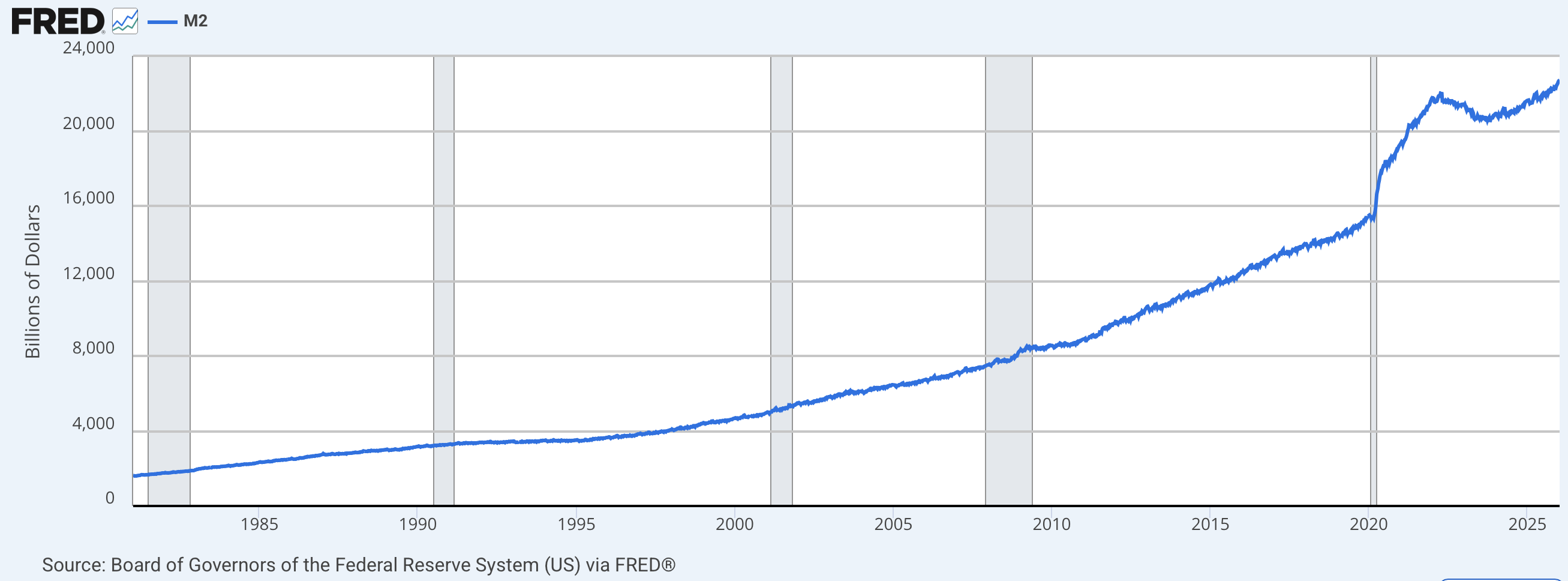

Economist and Bitcoin advocate Lyn Alden outlined her view of the Federal Reserve’s next phase of balance sheet expansion, describing it as measured and likely to modestly support asset prices.

In her February 8 investment newsletter, Alden wrote that the Fed is entering a “gradual” era of money printing.

Unlike the large-scale quantitative easing of previous cycles, this phase is expected to expand the Fed’s balance sheet at a pace similar to overall bank asset growth or nominal GDP.

“My base case aligns roughly with the Fed’s expectations: to grow its balance sheet proportionally with overall financial system growth,” Alden stated.

