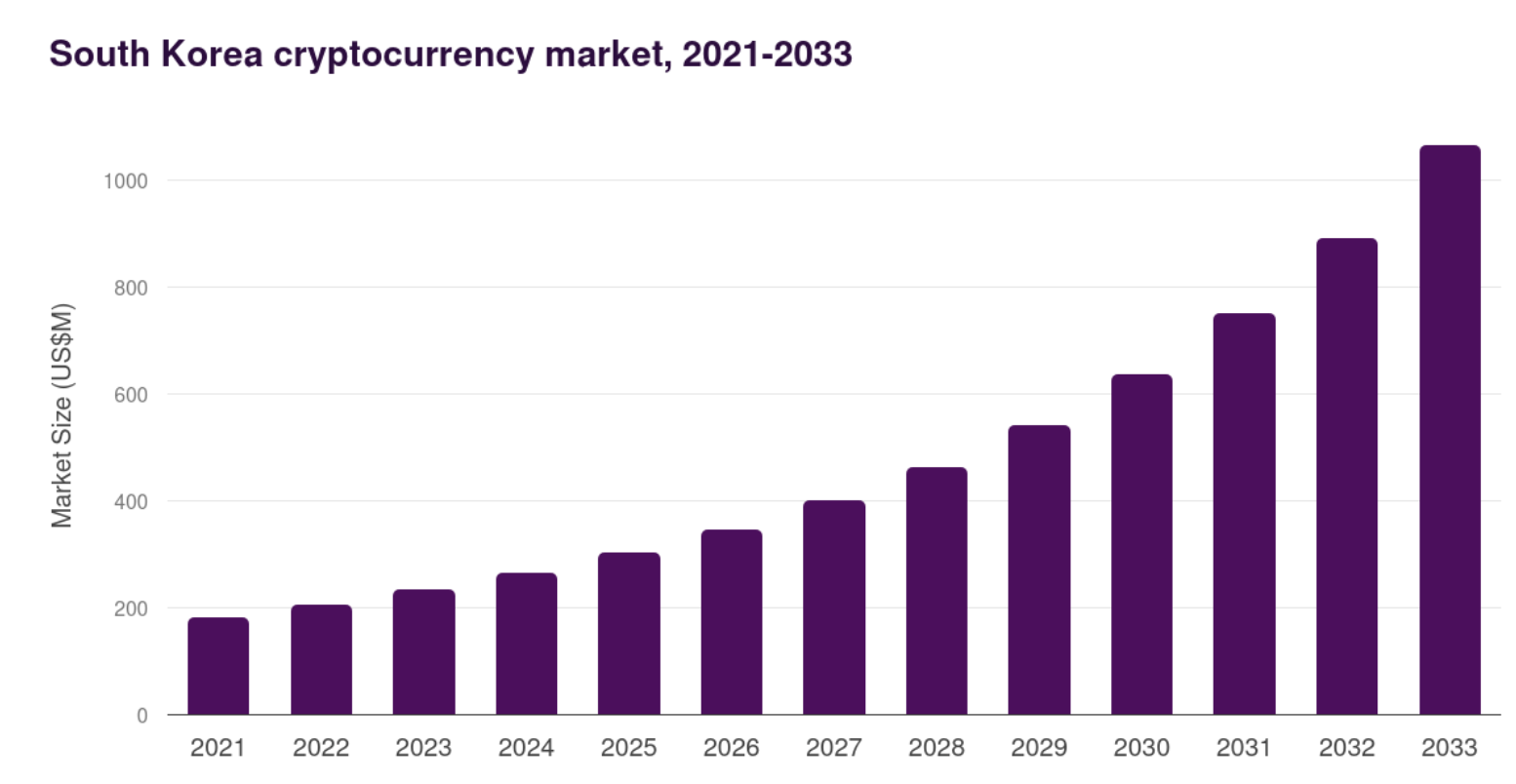

South Korea’s approach to cryptocurrency taxation has been anything but static.

After several postponements, political debates, and regulatory rewrites, the country is moving toward a clearer tax framework for digital assets in 2026. Yet despite the headlines about “delayed crypto taxes,” crypto activity in South Korea has never been tax-free in practice.

What’s changing in 2026 is not whether crypto is taxed, but how gains are categorized, reported, and enforced.

Why crypto regulation in South Korea matters heading into 2026

In mid-2025, lawmakers introduced the Digital Asset Basic Act, a proposal that would establish a formal licensing regime for stablecoin issuers and create a presidential-level Digital Asset Committee. The bill builds on the Virtual Asset Investor Protection Act, which came into force in 2024 and strengthened custody, disclosure, and market conduct rules for exchanges and service providers.

Political changes have reinforced that direction.

President Lee Jae-myung, elected in June 2025 on a platform that included crypto-friendly pledges, has publicly backed the idea of a won-denominated stablecoin and looser institutional barriers for digital asset investment. His administration has framed crypto policy less as a speculative risk to contain and more as an industry to structure, supervise, and integrate into the domestic economy.

Regulators have also softened their stance toward crypto businesses. In September 2025, South Korea lifted a seven-year restriction that barred crypto firms from qualifying as venture companies, restoring access to state-backed financing, tax incentives, and innovation programs.

