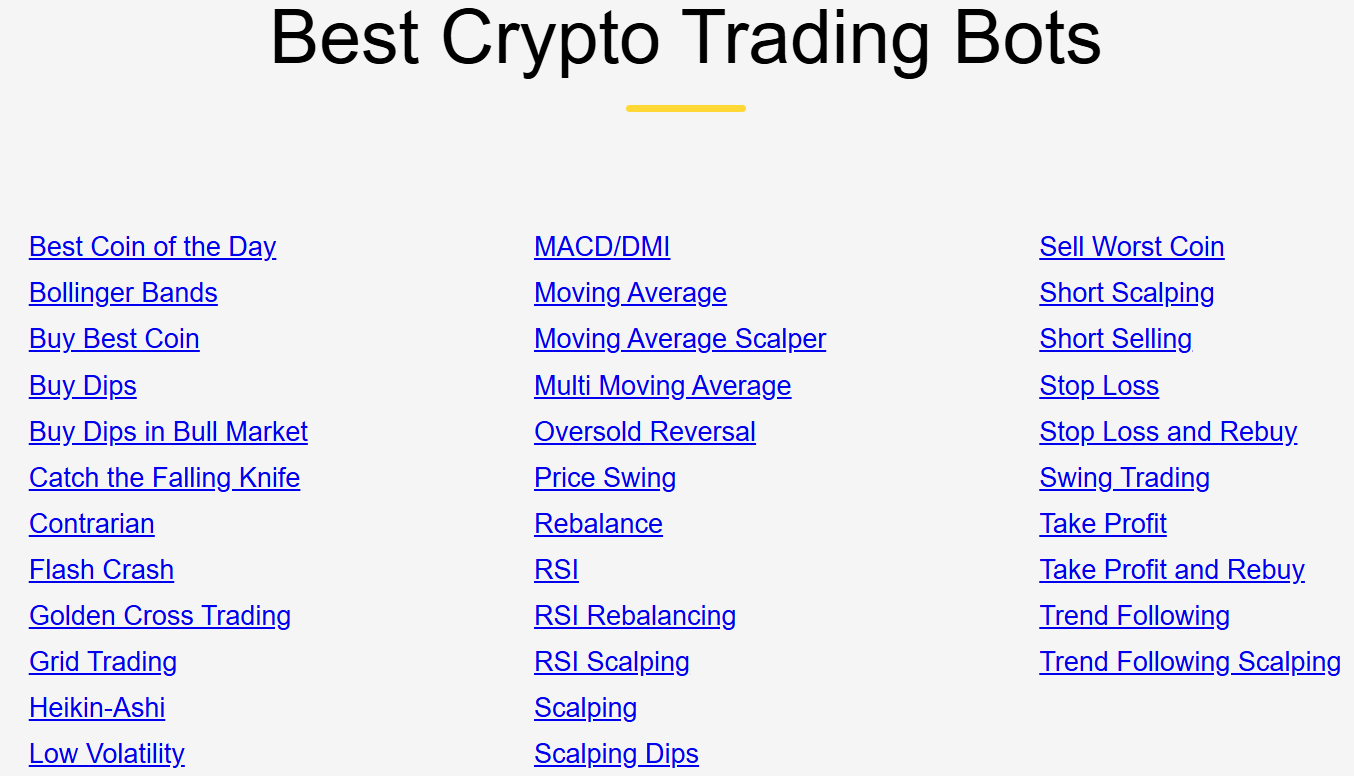

Cryptohopper

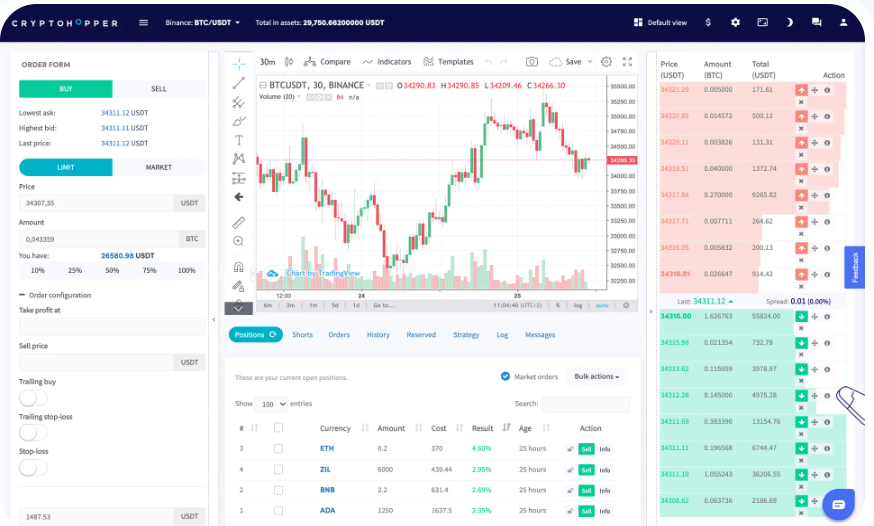

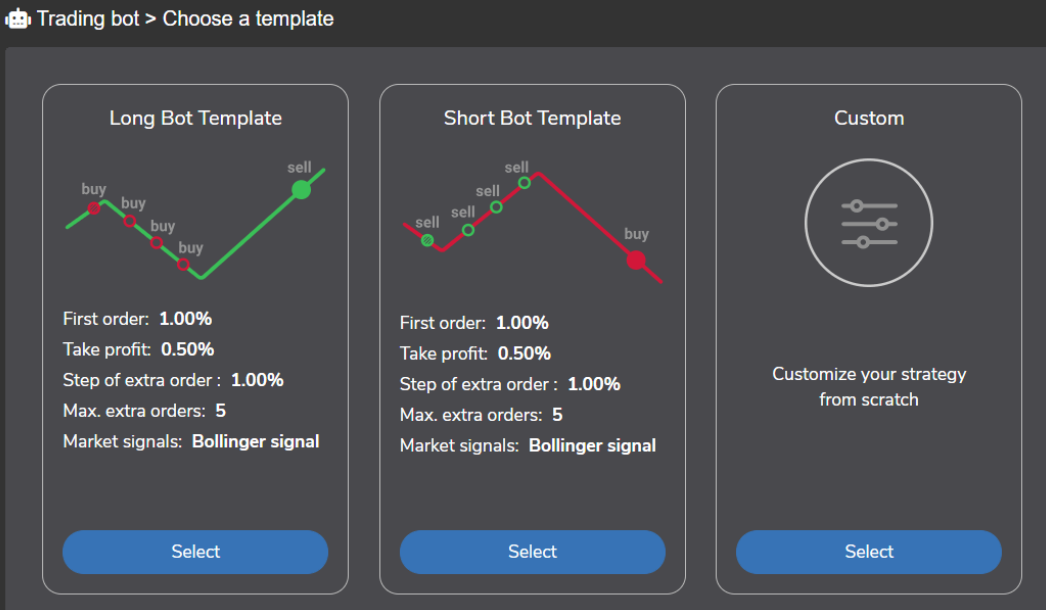

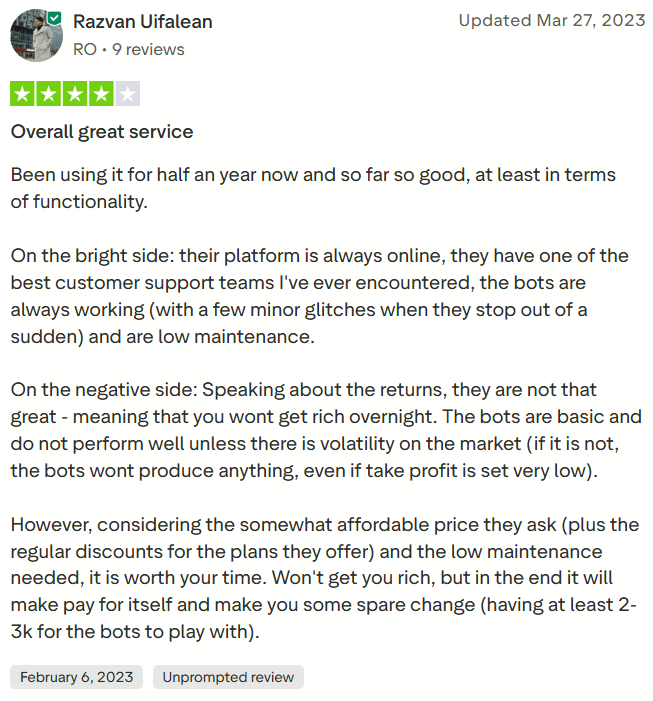

Cryptohopper is a crypto trading bot that offers wide customization. The crypto trading bot offers tools like DCA, Market-Making, Arbitrage, and built-in charting software.

You can use a Cryptohopper automated trading bot powered by the