Top stories spanning digital currencies, AI, and political news, all in one snapshot.

AI platforms are opening new doors for autonomous software, while Tether is shaking up Bitcoin mining with an open-source operating system. European banks are racing to integrate crypto as regulatory clarity clears the way, and former President Trump denies knowledge of a major investment tied to a UAE sheikh.

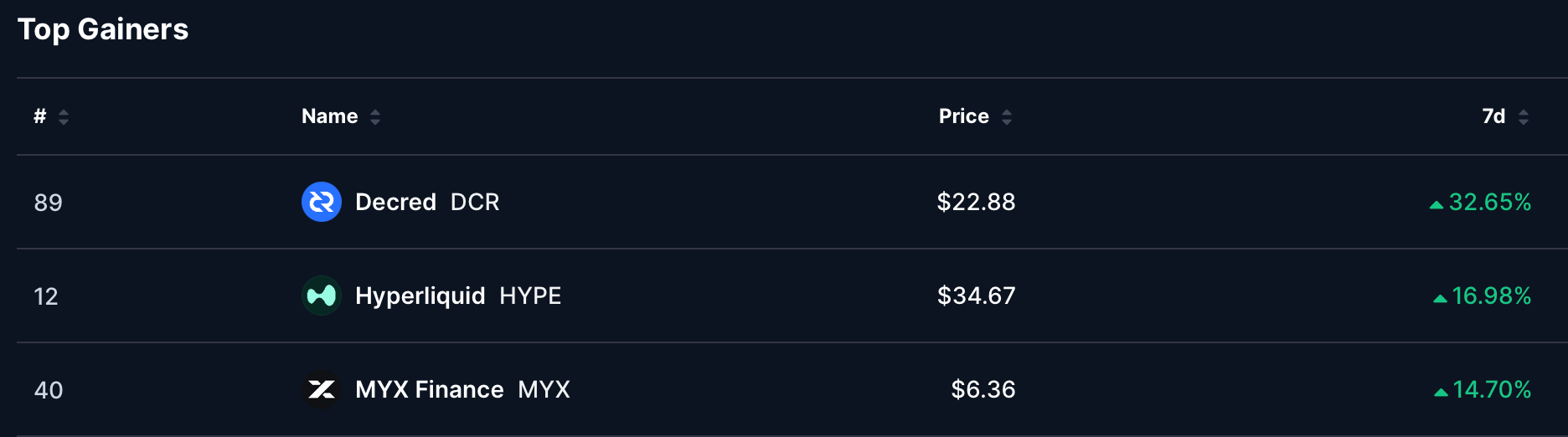

But first our Gainers and Losers section observations.

Top gainers and losers

- Decred (DCR) - Raised significantly for 32.65% up to the price of $22.88

- Hyperliquid (HYPE) - 16.98% growth to a end week price of $34.67

- MYX Finance (MYX) - 14.70% jump to a price of $6.36 this week

- Story (IP) - Lost a noticeable amount of 31.38% to a price of $1.24

- Optimism (OP) - 30.54% drop to a price of $0.1848 this week

- Zcash (ZEC) - 29.93% loss to a end price of $232.62

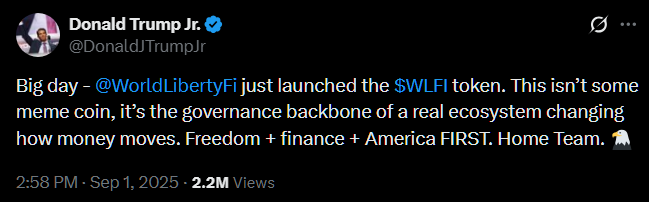

Trump denies knowledge of UAE-linked investment in World Liberty

Donald Trump said he was unaware of a reported $500 million investment by a UAE-linked entity into World Liberty Financial (WLFI), a crypto venture backed by his family, after reporting raised fresh questions about the project’s financing.

“I don’t know about it,” Trump said during a recent media appearance.

He added that while he recognizes crypto’s growing role in finance, he is not involved in the venture’s operations.

“My sons are handling that, my family is handling it. I guess they get investments from different people.”

The remarks followed a Wall Street Journal report citing transaction documents and people familiar with the matter.

This report outlined a previously undisclosed investment linked to Sheikh Tahnoon bin Zayed Al Nahyan, the United Arab Emirates’ national security advisor, routed through a firm called Aryam Investment 1.

According to the Journal, the transaction was split across multiple tranches.

The first installment totaled about $250 million, with roughly $187 million directed to entities associated with the Trump family. Another $31 million was allocated to companies tied to WLFI co-founders Zak Folkman and Chase Herro. If accurate, the investment would position Aryam as the company’s largest external shareholder. WLFI has not publicly confirmed or denied the report.

The timing of the transaction has also drawn attention.

Documents cited by the Journal show the deal was signed by Eric Trump on Jan. 16, four days before Donald Trump was sworn in. No evidence has been presented that the transaction violated U.S. law, though the proximity has added to scrutiny surrounding the venture.

Sheikh Tahnoon holds a central role in the UAE’s security and technology strategy.

He chairs artificial intelligence firm Group 42, which recently received U.S. approval to purchase advanced chips from Nvidia and AMD. He also leads MGX, a firm that earlier this year used the USD1 stablecoin to facilitate a multi-billion-dollar investment into Binance.

The reported investment follows a shift in WLFI’s ownership structure. In June 2025, DT Marks DEFI LLC reduced the Trump family’s stake from 75% to roughly 40%. Reporting at the time suggested the sale generated substantial proceeds, though detailed terms were not disclosed.

