Sam Bankman-Fried, the imprisoned former CEO of FTX, has reignited controversy over the collapse of the cryptocurrency exchange, claiming the company was never bankrupt and that lawyers orchestrated a “bogus” bankruptcy to seize assets. The statements were made in a series of posts on X this week and backed by court filings dating back to January 2023.

🚨 BREAKING: Sam Bankman-Fried says FTX “was never actually bankrupt,” claiming the bankruptcy filing was pushed through by lawyers without his consent or approval. pic.twitter.com/85msh0cMWj

— HodlFM (@Hodl_fm) February 10, 2026

Bankman-Fried emphasized that he never personally filed for bankruptcy.

“FTX was never bankrupt. I never filed for it. The lawyers took over the company and 4 hours later they filed a bogus bankruptcy so they could pilfer it for money,” he wrote.

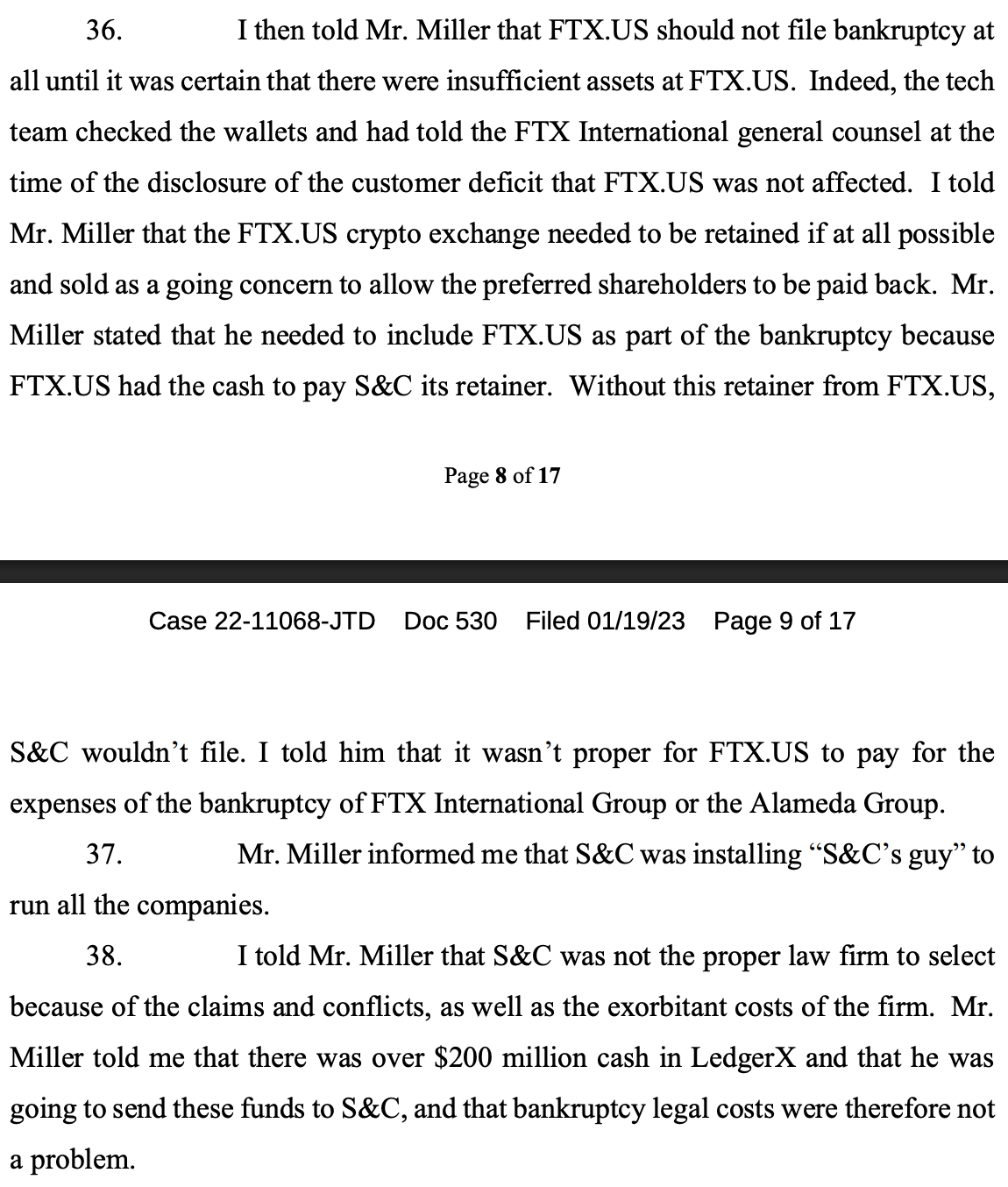

He shared a screenshot of a sworn court filing detailing his conversations with attorney Ryne Miller prior to the filing.

FTX.US solvency and ignored warnings

According to Bankman-Fried, he warned that FTX.US did not require bankruptcy.

“I then told Mr. Miller that FTX.US should not file bankruptcy at all until it was certain that there were insufficient assets at FTX.US… the tech team checked the wallets and had told the FTX International general counsel at the time of the disclosure of the customer deficit that FTX.US was not affected,” he said in the filing.

He suggested that FTX.US could have been sold as a going concern, allowing preferred shareholders to be repaid.

Bankman-Fried claims these warnings were ignored. He said Miller insisted that FTX.US be included in the filing because the law firm Sullivan & Cromwell (S&C) needed its cash to pay a retainer.

“Without this retainer from FTX.US, S&C wouldn’t file,” Bankman-Fried wrote.

Allegations of misconduct and conflicts of interest

Bankman-Fried accused the law firm of installing its own representative to oversee all FTX companies.

“Mr. Miller informed me that S&C was installing ‘S&C’s guy’ to run all the companies,” he stated.

He also questioned S&C’s conflicts of interest and excessive legal costs:

“I told Mr. Miller that S&C was not the proper law firm to select because of the claims and conflicts, as well as the exorbitant costs of the firm. Mr. Miller told me that there was over $200 million cash in LedgerX and that he was going to send these funds to S&C, and that bankruptcy legal costs were therefore not a problem.”