platform’s own AI, copy other traders, or download pre-configured bot templates.

The standout feature of this bot is social trading. Users can subscribe to signals, purchase strategies or bot templates, and discuss ideas in the internal chat.

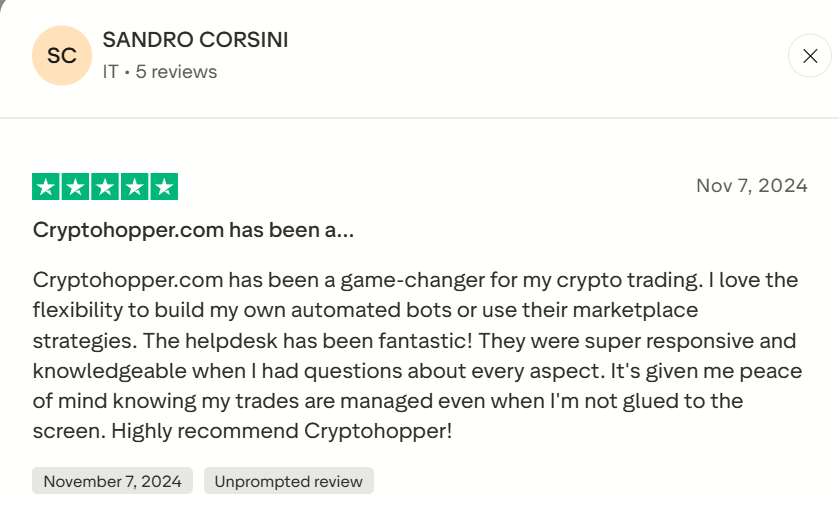

A Trustpilot reviewer Sandro Corsini described Cryptohopper as a “game-changer” that gave them flexibility to build automated bots.