U.S. lawmakers have since urged regulators to examine the project more closely.

Earlier this month, Senator Elizabeth Warren called on agencies to pause review of WLFI’s banking charter application, citing unresolved conflict-of-interest concerns tied to President Trump.

OpenClaw’s rapid rise draws developer interest and early security scrutiny

OpenClaw has surged in popularity within the open-source community, reaching roughly 147,000 GitHub stars within weeks. The AI agent framework has attracted developers for its ability to run persistent, self-hosted agents, while also drawing early scrutiny as copycat projects and third-party tools emerged around it.

Created by Austrian engineer Peter Steinberger after stepping back from PSPDFKit, OpenClaw allows users to deploy agents that operate continuously rather than respond only when prompted.

Agents can wake on schedules, store memory locally, and interact with messaging platforms such as Telegram, WhatsApp, Discord, Slack, and Signal.

Depending on configuration, they may also access email, calendars, browsers, local files, and system shells. The framework runs locally and avoids centralized cloud control, a design choice that has appealed to developers seeking more direct control over deployment and data.

IBM researcher Kaoutar El Maghraoui has noted that similar frameworks operate outside the vertically integrated model common among large technology platforms.

“this loose, open-source layer that can be incredibly powerful if it has full system access,” El Maghraoui said

The project’s visibility led to rapid ecosystem growth.

Moltbook, a Reddit-style platform that presented itself as a space where only AI agents post content, gained attention for streams of automated discussions and self-descriptions. Wiz researcher Gal Nagli later reported that Moltbook’s claimed population of about 1.5 million agents corresponded to roughly 17,000 human owners, suggesting extensive reuse and human direction.

Other viral experiments followed similar patterns.

Crustafarianism, a crab-themed AI religion complete with generated texts and lore, spread widely online, though similar outputs can be produced through deliberate prompting rather than independent belief or intent.

Security researcher Nathan Hamiel has warned that without external secrets management, sensitive data may be stored locally, increasing exposure if systems are compromised.

OpenClaw agents run with the permissions of their operators, inheriting access to files, credentials, and system resources.

“these systems are operating as "you.” … they operate above the security protections provided by the operating system and the browser. This means application isolation and same-origin policy don't apply to them.”

Reports of malicious third-party tools soon followed. Tom’s Hardware documented skills uploaded to ClawHub that attempted to run silent commands or engage in crypto-related attacks by exploiting user trust.

“basically just AutoGPT with more access and worse consequences.” Nathan Hamiel specified

Moltbook later suffered its own breach after leaving a Supabase database exposed, leaking private messages, email addresses, and API tokens, according to Wiz.

Tether releases open-source operating system for Bitcoin mining

Tether has released an open-source operating system for Bitcoin mining, expanding its footprint beyond stablecoins and into core infrastructure.

The company announced the launch of MiningOS (MOS) on Monday, describing it as a modular, self-hosted mining stack designed to support everything from home setups to large-scale industrial operations.

“The mining industry has long been limited by closed systems and proprietary tools,” Tether said on the MiningOS website.

According to Tether, the software allows mining devices to communicate through an integrated peer-to-peer network, removing the need for centralized services.

“MiningOS changes that introducing transparency, openness, and collaboration into the core of Bitcoin infrastructure.”

CEO Paolo Ardoino said the platform is built to scale “from a home setup to industrial-grade sites, even across multiple geographies.”

MiningOS is released under the Apache 2.0 license and is built on Holepunch peer-to-peer protocols, which Tether says eliminates lock-in and third-party dependencies.

Tether first announced plans for an open-source mining operating system in June last year, arguing that miners should be able to “enter the game and compete” without relying on expensive third-party vendors.

It puts Tether alongside firms such as Jack Dorsey’s Block, though Block’s mining software is designed to work primarily with its own hardware.

aOver the past year, the company has increased its Bitcoin and gold holdings while investing across areas including tokenization, artificial intelligence, and decentralized finance.

European Banks bring Crypto to retail investors

Germany’s ING Deutschland launched seamless crypto access for retail brokerage customers. Starting Feb. 2, the bank’s 3.2 million users can purchase crypto exchange-traded notes (ETNs) directly in the ING app. Trades above €1,000 carry no order fees, and users can set up recurring savings plans.

“2025 was marked by growth and important strategic decisions. We continued to expand commercially, closed initial gaps in our offerings, and made initiatives with direct customer benefits top priorities,” summarizes Lars Stoy, CEO of ING in Germany.

VanEck provides 11 ETNs covering Bitcoin, Ethereum, and select altcoins, integrating crypto alongside equities in the same account.

The expansion follows the full implementation of the EU’s Markets in Crypto-Assets (MiCA) regulation, which allows banks to treat crypto as a regulated security.

Other European banks, including Spain’s BBVA, Openbank, and CaixaBank, have launched similar services, offering trading and custody while managing compliance internally.

ING’s brokerage system processed over 55 million transactions in 2025. Even modest adoption of crypto ETNs could channel billions into digital assets without customers handling private keys.

“We want to further strengthen our innovative capacity, accelerate the pace of product launches, and offer our customers a more personalized digital banking experience.”

Chainalysis and CoinShares data show that German retail investors are steadily adopting crypto, with flows remaining relatively resilient even during broader market outflows. MiCA compliance ensures that banks can offer these products efficiently, positioning regulated institutions as the main access point for European retail crypto.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.