Prediction markets and diplomatic tensions are intersecting once again as President Donald Trump revives talk of bringing Greenland under U.S. control. What began as political speculation has now attracted significant trading activity from retail and institutional participants on crypto prediction markets.

On Polymarket, traders are wagering that Trump will place Greenland under U.S. sovereignty before the end of 2026. As of Wednesday, the probability stood at about 15%, with more than $3 million traded since late December.

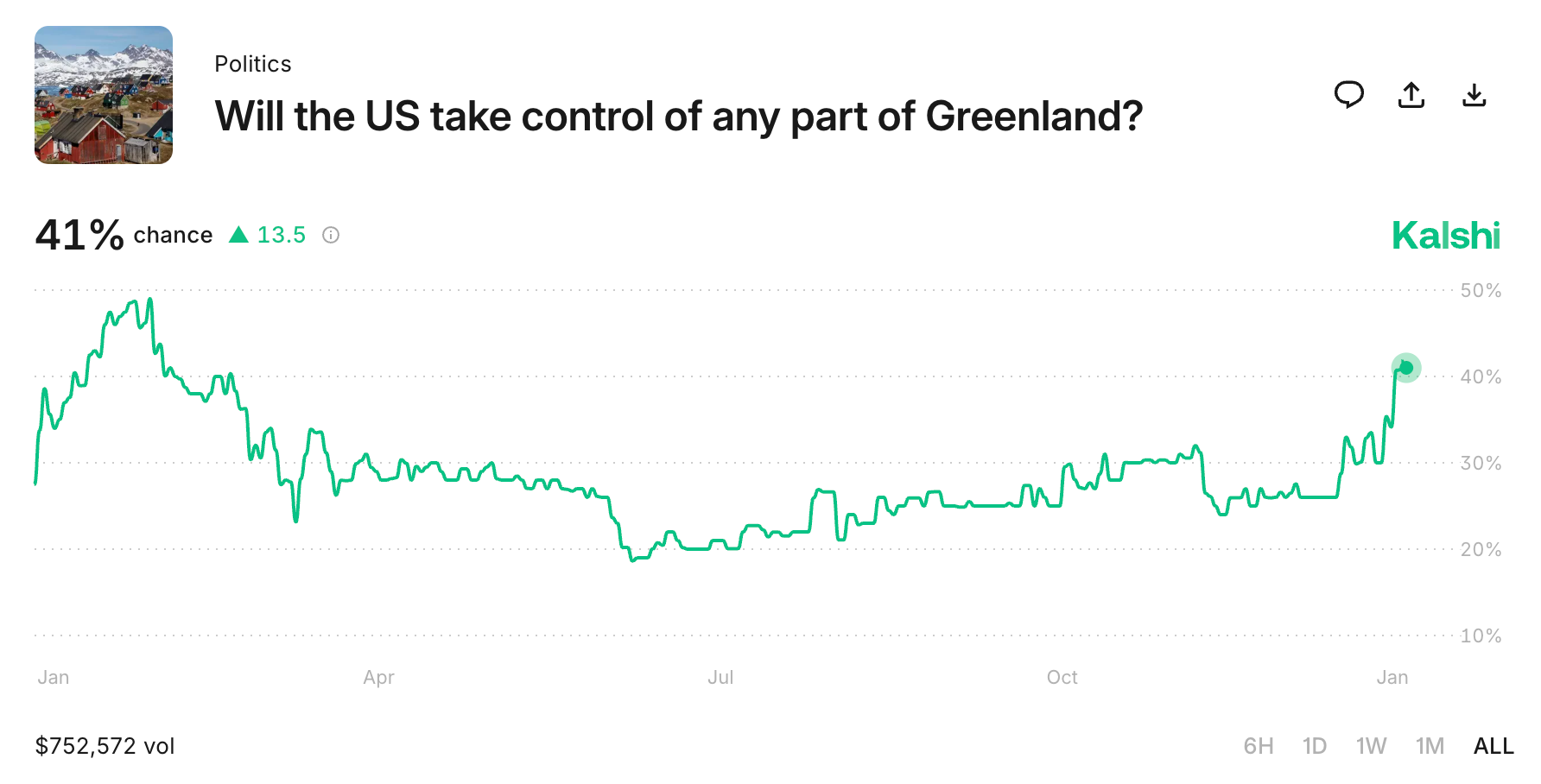

On Kalshi, a U.S.-regulated exchange, the outlook extends further. Traders there assign a 41% chance that some form of acquisition will happen before Trump’s term ends in 2029. That market has seen around $752,500 change hands, according to figures shared this week.

