This week’s crypto headlines cut across regulation, market structure, and corporate strategy.

South Korean authorities are moving to clamp down on manipulation and technical abuse. In China, a revised legal framework has quietly made individual crypto losses harder to contest. Elsewhere, exchanges and asset managers are experimenting with tokenized collateral and mainstream marketing as they adjust to tighter oversight and slower retail growth.

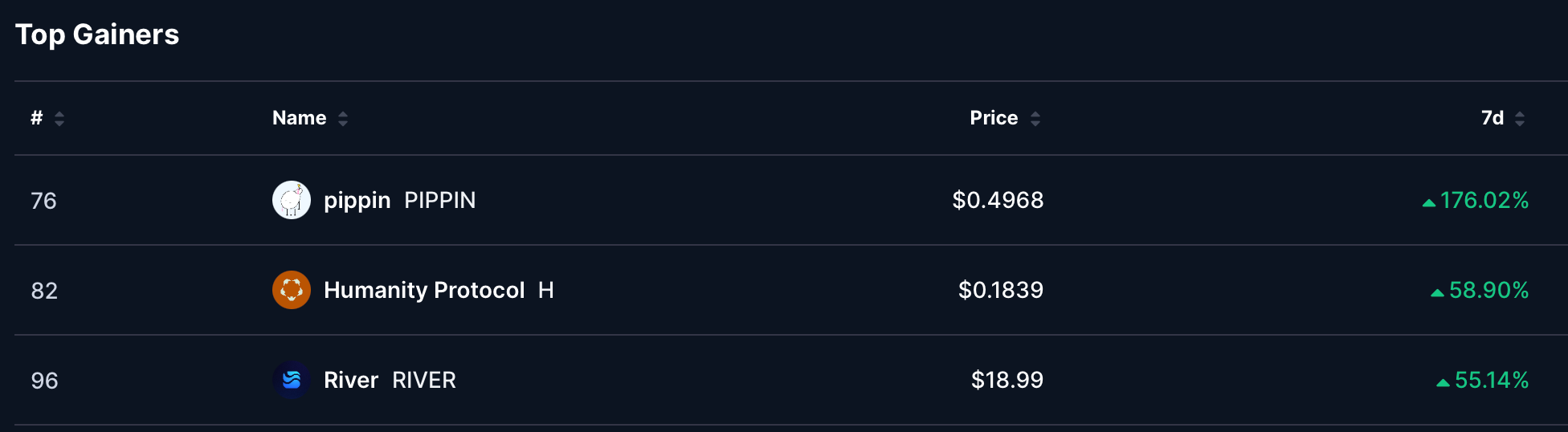

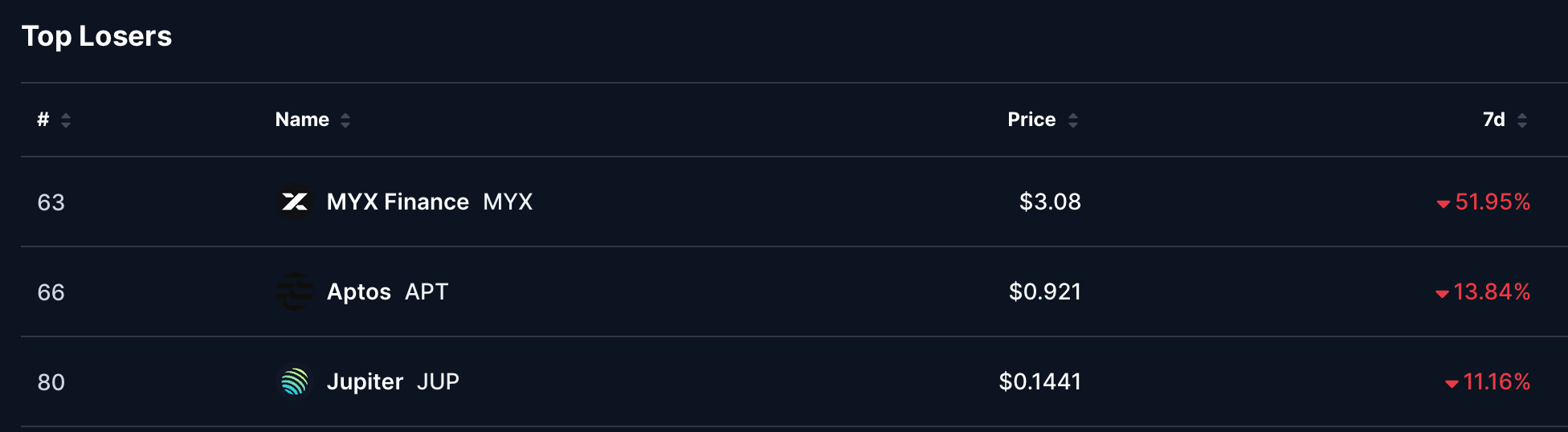

Top gainers and losers

- pippin (PIPPIN) - incredible growth of 176.02% this week to a price of $0.4968

- Humanity Protocol (H) - 58.90% rise to the end week price of $0.1839

- River (RIVER) - significantly growing this week with 55.14% with a price of $18.99

- MYX Finance (MYX) - Lost half of its progress this week, 51.95% with end week price of $3.08

