Crypto exchange Gemini will shut down operations in the United Kingdom, the European Union, and Australia, the company confirmed in an announcement released Thursday, only months after its Nasdaq debut. The move follows a reduction of roughly 25% of its global workforce and a broader shift toward the US market and new product priorities.

A message on @Gemini 2.0 — AI, prediction markets, and focus.https://t.co/aObX0u5N7U

— Cameron Winklevoss (@cameron) February 5, 2026

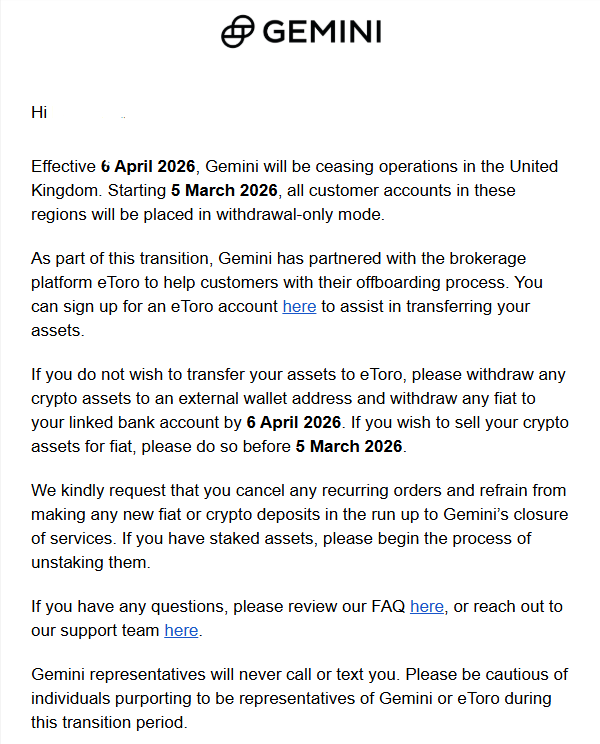

Customers in the affected regions will retain withdrawal access from March 5. Gemini asked users to close recurring orders and avoid new deposits ahead of the shutdown. The company also advised users to unstake assets where applicable. An email to customers noted:

"We kindly request that you cancel any recurring orders and refrain from making any new fiat or crypto deposits in the run up to Gemini’s closure of services. If you have staked assets, please begin the process of unstaking them."

The firm confirmed cooperation with trading platform eToro as part of the offboarding process.

Strategic focus returns to the US

Gemini stated that the decision reflects a renewed focus on its home market. The company said it would concentrate resources on US operations and emerging product areas tied to prediction markets and artificial intelligence.

The announcement included a clear statement of direction: "time for Gemini to focus and double down on America."

The company described operational pressure across foreign markets.

"These foreign markets have proven hard to win in for various reasons, and we find ourselves stretched thin with a level of organizational and operational complexity that drives our cost structure up and slows us down. We don’t have the demand in these regions to justify them. The reality is that America has the world’s greatest capital markets."

Gemini first launched in the United States in 2015 and later expanded to more than 60 countries. Leadership now plans a narrower footprint to reduce expenses and speed up profitability efforts.

Workforce reduction tied to AI and restructuring

The exchange also outlined the role of artificial intelligence in its internal transformation. Gemini described a shift in productivity expectations across engineering and non-engineering roles. The company noted that AI tools have increased output per employee and reshaped its staffing model.

The firm reported that its workforce peaked at about 1,100 employees in 2022. Headcount fell to roughly half that level by the end of 2025. Another reduction followed this year. Gemini stated that the new structure aligns with its mission and operational priorities.

The company said the change reflects efficiency gains and faster execution cycles. It acknowledged the contributions of departing employees and described the layoffs as part of a long-term reset.

Prediction markets move to the center of strategy

Gemini now places prediction markets at the core of its product roadmap. The company launched Gemini Predictions in December 2025 and reported early adoption.

"Our thesis is that prediction markets will be as big or bigger than today’s capital markets," the announcement said.

The platform recorded more than 10,000 users and over $24 million in trading volume since launch. The company plans to make the feature more visible inside its main app as it pursues a broader "super app" model that combines trading, payments, and market forecasting tools.

Data referenced in the announcement highlighted rising activity across the prediction market sector. Trading volumes increased during the US presidential election cycle and remained active into early 2026. Market leadership remains concentrated among established platforms such as Polymarket and Kalshi, based on Dune data cited in the materials.

Regulatory and market pressures shape the backdrop

The exit follows a period of regulatory scrutiny and market volatility. The US Securities and Exchange Commission dismissed its lawsuit against Gemini in January after the exchange returned customer assets tied to its Earn program. The regulator had filed the case in 2023 over allegations that the program offered unregistered securities.

Banking relationships also affected crypto platforms in Europe and the UK. A group of exchanges reported that close to £1 billion in transactions faced rejection. About 80% of customers said bank transfers to crypto platforms faced blocks or limits. One exchange stated:

"Blanket restrictions from the bank are designed to constrain the growth of the crypto industry. No consideration of our regulatory status, actual fraud levels or genuine risks have been taken into account."

The broader digital asset market has faced pressure since a flash crash in October and delays around the CLARITY Act, a proposed US crypto market structure bill. Gemini referenced this environment as part of its strategic reassessment.

Customers transition as Gemini narrows global footprint

The closure across the UK, EU, and Australia marks a major shift in Gemini’s international strategy. The company now aims to consolidate operations and prioritize US-based products tied to payments, prediction markets, and AI-supported workflows.

Gemini framed the decision as a structural reset designed to simplify operations and accelerate growth in its strongest market. The exchange maintains that it will continue to develop new services as it adapts to changes across crypto infrastructure, regulation, and digital trading behavior.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.