Market context and interest rate implications

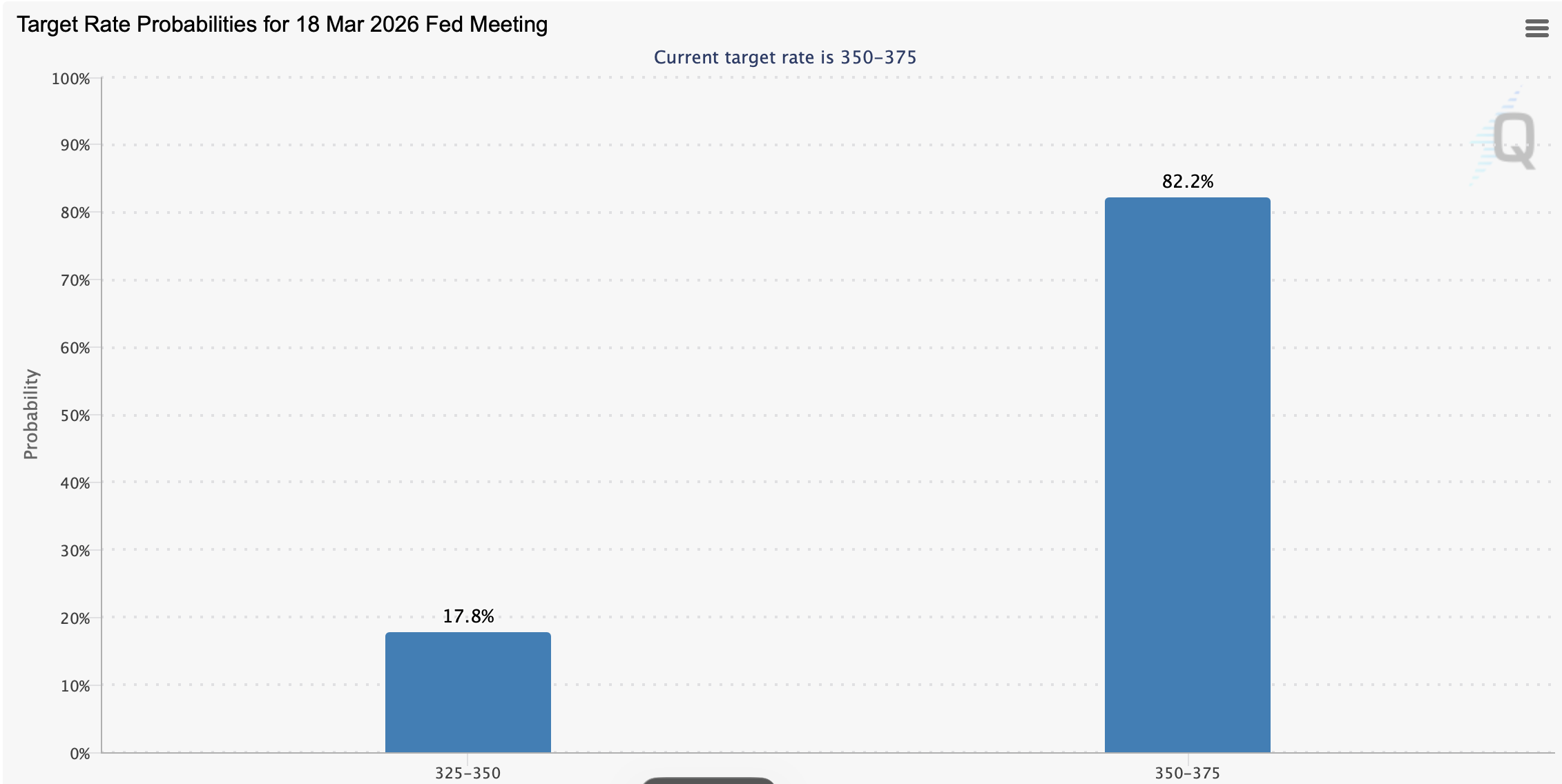

Alden’s commentary followed the nomination of Kevin Warsh as a potential next Federal Reserve chairman by U.S. President Donald Trump. Traders view Warsh as potentially more hawkish than other candidates, which could influence monetary policy decisions.

“This environment continues to favor high-quality scarce assets, with a tendency to shift allocation away from highly euphoric sectors toward under-owned opportunities.” Alden added.

Monetary policy affects both crypto and broader financial markets. Expanding the money supply tends to support asset prices, while higher interest rates or tighter policy can slow economic activity.

Current Fed Chair Jerome Powell has issued mixed guidance following several rate cuts in 2025.

After the December FOMC meeting, he said:

“In the near term, risks to inflation are tilted to the upside and risks to employment to the downside. There is no risk-free path for policy.”

Limited expectations for a rate cut

CME FedWatch data shows that 19.9% of traders expect a rate cut at the March FOMC meeting, down slightly from 23% the previous week. Powell’s term expires in May 2026, and Warsh has not yet been confirmed by the Senate, leaving investors uncertain about the Fed’s policy direction.

Alden emphasized that “gradual” balance sheet growth should be understood in the context of official Fed guidance.

She continues to favor scarce and high-quality assets, noting that measured expansion still contributes to currency debasement over time.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.