Despite years of planning, South Korea’s dedicated virtual asset tax regime has been postponed multiple times and is now scheduled for January 2027.

Reporting infrastructure, asset definitions, and treatment of activities such as staking or airdrops are still under development, even as enforcement capabilities expand. This mix of regulatory ambition and unfinished tax policy sets the backdrop for understanding how crypto is taxed in South Korea today and what is likely to change next.

How South Korea views cryptocurrency under the law

Cryptocurrencies are not legal tender in South Korea, and they are not treated as traditional financial instruments either. Instead, they sit in a separate regulatory category governed by tax law, anti-money laundering rules, and financial reporting obligations.

The National Tax Service (NTS) already treats crypto as a taxable asset under existing legislation, even without a dedicated digital asset tax regime in force. Which law applies depends on the nature of the activity rather than the technology itself.

Personal income from crypto-related activity falls under the Income Tax Act.

Businesses dealing in digital assets operate under the Corporate Tax Act. Transfers of crypto between individuals, whether intentional or accidental, are covered by the Inheritance and Gift Tax Act.

Together, these frameworks allow the tax authority to assess most crypto-related economic activity without waiting for new legislation.

The delayed capital gains tax and what replaces it for now

South Korea’s proposed digital asset capital gains tax was originally scheduled for 2023, then moved to 2024, and later postponed again. Under the current plan, the dedicated crypto gains tax will apply starting in 2026.

Once active, the regime is expected to tax net crypto gains exceeding 50 million KRW per year at a flat rate of 20 percent. Gains would be calculated based on disposal value minus acquisition cost, with transaction fees taken into account. For taxpayers who cannot document purchase prices, authorities have indicated that a simplified cost basis may be permitted.

Until that framework becomes operational, crypto profits do not simply fall into a regulatory gap. Instead, earnings are assessed through existing income classifications.

When crypto earnings count as taxable income

Crypto received through staking, mining, liquidity provision, or platform incentives is generally treated as income at the time it is earned. The classification depends on scale and intent.

Occasional or irregular activity may be taxed as “other income.” More systematic operations, particularly those resembling commercial activity, may be treated as business income. The difference matters because business income allows expense deductions but also carries stricter reporting requirements.

If crypto is paid as compensation for work or services, its fair market value in Korean won at the time of receipt must be declared as income. This applies to freelancers, consultants, and companies that accept crypto instead of cash.

Trading activity and unrealized assumptions

For now, spot trading profits are not taxed under a standalone capital gains rule. That does not mean they are invisible.

If trading activity reaches a level that resembles a business operation, the NTS may treat profits as taxable income under existing law. Frequency, scale, and reliance on trading as a primary source of income all factor into that assessment.

Losses, on the other hand, currently sit in a grey area.

Without a formal capital gains framework, there is no standardized mechanism for offsetting crypto trading losses against other income for individual taxpayers. This is expected to change once the 2026 regime comes into force.

Gifts, inheritance, and overlooked tax exposure

Crypto transfers between individuals often trigger tax obligations that receive far less attention than trading profits.

When cryptocurrency is given as a gift or passed through inheritance, it falls under the Inheritance and Gift Tax Act. The recipient must declare the asset at its fair market value, and progressive tax rates can reach as high as 50 percent depending on the amount and the relationship between the parties.

This applies even when no fiat currency is involved. Wallet-to-wallet transfers between family members are not exempt simply because they occur on-chain.

Corporate crypto activity and accounting expectations

Businesses that handle crypto assets operate under corporate tax rules that already require detailed accounting.

Exchanges, custodians, mining firms, and Web3 service providers must record crypto inflows and outflows in their financial statements using Korean won valuations. Revenue recognition, asset valuation, and expense tracking follow the same principles applied to other taxable assets.

From the second half of 2026, companies involved in cross-border virtual asset transactions will also face monthly reporting obligations to the Bank of Korea.

This adds an additional compliance layer for firms operating across jurisdictions.

Can the NTS track crypto transactions?

South Korea has one of the most transparent crypto oversight systems among major markets.

Domestic exchanges are required to operate real-name account systems, linking trading activity directly to verified bank accounts. Anonymous trading has been banned for years. Exchanges must comply with strict anti-money laundering and counter-terrorist financing standards, including transaction monitoring and suspicious activity reporting.

Crypto service providers must also obtain Information Security Management System certification from the Korea Internet & Security Agency, reinforcing data protection and cybersecurity standards.

Through exchange reporting, banking data, and foreign asset disclosures, the NTS has multiple ways to identify undeclared crypto activity. Overseas exchanges and private wallets do not automatically fall outside this scope, particularly for Korean residents subject to worldwide income taxation.

NFTs, DeFi, and newer crypto use cases

NFT transactions are currently taxed based on their economic substance rather than their label. Profits from selling NFTs may be treated as income, depending on frequency and intent. A dedicated NFT tax framework has not yet been finalized.

DeFi activity presents similar challenges. Rewards, yield, or interest earned through decentralized protocols may be taxable if they represent a clear economic gain. As with staking and mining, classification depends on how the activity is carried out rather than the platform itself.

These areas remain under active review as regulators prepare broader digital asset legislation.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice. HODL FM strongly recommends contacting a qualified industry professional.