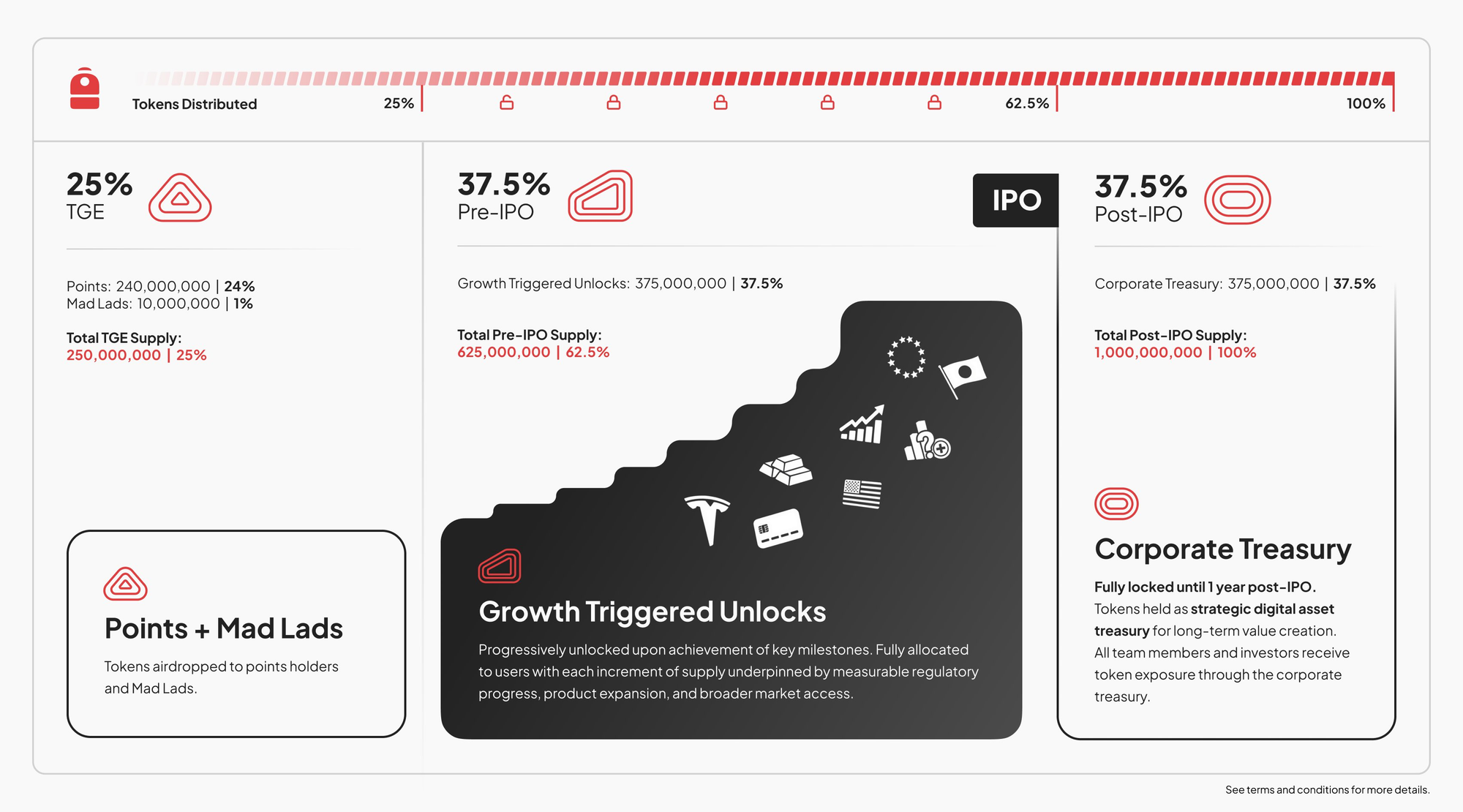

On Monday, the crypto exchange Backpack announced a structured tokenomics plan for its upcoming utility token with a supply of 1 billion. The framework ties the release of tokens to specific growth goals and a future initial public offering (IPO) in the U.S. Its goal is to stop insiders from making money before the platform reaches "escape velocity."

25% on TGE

— Backpack 🎒 (@Backpack) February 9, 2026

Here's the entire token distribution

Utility coming next 🎒 pic.twitter.com/O7gyL7WP4v

Backpack co-founder and CEO Armani Ferrante detailed the plan on X, noting that the guiding principle is to ensure "insiders 'dumping on retail' should be impossible."

He added that no founder, executive, team member, or venture investor has received direct token allocations.

"It’s not until the company goes public (or has some other type of equity exit event) that the team can earn any wealth from the project," Ferrante wrote.

Initial token distribution and airdrops

The token generation event (TGE) will release 25% of the total supply, or 250 million tokens. Of these, 240 million are earmarked for participants in Backpack Points, the platform’s loyalty program, and 1 million for holders of Mad Lads NFTs. The remaining 750 million tokens will be divided into two tranches of 37.5% each: pre-IPO and post-IPO allocations.

Ferrante explained that pre-IPO tokens unlock progressively when key growth milestones are achieved. These milestones include launching in new regions, regulatory approvals, and rolling out products such as predictions, stocks, and a card offering.

"Every time we open up a new region, every time we launch a new product, that's an opportunity to grow," he said.

The design positions tokens as a tool to fuel expansion, incentivizing user engagement while aligning token unlocks with tangible business progress.

Post-IPO lockup and corporate treasury

The post-IPO tranche, comprising another 37.5% of tokens, will be held in the corporate treasury and remain locked for at least one year following Backpack's public listing. The company owns this portion strategically, ensuring that the team can only benefit financially after completing the work necessary to access major capital markets. Ferrante emphasized,

"It’s not until the company has done all the hard work to earn access to those markets that the team can reap the rewards of the value created by the Backpack community from now until then."

The model separates token wealth from equity ownership. The team retains equity in Backpack, linking their financial upside to the company’s overall success rather than immediate token sales. This structure seeks to mitigate dilution for retail participants and prevent early insider selling from negatively impacting the community.

Growth strategy and international expansion

Backpack’s launch in 2022 focused on measured, regulated growth. The platform currently serves approximately 48% of the global market. Ferrante described the expansion as deliberate:

"We’ve been very slow, very intentional about opening up our product to the world, ensuring that we have every 'i' dotted and every 't' crossed as a regulated financial institution."

Backpack aims to offer both crypto and traditional finance products, including access to global payment rails and brokerage services. The staged unlocks for pre-IPO tokens, long post-IPO lockup, and equity-based team incentives are all designed to align token circulation with sustainable, long-term development.

Next steps for the token launch

Backpack has not announced a date for the TGE but indicated that more details about the token’s utility will be shared soon. The staged approach ensures that token distribution aligns with the company’s growth, regulatory milestones, and strategic goals, creating a framework that balances user incentives with corporate accountability.

According to the Axios report, Backpack is also in talks to raise $50 million at a $1 billion pre-money valuation, which would make it a possible crypto unicorn before its expected IPO.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.