The activity shows that blockchain-based prediction tools are becoming better at showing geopolitical risk. Participants buy “yes” or “no” shares that track real-world outcomes. Prices shift as traders adjust probabilities, effectively transforming global events into tradeable assets.

White House confirms options under discussion

The White House on Tuesday told the BBC that President Trump and his team are reviewing “a range of options” to pursue the goal of acquiring the Arctic territory, which they called the effort a “national security priority.” The statement followed a weekend speech in which Trump said the U.S. “needed” Greenland for strategic reasons.

“The president and his team are discussing a range of options to pursue this important foreign policy goal, and of course, utilising the U.S. military is always an option at the commander-in-chief’s disposal,” the White House said.

Secretary of State Marco Rubio confirmed in remarks reported by Reuters that diplomacy remains the preferred route. He mentioned that purchasing Greenland from Denmark, rather than seizing it, remains the focus.

"Washington has not retreated from its long-standing interest in the Arctic territory," he told lawmakers in a closed-door briefing.

Officials argue the U.S. must secure influence in the Arctic to counter growing Russian and Chinese presence in the region.

Europe pushes back, says “Greenland belongs to its people”

European allies reacted with disapproval to Trump’s statements. Leaders from the U.K., France, Germany, Italy, Poland, Spain, and Denmark issued a joint declaration on Tuesday underscoring the principles of sovereignty and territorial integrity.

“Greenland belongs to its people, and only Denmark and Greenland can decide on matters concerning their relations,” the statement said.

Denmark’s Foreign Minister Lars Løkke Rasmussen added that talks with American officials must clarify “certain misunderstandings.” Meanwhile, Greenland’s Prime Minister Jens-Frederik Nielsen urged “respectful dialogue,” stating that discussion must occur “with respect for the fact that Greenland’s status is rooted in international law and the principle of territorial integrity.”

Greenland’s Prime Minister Jens-Frederik Nielsen says Greenland is not for sale. pic.twitter.com/nOZL4ZUKf1

— Globe Eye News (@GlobeEyeNews) January 5, 2026

From prediction markets to policy risk

For traders on Polymarket and Kalshi, these developments translate into measurable odds. Contracts on both platforms define U.S. sovereignty as a formal political transfer announced by both Washington and Copenhagen. A confirmed policy or official declaration could trigger a market resolution even before physical control changes hands.

However, not all trading outcomes are straightforward. A recent Polymarket contract tracking whether the U.S. had invaded Venezuela created a similar dispute. Some traders argued that the January 3 extraction of President Nicolás Maduro from Caracas met conditions for a “yes” outcome. The platform ruled otherwise, clarifying that only an attempt to seize control of the country would qualify as an invasion.

This ambiguity illustrates the challenge of using decentralized markets to interpret political acts. These exchanges operate under pre-defined rules but rely on subjective news criteria for event verification.

Still, growing volumes show how market sentiment treats geopolitical actions as early indicators of risk and policy intent.

Greenland and economic motives

Beyond security, Greenland’s value lies in natural resources and geographic positioning. Its ice-free coastline hosts deposits of rare earth minerals and untapped energy potential. These assets have long attracted interest from Beijing and Washington. Trump’s renewed focus suggests an effort to secure U.S. presence within that resource corridor.

White House officials told NBC News that “acquiring Greenland is a national security priority of the United States.” They said any move would support Arctic defense infrastructure and “benefit Americans and the people of Greenland.”

On Polymarket, the 15% odds on near-term acquisition reveal limited trader confidence. Kalshi’s longer horizon, with odds near 41%, reflects expectations that a symbolic agreement or partial purchase might be feasible within Trump’s second term, which ends in 2029.

As financial bets grow, NATO faces new friction

NATO members worry that Trump’s Arctic policy could widen divisions inside the alliance. Danish Prime Minister Mette Frederiksen warned that “any attack by the U.S. would spell the end of NATO,” echoing rising concerns among European defense circles.

For now, no military action appears imminent. But the financialization of Trump’s Greenland ambitions shows that markets are treating the issue not merely as political theater but as a possible element of U.S. foreign policy risk.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice. HODL FM strongly recommends contacting a qualified industry professional.