TradeSanta

TradeSanta is a crypto automation platform that supports both spot and futures markets. It offers long bots for upward trends and short bots for downward ones.

Bots can be triggered by popular indicators such as MACD, RSI, Bollinger Bands, or even TradingView signals. For risk management, users can set tools like stop loss, trailing stop loss, and TradingView-based stop conditions.

TradeSanta’s users note its support team tends to be responsive when issues come up.

Pionex

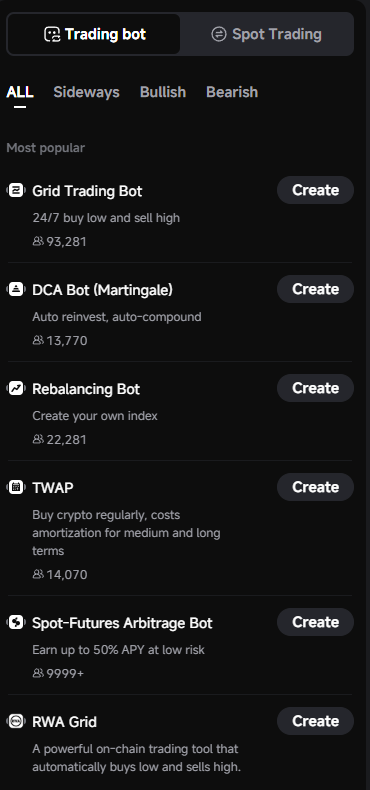

Pionex is a trading bot platform with more than 5 million users. 16 bots are built directly into the exchange and come for free. The most widely used among them are the Pionex grid trading bot and the Pionex arbitrage bot.

With support for up to 500 grids, users can design detailed and highly tailored bot configurations based on their preferred risk level and strategy.

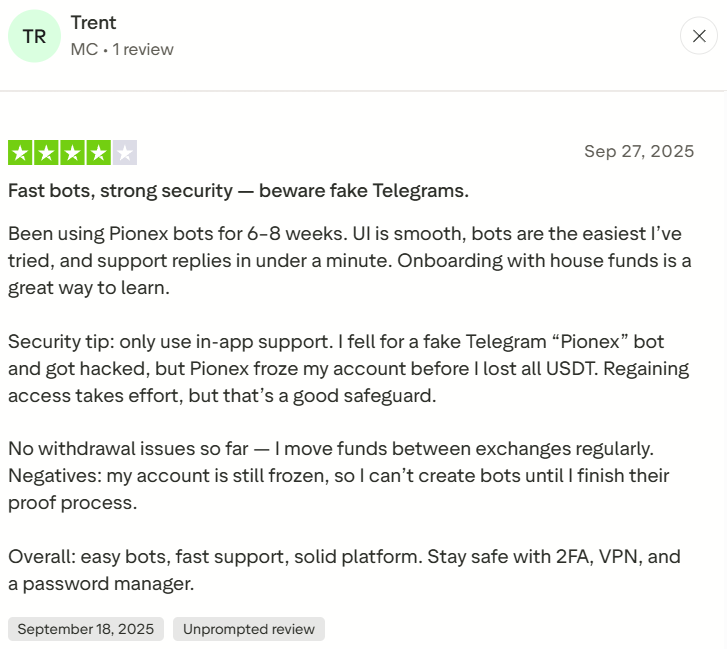

Trustpilot user Trent found Pionex bots to be the easiest he had ever tried.

Gunbot

Gunbot is a privacy-focused crypto trading bot that runs directly on your computer on Windows, macOS, or Linux.

For those who want more structure, Gunbot includes ready-to-deploy algorithms such as StepGridScalp. Advanced users can go further by integrating TradingView scripts or writing their own logic in JavaScript.

The platform supports unlimited trading pairs, unlimited bot instances, and more than 150 configurable parameters, along with 20+ proven strategies.

Users note that the interface is intuitive, and customer support is responsive.

What risks of crypto trading bots should you be ready for?

Automation removes emotions from trading, but it doesn’t remove risk. Here are the main ones to keep in mind:

- API key leaks and security breaches. Bots use API keys to connect to your exchange account. If these keys are stolen through phishing, malware, or poor security, attackers can control your account and drain your funds in minutes.

- Following outdated or irrelevant patterns. Bots don’t “understand” the market. If market conditions change suddenly, the bot will still keep executing the same strategy at machine speed.

- Technical failures. Server outages, software bugs, API errors, or delayed price feeds can all lead to missed exits, wrong orders, or trades being executed at bad prices. Even a small technical issue can have real financial consequences.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.