Global crypto markets are adjusting to regulatory pressures, evolving governance, and new market opportunities.

South Korea is restricting access to unregistered crypto apps as tokenized securities gain legal clarity. In the US, the CLARITY Act’s stablecoin yield ban sparks debate over dollar competitiveness, while DeFi platform Pendle overhauls its governance token to simplify adoption.

Meanwhile, NFT marketplace Magic Eden pivots toward prediction markets and crypto entertainment, signaling a speculative “supercycle” in user-driven financial products.

Yet, let's look at our weekly Coin performers first.

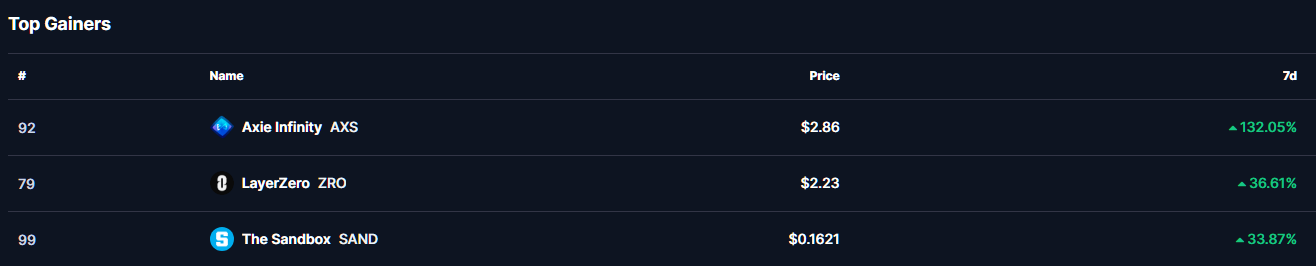

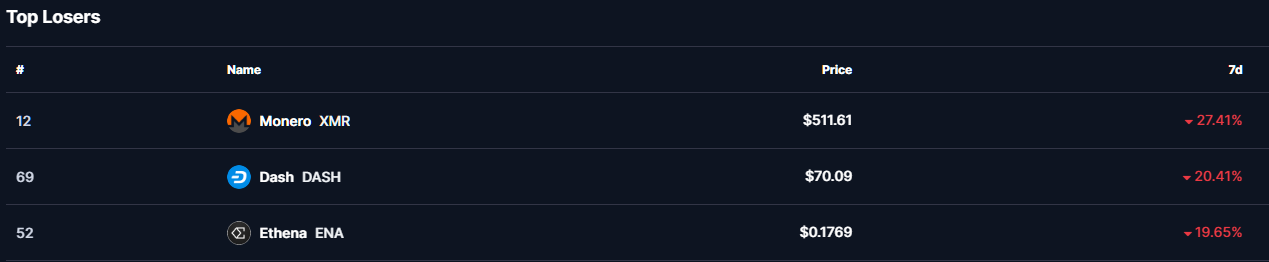

Top gainers and losers

- Axie Infinity (AXS) - Amazing rise 132.05% to a price of $2.86

- LayerZero (ZRO) - 36.61% growth to weekly end price $2.23

- The Sandbox (SAND) - Weekly rise of 33.87% to a price of $0.01621

- Monero (XMR) - 27.41% drop to a week price of $511.61

- Dash (DASH) - Loss of 20.41% to a price of $70.09

- Ethena (ENA) - 19.65% loss this week to end price of $0.1769

South Korea tightens crypto access as app stores enforce registration rules

South Korea is moving to redraw the boundaries of its crypto market, combining new legislation for tokenized securities with tougher controls on how digital asset platforms reach users. Lawmakers have passed amendments to the Capital Markets Act and the Electronic Securities Act that formally establish a legal framework for security token offerings, defining them as securities issued and managed on blockchain-based distributed ledgers. The regime, overseen by the Financial Services Commission, is set to take effect in January 2027 after a one-year preparation period and is intended to bring blockchain-based debt, equity, and investment contract products firmly under existing financial law.

Alongside that push, access to crypto trading apps is tightening. Google Play has begun enforcing a policy that requires exchanges and wallet providers to register as virtual asset service providers with South Korea’s Financial Intelligence Unit to remain listed. From Jan. 28, Android users in South Korea will no longer be able to download or update apps from unregistered overseas exchanges. Only 27 domestic platforms, including Upbit and Bithumb, currently meet the requirement, while global exchanges such as Binance, Bybit, and OKX remain unregistered and effectively blocked from the Play Store.

The impact is likely to be significant in a country where Android devices dominate. “As an enforcement tool, the impact is substantial,” said Siwon Huh, a researcher at South Korean crypto research firm Four Pillars.

Android users account for more than 80% of the local market, he noted, adding that alternatives like browser-based trading or sideloaded apps are “not realistic” for most users given security concerns. Huh also said the move appears to have originated with Google’s own policy update rather than a direct government order, though it aligns closely with regulators’ broader direction.

