Bitcoin extended its decline this week, with prices falling to levels not seen since late 2024. The downturn has renewed debate across the industry over whether the market has entered a prolonged bear phase or a temporary reset.

TradingView data shows Bitcoin dropped to about $70,894 late Wednesday, while Ethereum fell to roughly $2,091.

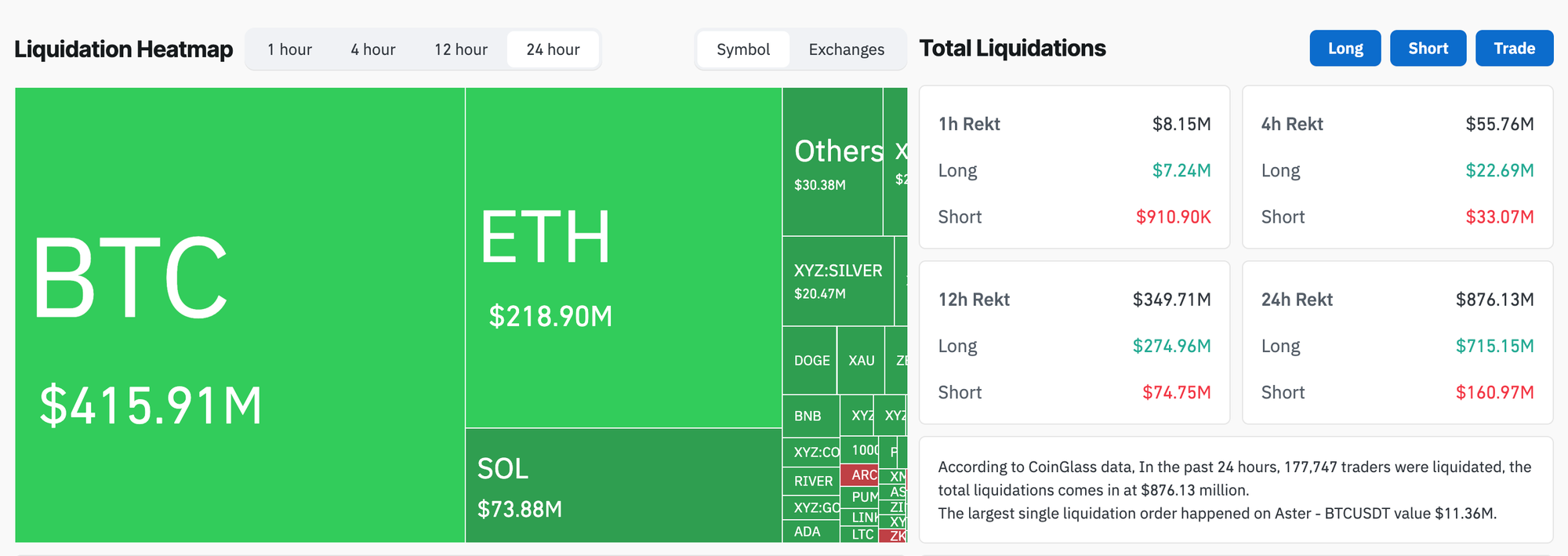

Total liquidations climbed above $876 million in 24 hours, according to CoinGlass, with Bitcoin accounting for about $416 million. The pressure coincided with broader market weakness and a shift in investor positioning.

Vincent Liu, chief investment officer at Kronos Research, described the market conditions in a statement.

"BTC extended losses after a failed relief bounce lost key support."

He attributed the move to a wave of long liquidations, pressure from U.S. equity markets and continued ETF outflows.

Institutional voices define a bear phase

Bitwise Chief Investment Officer Matt Hougan described the current environment as a full bear market that began in January 2025. In a recent analysis, he compared the situation to downturns in 2018 and 2022 and linked the decline to excessive leverage and profit-taking by long-term holders.

The report noted that positive developments across the sector have not translated into price recovery. Institutional participation and regulatory progress failed to offset downward momentum during the deepest phases of the cycle, according to Hougan’s assessment.

The Crypto Fear and Greed Index remains near extreme fear levels, a condition that has historically accompanied extended market declines.

Historical comparisons highlight similar timelines. Bitcoin peaked in December 2017 before reaching a bottom about a year later. The asset repeated a comparable pattern after the October 2021 peak, with a low point in November 2022.

Hougan said exchange-traded funds and digital asset treasuries bought more than 744,000 Bitcoin during the recent period of weakness. The report stated that prices could have fallen by as much as 60% without this demand.

Analysts track structural signals

Julio Moreno, head of research at CryptoQuant, stated that the bear market could extend through the third quarter of 2026. He cited weak demand and contracting liquidity as major constraints.

Bitcoin trades below key long-term trend indicators. CryptoQuant tracks the 365-day moving average as a regime marker, which currently sits above the market price. The Bull Score Index registered 20 out of 100, a level associated with extreme bear territory.

Coinbase Institutional and Glassnode research focus on positioning and derivatives data. Options markets show strong demand for downside protection, and traders continue to hedge against further declines. CoinShares estimates that large holders sold about $29 billion worth of Bitcoin since October. Digital asset exchange-traded products recorded about $440 million in outflows this year.

The U.S. Securities and Exchange Commission defines a bear market as a drop of 20% or more over at least two months. Bitcoin surpassed that threshold months ago after falling more than 40% from its peak.

Market stress meets long-term conviction

Despite bearish signals, institutional exposure remains intact in several cases. A Coinbase Institutional and Glassnode survey conducted between December 2025 and January 2026 found that 26% of institutions described the market as bearish. The same survey showed that 62% held or increased net long exposure since October and 70% considered Bitcoin undervalued.

This contrast reflects a shift in how bear markets function in digital assets. Price declines coexist with continued accumulation.

John Haar, managing director at Swan Bitcoin, said the recent volatility does not undermine long-term fundamentals.

"It was less than four months ago that Bitcoin hit a new all-time high of $125,000."

"Nothing has changed the long-term Bitcoin investment thesis."

Georgii Verbitskii, founder of the TYMIO crypto investment app, linked selling pressure to long-term holders who reduced exposure.

"One of Bitcoin’s core narratives—that it reliably protects against fiat inflation—is being questioned in the short term," he said.

"While gold and other metals continue to rise, Bitcoin has moved in the opposite direction, and that divergence matters."

Macro forces weigh on sentiment

Macro conditions continue to influence price action. Market participants point to geopolitical tension, Federal Reserve leadership developments and leverage unwinds as key factors.

Peter Chung, head of research at Presto Research, described the broader context in remarks.

"Current price action in crypto is following the broader risk-off in markets and other asset classes."

The Nasdaq Composite fell 1.51% during the same session, while crypto-related equities also declined. Coinbase shares dropped more than 6% and Ethereum treasury firm Bitmine fell more than 9%.

Outlook remains uncertain

Future scenarios vary across research groups. Some forecasts describe a classic crypto winter that extends through mid or late 2026. Others expect a shorter period of consolidation followed by recovery.

Hougan identified several possible catalysts for improvement. He pointed to stronger global growth, progress on U.S. crypto legislation such as the CLARITY Act and early sovereign adoption signals as potential drivers.

Vincent Liu said market participants monitor the $70,000 level closely. He noted that stabilization in leverage, sentiment and ETF flows would signal easing pressure.

The market now sits at a turning point defined by price declines, defensive positioning and persistent institutional exposure. The direction of demand and liquidity will determine the next phase.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.