U.S. President Donald Trump said Tuesday he will soon name a successor to Federal Reserve Chair Jerome Powell. He signaled that the next chair could lead to lower borrowing costs, raising questions about the Fed’s policy path amid stubborn inflation and a late-cycle economy.

"When we have a great Fed chairman, I think we’re going to have one. I’ll announce it pretty soon. You’ll see rates come down a lot," Trump said during a speech in Iowa.

The remarks came amid speculation over Powell’s replacement, whose term ends in May 2026. Trump has repeatedly criticized Powell for not cutting interest rates more aggressively, despite the Fed’s gradual reductions in late 2025, which brought the federal funds rate to 3.5–3.75 percent.

Economic context and political stakes

Trump's comments highlight the tension between political influence and the Fed’s independence. Explicit forecasts about future rate levels from the Oval Office remain unusual and could attract scrutiny from investors wary of political interference.

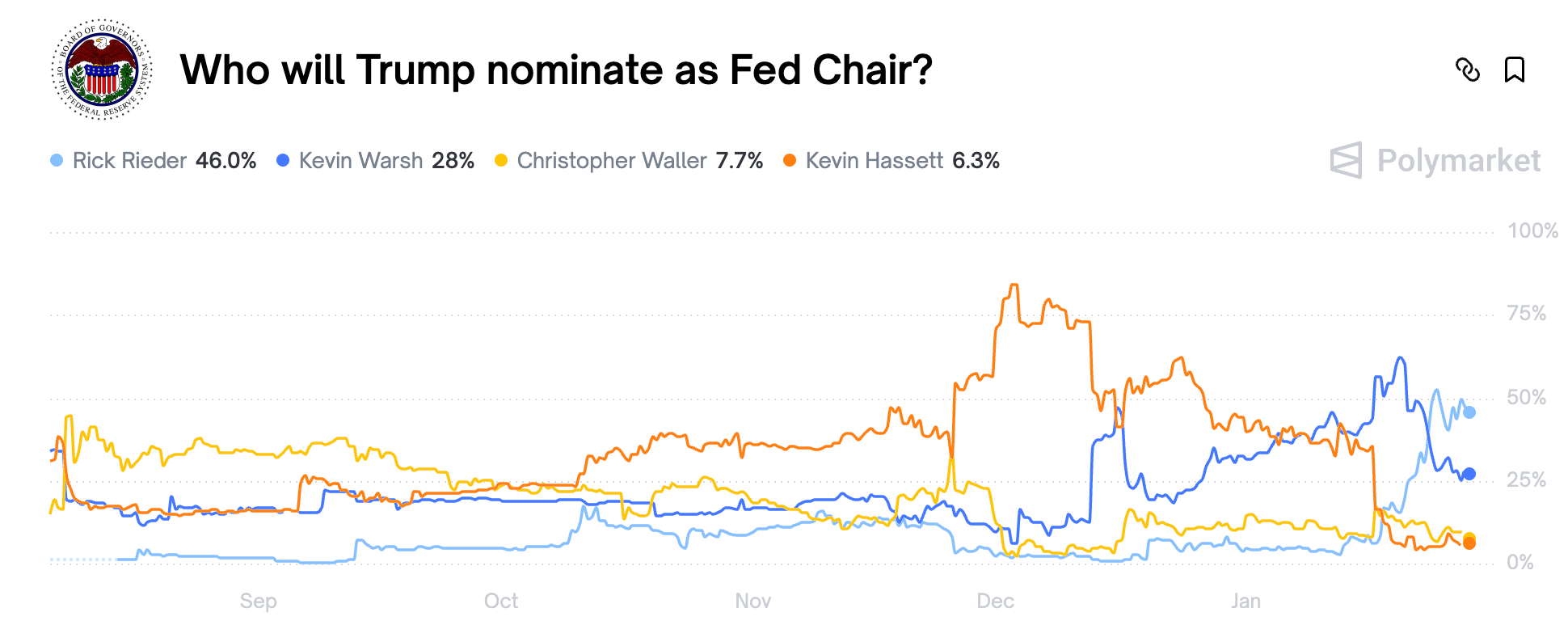

The White House has not disclosed a formal shortlist, but potential candidates include BlackRock Chief Investment Officer Rick Rieder, former Fed Governor Kevin Warsh, White House economic adviser Kevin Hassett, and Fed Governor Christopher Waller. Prediction markets currently favor Rieder at 46 percent odds, followed by Warsh at 28 percent.

Markets react to Trump’s remarks

Trump also indicated he does not worry about a weakening U.S. dollar. The comments contributed to a dip in Bitcoin and pushed gold prices to a new high above $5,200. The U.S. dollar index hovered near 96, while the 10-year Treasury yield steadied around 4.24 percent. Bitcoin traded near $88,000 after touching a 24-hour high of $89,427 and a low of $87,228.

Trump says he's not worried about the dollar's decline despite four year lows. 💵 pic.twitter.com/b6MR62N8C5

— Yahoo Finance (@YahooFinance) January 27, 2026

Markets will focus on any signals from the upcoming Federal Open Market Committee (FOMC) meeting. CME FedWatch Tool data suggested a 97 percent probability that rates remain steady. Odds of a rate cut by June rose slightly ahead of the meeting.

Fed decision and ongoing investigations

The Fed is expected to maintain rates at 3.5–3.75 percent when it announces its policy decision on Wednesday, January 28, at 2 p.m. Eastern Time. Fed Chair Jerome Powell will hold a press conference at 2:30 p.m. to explain the committee’s reasoning.

The central bank faces additional pressures. The Department of Justice recently opened an investigation related to Fed building renovations, which Powell criticized as a pretext to weaken central bank independence. Meanwhile, the Supreme Court considers whether Fed Governor Lisa Cook can remain in her position after Trump attempted to remove her.

Financial analysts expect Powell to defend the Fed’s independence during the press conference.

"We expect that Powell will use his platform to provide an erudite but accessible defense of central bank independence," said Joe Brusuelas, chief economist at RSM.

Implications for consumers and markets

Fed rate decisions affect loans ranging from mortgages to credit cards. Keeping rates steady would have minimal impact on borrowing costs, while a typical 0.25 percentage-point cut would not significantly alter consumer payments.

Still, the Trump administration seeks to demonstrate efforts to improve affordability. Measures include proposals to cap credit card rates at 10 percent and restrict institutional investors from buying single-family homes.

LendingTree’s Matt Schulz noted that recent rate cuts have already eased borrowing costs for many loans.

"Rates on several types of loans are at their lowest levels in years and should keep drifting down for a little while longer," he said.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.