A configuration error during a promotional event at South Korean crypto exchange Bithumb led to the accidental distribution of hundreds of thousands of bitcoin to customer accounts, briefly disrupting prices on the platform and prompting regulatory inspections.

Bithumb said the incident occurred on Feb. 6 during a rewards campaign intended to distribute small cash incentives of about 2,000 Korean won, or roughly $1.40. Instead, due to an internal system error, bitcoin was credited to user accounts, with some customers receiving at least 2,000 BTC.

The mistake resulted in the unintended distribution of roughly 620,000 bitcoin, valued at approximately $44 billion at prevailing market prices.

A routine reward event goes wrong

According to the exchange, the error stemmed from a misconfigured reward unit in its internal payout system. Rather than issuing Korean won-denominated credits, the system processed the rewards in bitcoin.

Bithumb said it detected the issue quickly and restricted trading and withdrawals for 695 affected accounts within 35 minutes. The exchange added that the incident was operational in nature and unrelated to hacking or external interference.

"We would like to make it clear that this incident is unrelated to external hacking or security breaches," Bithumb said in a statement.

The company said it has since recovered 99.7% of the mistakenly distributed bitcoin. The remaining 125 BTC, worth about $9 million, could not be retrieved after some recipients sold or transferred the assets before restrictions were imposed. Bithumb said it covered that shortfall using its own funds.

"There are no problems with system security or customer asset management."

