Tether’s USDT, the world’s largest stablecoin, continued to grow through the final quarter of 2025, even as the broader crypto market dealt with a large liquidation event and sustained volatility.

According to Tether’s fourth-quarter market report, USDT’s market capitalization reached a record $187.3 billion by the end of December, rising $12.4 billion over the quarter. This expansion occurred while overall crypto market capitalization contracted and prices across major assets declined.

Tether highlighted that the growth in USDT reflects usage that extends beyond trading activity.

“The continued growth in USDT comes from diverse use cases beyond the crypto market, with the data clearly showing users’ preference for USDT as the stablecoin to both store wealth and transact in,” the report said.

User adoption remained robust.

On-chain activity and reserves continue to rise

Tether estimated the stablecoin added 35.2 million new users in the fourth quarter, bringing its total estimated global user base to 534.5 million. It was the eighth consecutive quarter in which USDT added more than 30 million users.

On-chain metrics tracked alongside user growth.

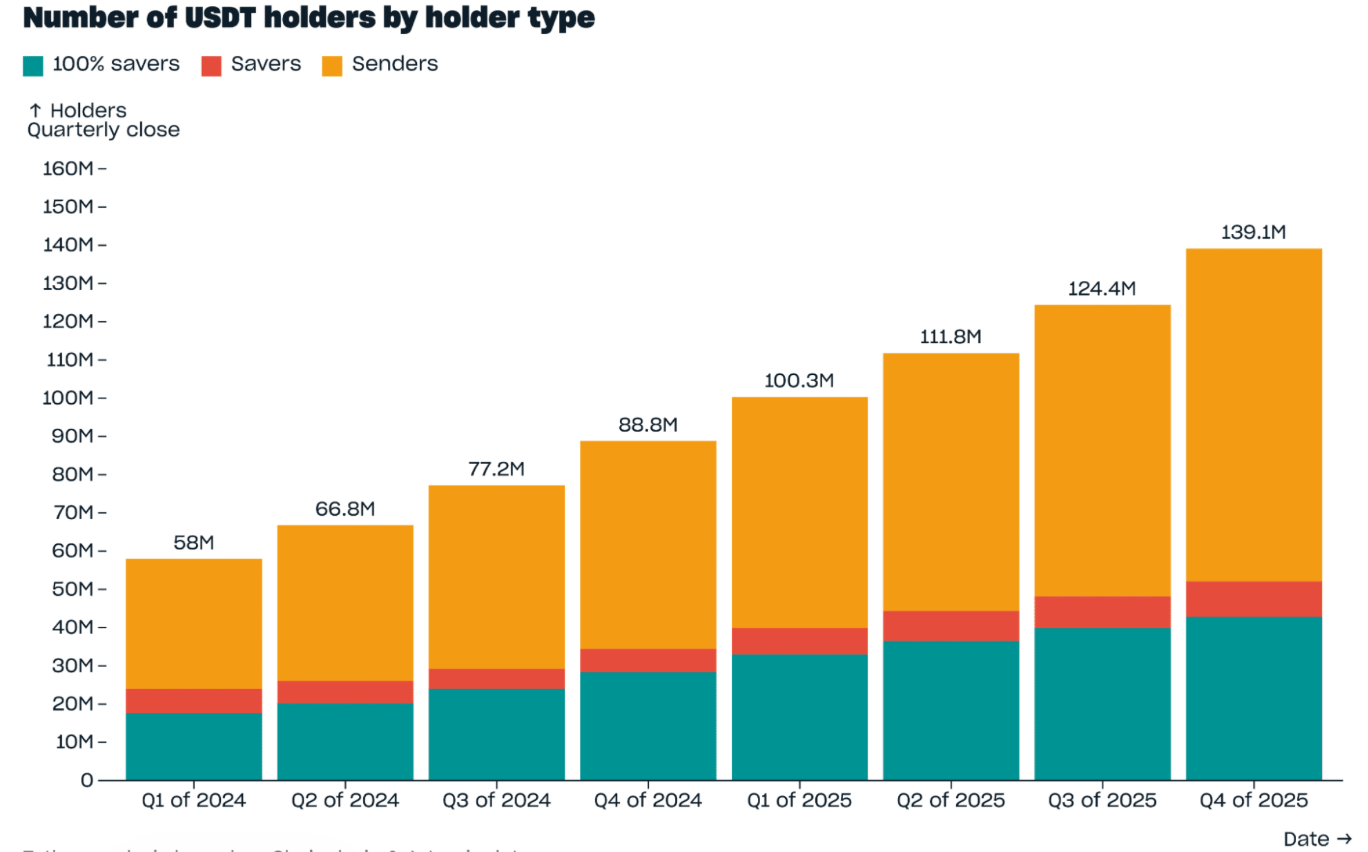

The number of addresses holding USDT increased by 14.7 million to 139.1 million, with USDT wallets accounting for just over 70% of all stablecoin wallets.

Tether also estimated that over 100 million users hold USDT on centralized platforms.

Monthly active on-chain users reached an all-time high average of 24.8 million during the quarter.