- Aptos (APT) - 13.84% loss to the week price of $0.921

- Jupiter (JUP) - Decreased up to 11.16% of its week price, ending as $0.1441

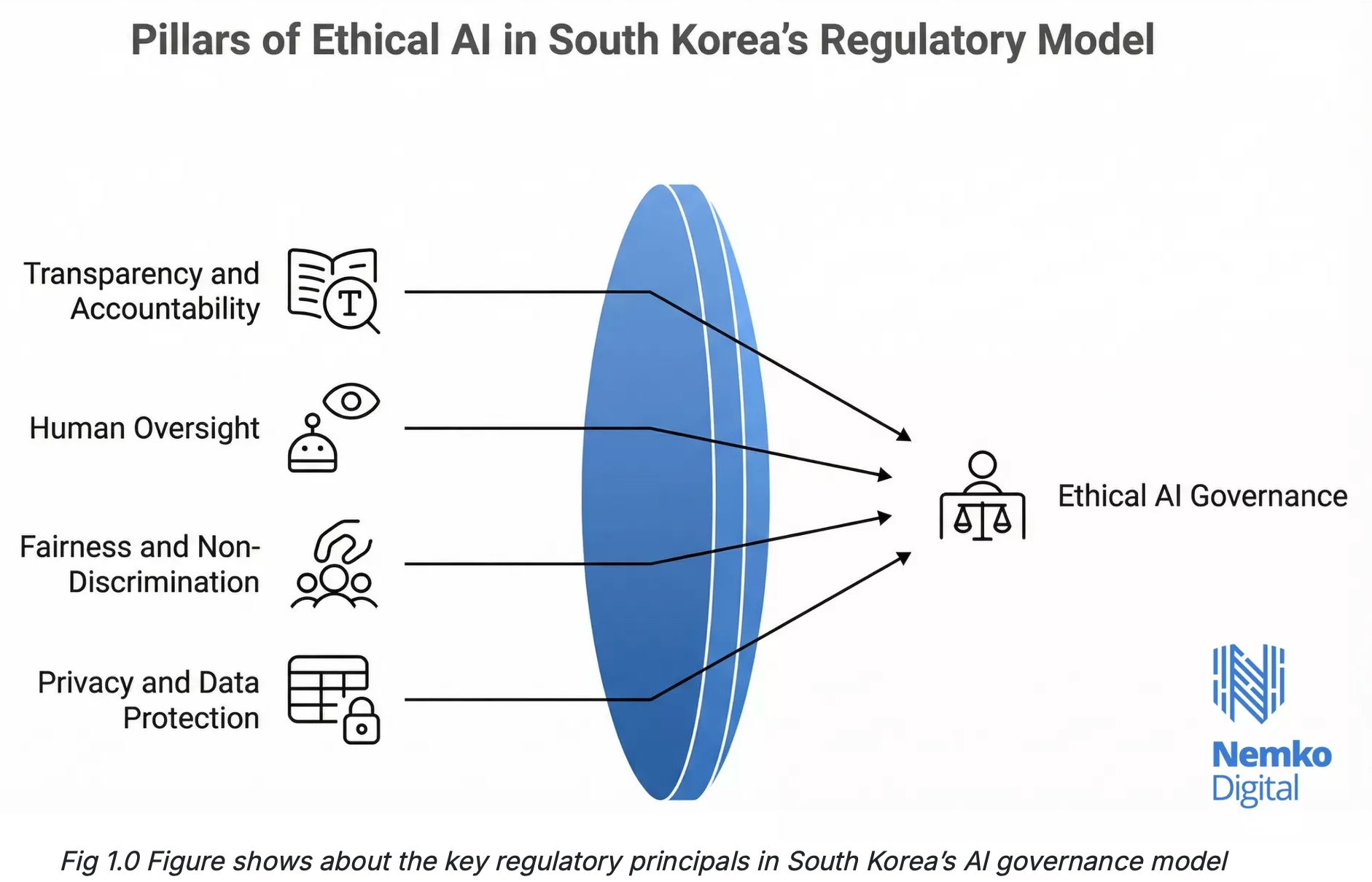

South Korea’s FSS cracks down on whale manipulation and spoofing

South Korea’s Financial Supervisory Service (FSS) plans to investigate high-risk practices in the virtual asset market, including whale-driven price manipulation and API-based spoofing, according to local media reports.

As part of its 2026 enforcement plan, the FSS will expand oversight using artificial intelligence tools alongside legislative measures under the Digital Asset Basic Act to curb market abuse and strengthen supervision, Yonhap reported on Feb. 9.

The investigation will cover manipulation tactics such as large-scale whale trading, the so-called “net cage” method where deposits and withdrawals are selectively suspended for specific tokens and “horse racing” schemes that involve concentrated buying to rapidly inflate prices. Regulators will also examine the misuse of API-based orders and cases where social media is used to spread false information to influence token prices.

The FSS said it will deploy AI systems to detect suspicious trading at the second- and minute-level, automatically flag coordinated activity, and analyze text data to identify organized manipulation efforts. Separate AI tools will be used to combat voice phishing by enabling real-time information sharing between telecom and financial firms.

Alongside enforcement, the regulator will form a preparatory team for the second phase of the Digital Asset Basic Act, tasked with establishing disclosure standards for token issuance and trading support, as well as licensing guidelines for exchanges and stablecoin issuers. A special judicial police consultative body will be created to strengthen on-site enforcement, while a separate task force will focus on IT risks, introducing new fines for security failures.

The announcement follows scrutiny of Bithumb after an internal error led to the accidental distribution of bitcoin to users, briefly pushing prices on the exchange more than 10% below levels on other major platforms.

Coinbase returns to Super Bowl with Backstreet Boys-Inspired ad

Coinbase returned to the Super Bowl on Sunday with a one-minute TV spot built around flashing lyrics from the Backstreet Boys’ 1997 hit Everybody (Backstreet’s Back), reviving memories rather than pitching products.

The ad marked Coinbase’s first Super Bowl appearance since 2022, when its minimalist QR code commercial drove so much traffic that the exchange’s website briefly crashed. That earlier spot reportedly generated around 20 million hits in a single minute by offering new users $15 in bitcoin.

This year’s campaign drew sharply divided reactions online. Some viewers criticized the timing and tone amid a volatile crypto market and political controversy, while others praised the ad’s simplicity and memorability.