Over time, he warned, the approach could deepen the split between tightly regulated digital finance and higher-risk crypto markets, potentially paving the way for further restrictions across other app stores and access points.

Scaramucci criticizes stablecoin yield ban as dollar competitiveness issue

Anthony Scaramucci criticized the CLARITY Act’s expanded restrictions on stablecoin rewards during remarks on Jan. 18, arguing that prohibiting yield on dollar-backed tokens weakens the U.S. dollar’s position in global digital finance.

The SkyBridge Capital founder said the ban prevents U.S. stablecoins from competing with China’s digital yuan, which now allows interest through commercial banks.

“The banks do not want the competition from the stablecoin issuers, so they’re blocking the yield,” Scaramucci commented.

He added that countries evaluating digital payment rails are more likely to adopt systems that offer returns rather than those that do not.

The comments followed a policy change by the People’s Bank of China, which began allowing interest payments on digital yuan deposits in January. That move has drawn criticism from U.S. crypto executives concerned about the international use of dollar-based stablecoins.

Coinbase CEO Brian Armstrong has raised similar objections in recent statements, saying restrictions on rewards do not materially affect bank lending but reduce the appeal of U.S. stablecoins in foreign exchange and settlement markets.

Banking executives have pushed back.

During an earnings call this week, Bank of America CEO Brian Moynihan warned that widespread adoption of stablecoins could lead to as much as $6 trillion in deposit outflows, potentially constraining traditional bank lending.

The CLARITY Act builds on limits introduced under the GENIUS Act last year, extending the prohibition on yield tied solely to holding stablecoins. The debate now centers on whether U.S. stablecoins should function strictly as non-yielding payment instruments or compete more directly with foreign digital currencies that offer interest.

Pendle moves to replace vePENDLE after governance design limits participation

Pendle is restructuring its governance system after concluding that its long-running vePENDLE model failed to attract broad participation, despite strong growth across the protocol itself.

The DeFi yield-trading platform said it will begin phasing out vePENDLE this month and replace it with a new liquid staking and governance token, sPENDLE. The change follows internal assessments that vePENDLE’s extended lock-up periods, non-transferable design, and active voting requirements discouraged most users from engaging in governance.

— Pendle (@pendle_fi) January 20, 2026

Pendle Official Statement.

Pendle’s underlying business has continued to expand.

Data from DeFi Llama shows the protocol now holds close to $3.5 billion in total value locked, placing it among the largest DeFi platforms by size. Governance participation, however, remained concentrated among a small subset of sophisticated users.

Under the existing system, vePENDLE holders were required to lock tokens for fixed periods and participate in weekly votes to earn rewards. While the structure was intended to encourage long-term alignment, Pendle said it instead created friction for users who lacked the time or technical expertise to optimize voting strategies. In 2025, the protocol generated more than $37 million in revenue, but most governance rewards accrued to a narrow group of active participants.

The replacement token, sPENDLE, is designed to be transferable and usable across other DeFi applications. Holders will be able to withdraw staked tokens after a 14-day unwinding period, or exit immediately for a fee. Pendle said this flexibility is intended to lower the cost of participation and allow governance tokens to function more like capital rather than a long-term commitment.

Governance mechanics will also change. Instead of weekly engagement, sPENDLE holders will only need to vote on major protocol proposals to remain eligible for rewards. When no proposal is active, eligibility will continue automatically. Pendle said this approach reflects how most users interact with governance in practice, rather than how the system was originally designed on paper.

The protocol also plans to use up to 80% of its revenue for PENDLE token buybacks, distributing those tokens as governance rewards. By tying incentives more directly to protocol performance, Pendle aims to broaden participation without relying on constant voting activity.

Staking for sPENDLE is scheduled to begin this week. New vePENDLE locks will be paused later this month, followed by a snapshot of existing balances to complete the transition.

Magic Eden CEO sees speculation driving next phase of crypto platforms

Magic Eden is repositioning its business around speculative crypto products as interest grows in markets that combine financial risk-taking with interactive entertainment, according to CEO Jack Lu.

Lu said the NFT marketplace is shifting focus toward prediction markets and betting, arguing that speculation has moved from the margins of crypto into everyday user behavior. As part of that strategy, Magic Eden plans to launch Dicey this quarter, a decentralized betting platform that will let users create games, place wagers, and participate directly in outcomes.

The pivot follows a prolonged slowdown in NFT activity through 2025. Despite the downturn, Lu said Magic Eden generated roughly $24 million in revenue during the year. He described the company’s native token, ME, as the foundation of a broader “crypto entertainment” model that extends beyond traditional NFT trading.

Growth in prediction markets has reinforced that shift.

Data from Kalshi and Polymarket dashboards shows daily trading volume across major platforms recently reached a record $814.2 million, surpassing the prior high of $701.7 million. Kalshi remains the largest venue by volume, while Polymarket and Opinion continue to attract consistent activity.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice. HODL FM strongly recommends contacting a qualified industry professional.