Bankman-Fried alleges internal conflict and financial maneuvering that critics argue undermined the exchange’s operations. Bankman-Fried suggested the lawyers prioritized their financial gain over customer interests.

Prosecutorial decisions and trial controversies

Bankman-Fried also attacked prosecutors and the judicial process in his posts, alleging that evidence proving FTX’s solvency was deliberately withheld. He claimed prosecutor Danielle Sassoon documented materials that could have aided his defense but were excluded from the trial.

“The money was always there, and FTX was always solvent,” he wrote.

He further alleged that former FTX executive Ryan Salame faced pressure to testify against him, with threats extended to Salame’s pregnant fiancée, Michelle Bond. Salame received a 90-month sentence, while Bond was later indicted on campaign finance charges. These claims have not been independently verified, though Sassoon testified in November 2025 denying that she coerced Salame’s plea deal.

12) @rsalame7926 was backed up—as he said—with emails, memos, legal work.

— SBF (@SBF_FTX) February 9, 2026

So of course they couldn't let him actually present that evidence! Instead they threatened his pregnant fiancée to stop him from defending me, force him to plead guilty. https://t.co/vXXnB61XDC

Once…

Political undertones and presidential alignment

Bankman-Fried highlighted a political dimension to his prosecution, noting his shift from being a major donor to Joe Biden to praising Donald Trump. He accused the Biden administration of targeting him due to his association with crypto and opposition to SEC policies.

8) The Biden administration hated me for different reasons:

— SBF (@SBF_FTX) February 9, 2026

They hated crypto, and I was one of the faces of crypto in the US

I was a former Dem donor who turned and started giving to the GOP

I was Gensler's biggest foe—in DC dozens of times to get power moved away from him pic.twitter.com/eZoFibMp61

Bankman-Fried is currently serving a 25-year sentence following his conviction on seven federal fraud and conspiracy charges tied to FTX’s $8 billion collapse. His appeals partly hinge on the solvency argument he outlined in his posts and court filings.

The situation raises questions about the legal management of major crypto exchanges, the role of law firms in bankruptcy filings, and the interplay between political affiliations and high-profile financial prosecutions.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.