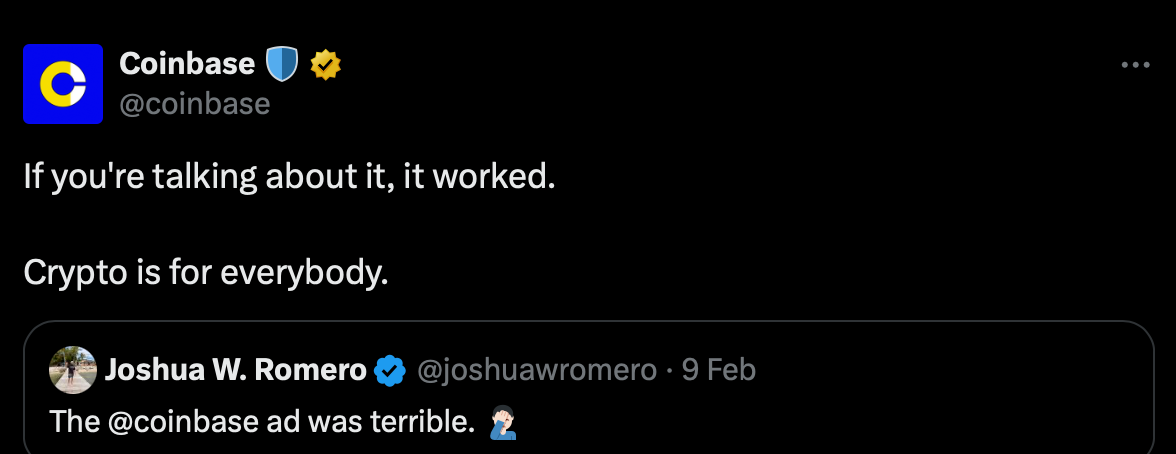

Coinbase leaned into the backlash, responding on X that conversation itself was the goal.

Marketing chief Catherine Ferdon said the ad was designed to create a shared experience and how the crypto community has evolved.

CEO Brian Armstrong later defended the approach, arguing that Super Bowl viewers often half-watch commercials and that only something distinctive can cut through the noise.

Most people half watch commercials (buzzed, in a loud room, with lots of people). It takes something unique to break through.

As in 2022, Coinbase appeared less focused on immediate conversion than on brand recall, accepting mixed reactions as the price of attention.

Binance and Franklin Templeton launch Off-exchange collateral program using tokenized funds

Binance has partnered with Franklin Templeton to allow institutional clients to post tokenized money market fund shares as off-exchange collateral for trading on the exchange.

The arrangement enables eligible participants to use shares issued through Franklin Templeton’s Benji Technology Platform while keeping the underlying assets in regulated custody via Ceffu, Binance’s partner custody layer. The tokenized fund value is mirrored within Binance’s trading system, while the assets themselves remain held off-exchange.

According to the companies, the structure allows institutions to deploy money market fund holdings in support of crypto trading activity without transferring those assets directly onto an exchange. The tokenized shares remain in custody, while their value is recognized for margin and settlement purposes.

Binance said the program is aimed at institutional traders that rely on regulated, yield-bearing instruments and require custody separation when accessing digital asset markets.

“Partnering with Franklin Templeton to offer tokenized real-world assets for off-exchange collateral settlement is a natural next step in our mission to bring digital assets and traditional finance closer together,” said Catherine Chen, Head of VIP & Institutional at Binance.

The initiative gives Franklin Templeton’s institutional clients an additional use case for tokenized money market fund shares, while Binance expands its collateral options for professional market participants using off-exchange custody structures.

China’s February 2026 crypto ban weighs on Bitcoin legalization odds

A prediction market on Polymarket is pricing the likelihood that China will legalize onshore Bitcoin purchases by the end of 2026 at about 5%. The contract resolves only if authorities announce that Chinese citizens can legally buy Bitcoin with yuan within mainland China, excluding Hong Kong, offshore products, or institutional structures.

In February 2026, Chinese regulators issued a joint notice that replaced the September 2021 framework and reaffirmed that virtual-currency business activity constitutes illegal financial activity. The notice states that crypto assets have no legal tender status and expands enforcement beyond trading itself.

Under the updated rules, marketing, traffic facilitation, payment clearing, and the naming or registration of entities connected to crypto activity fall within the scope of enforcement. Stablecoins were identified as a priority area, with regulators banning unauthorized offshore issuance of yuan-pegged tokens and citing concerns around capital controls and cross-border fund movement.

The notice also introduced a civil component.

Investing in virtual currencies or related products is classified as a violation of “public order and good morals,” rendering such transactions legally invalid and placing losses on individual participants.

Offshore experimentation continues under tight constraints. Hong Kong launched spot Bitcoin and Ethereum ETFs in 2024 and implemented a stablecoin licensing framework in 2025, though no issuers had been approved as of early 2026.

The Financial Times reported that Chinese firms including Ant Group and JD.com suspended plans tied to Hong Kong stablecoins following intervention from Beijing.

At the same time, regulators clarified boundaries around tokenization. In early February, the China Securities Regulatory Commission tightened requirements for offshore tokenized products linked to onshore assets, while the People’s Bank of China issued parallel guidance subjecting such structures to enhanced scrutiny.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.