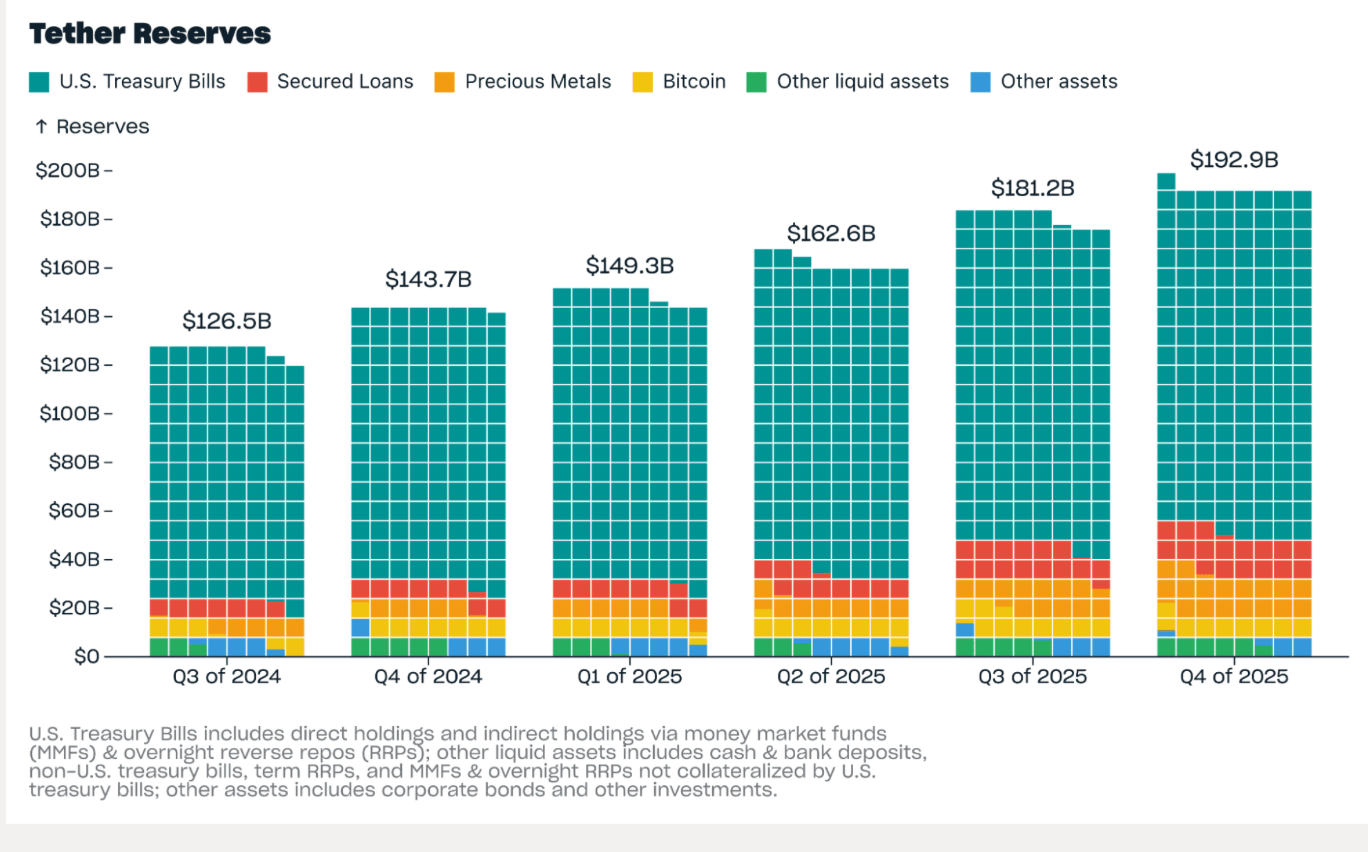

Tether’s total reserves expanded as well, rising by $11.7 billion during the quarter to reach $192.9 billion. Holdings included 96,184 bitcoin, 127.5 metric tons of gold, and $141.6 billion in U.S. Treasuries.

Growth holds up during a market downturn

The stablecoin’s expansion came amid a challenging market environment. A significant liquidation event on Oct. 10, 2025 was followed by heightened volatility through the rest of the quarter.

Since then, prices across major crypto assets have remained lower, with bitcoin trading near $71,200, its lowest level since October 2024.

Tether’s report addressed the contrast between stablecoin growth and broader market declines.

“The crypto liquidation cascade of 10 October 2025 has meant the stablecoin ecosystem is not growing as fast as it has been,” the report said.

“The total crypto market cap declined more than ⅓ between 10 October 2025 and 1 February 2026, while USDT has grown 3.5% since then, compared to the second and third largest stablecoins declining by 2.6% and 57% respectively.”

Separate disclosures made earlier this week indicated that Tether has revised its fundraising expectations, with advisers now discussing a potential $5 billion raise, down from earlier discussions of raising up to $20 billion.

Despite the volatility in crypto markets, USDT’s fourth-quarter metrics indicate continued adoption and utility across both on-chain and off-chain usage, with broad user engagement even as prices and total market capitalization have fluctuated elsewhere.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.