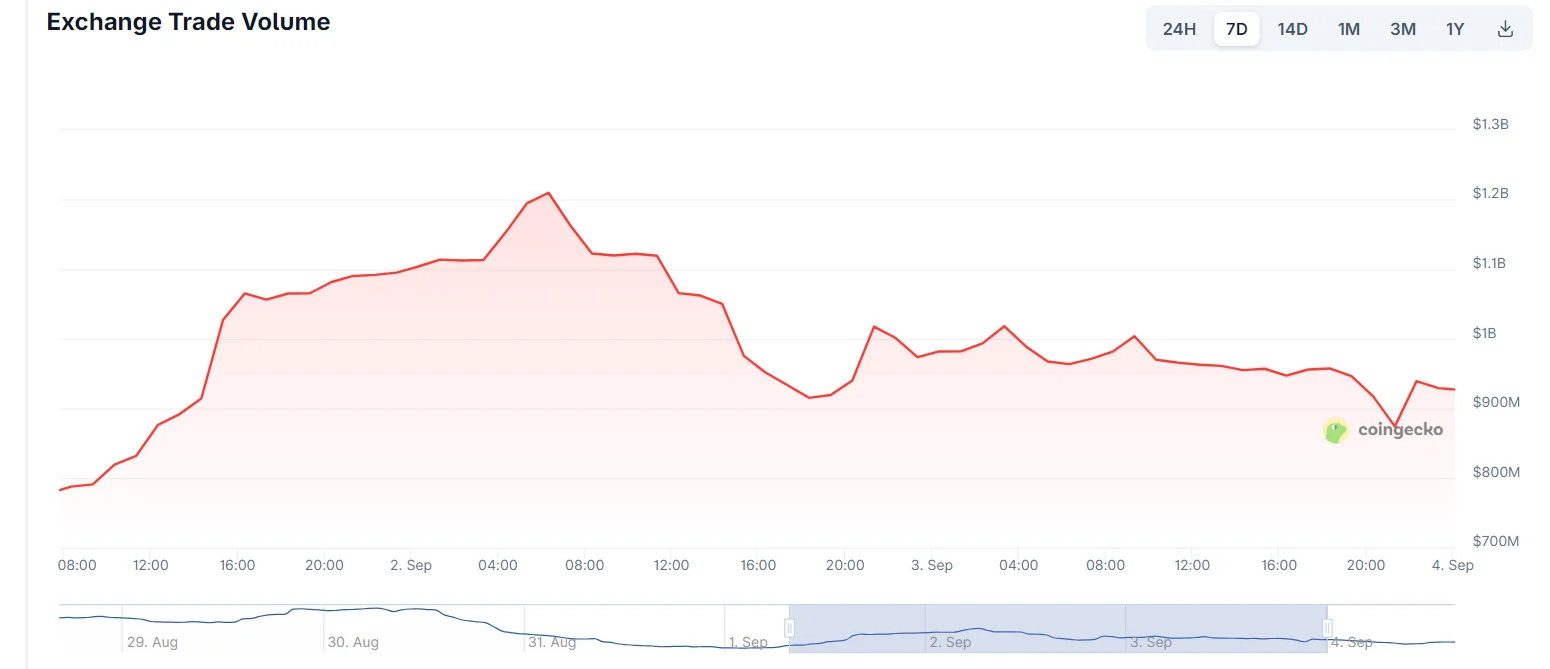

Sharp price swings on Bithumb’s BTC/KRW market

The erroneous payout triggered immediate volatility on Bithumb’s bitcoin market. During the disruption, BTC prices on the exchange briefly dropped as much as 17%, falling to around 81.1 million won, or roughly $55,000, before rebounding later in the session to about 104.5 million won.

Prices on other major global exchanges did not experience comparable moves, underscoring the localized nature of the liquidity shock. Trading data showed a surge in sell orders as unexpected balances entered the market before account restrictions were fully enforced.

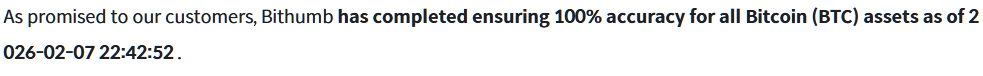

Bithumb said all affected balances were fully restored by late Feb. 7 and that customer assets are now securely held.

Regulators launch inspections

South Korea’s Financial Services Commission (FSC) said the incident raised concerns about internal controls at virtual asset service providers and confirmed it would review operational processes across domestic exchanges.

Local newspaper Kookmin Ilbo reported that regulators began on-site inspections at Bithumb’s offices on Feb. 7. Investigators reportedly requested documentation related to internal authorization procedures, including a list of employees with the ability to issue crypto payments.

Unnamed officials cited by the newspaper described the incident as evidence of "structural vulnerabilities" in exchange operations. The report said Bithumb’s systems allowed certain staff to issue loyalty points, Korean won, bitcoin, and ethereum without multilayer settlement verification.

Internal response and process changes

Bithumb executives acknowledged weaknesses in internal oversight following the incident. In an internal email to employees, Exchange Business Division Vice President Hwang Seung-wook said the error exposed shortcomings in the company’s operational safeguards.

"The fact that a single error in setting an event reward unit can destabilize an entire crypto exchange demonstrates the current state of our systems,"

Hwang wrote, according to local media. He added that the company would focus on improving controls and review processes rather than assigning individual blame.

The exchange said it has established a dedicated internal task force to strengthen payout controls, permission management, and settlement procedures to prevent similar incidents.

Compensation measures for affected users

To address user losses caused by abnormal trading conditions, Bithumb announced a compensation plan for customers impacted by the price disruption.

The exchange said users who sold bitcoin at unusually low prices during the incident would receive reimbursement equal to their sale amount plus an additional 10%. Bithumb also said it would waive trading fees across all markets for seven days starting Feb. 9.

In addition, the exchange said it would credit 20,000 Korean won, or about $15, to users who were actively trading on the platform at the time of the incident.

A sensitive period for the exchange

The error comes as Bithumb pursues plans to become the first South Korean crypto exchange to seek a public listing in the United States later this year. The company has been working to position itself as a compliant, institution-ready platform amid tighter global scrutiny of crypto exchanges.

Earlier this month, South Korea’s consumer protection watchdog also launched a separate probe into Bithumb’s marketing practices, increasing regulatory pressure ahead of the payout incident.

While the majority of the mistakenly distributed bitcoin was recovered within a day, the episode has drawn attention from regulators and highlighted the operational risks associated with automated reward systems at large exchanges.

Bithumb said it will continue cooperating with authorities and implementing additional safeguards to ensure similar errors do not occur in future promotional events.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.