Former BitMEX CEO Arthur Hayes has warned that instability in the Japanese yen could trigger a major rally in Bitcoin (BTC) and other cryptocurrencies. Hayes outlined his thesis in a January 28 essay titled “Woomph,” linking potential Federal Reserve action to market opportunities for crypto investors.

Hayes said that the yen’s recent depreciation and rising Japanese Government Bond (JGB) yields signal broader financial fragility in Japan. He argued that the U.S. Treasury and Federal Reserve have both the legal authority and the incentive to intervene, potentially expanding the Fed’s balance sheet to stabilize the yen and JGB markets.

“Bitcoin and quality shitcoins will mechanically levitate in fiat terms as the quantity of paper money rises,” he wrote.

He connected the yen’s stress to U.S. Treasury stability, noting that large-scale sales of U.S. Treasuries by Japanese investors could spike borrowing costs for the United States.

“Woomph” is a an essay on my theory about how the Fed could be printing money to manipulate the yen and JGB markets. If true money printer go fucking BRRRR!

— Arthur Hayes (@CryptoHayes) January 27, 2026

https://t.co/VdCUcd784t pic.twitter.com/loIlR5nOd0

Mechanism of potential intervention

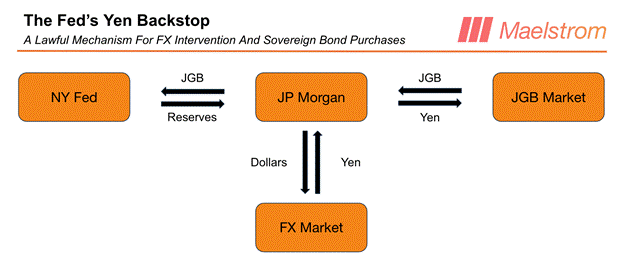

Hayes described a scenario in which the New York Fed, coordinating with the Treasury, creates new dollar reserves and swaps them for yen in the foreign exchange market. These yen would then be used to buy JGBs. The strategy would strengthen the yen, reduce JGB yields, and discourage Japanese investors from repatriating funds by selling U.S. Treasuries.

He pointed to a concrete example as evidence of official concern. On January 23, the New York Fed performed a “rate check” on USD/JPY, which analysts at QCP Capital interpreted as a signal of market sensitivity. Hayes viewed this as the Fed “deliberately and publicly telegraphing its intentions.”

He explained that the legal basis for such action lies in the Treasury’s Exchange Stabilization Fund and the Fed’s authority to hold foreign currency assets.

“Buffalo Bill Bessent can intervene in the currency markets… The Treasury taps the NY Fed to help manipulate the markets,” Hayes wrote.

He suggested that confirmation of Fed activity would appear in weekly increases in the “Foreign Currency Denominated Assets” line on the Fed’s balance sheet.

Japan’s financial pressures

Hayes highlighted several economic pressures in Japan. A weaker yen imports inflation because Japan relies heavily on imported energy. Rising JGB yields increase borrowing costs for the government. The Bank of Japan, as the largest JGB holder, faces massive unrealized losses from falling bond prices.

If domestic yields remain attractive, Japanese private investors, collectively called Japan Inc., might sell U.S. Treasuries to repatriate funds. Such a move could raise U.S. borrowing costs, exacerbate the country’s record peacetime deficits, and hurt export competitiveness by strengthening the dollar. Hayes noted that despite the Fed’s 1.75% rate cuts since September 2024, 10-year Treasury yields rose slightly due to persistent inflation and supply pressures.

Prime Minister Sanae Takaichi’s push for stimulus programs and defense spending adds urgency to the situation. Hayes inferred that the BOJ likely sought assistance from the Fed to stabilize the yen and bond markets after holding rates steady on January 23.

Implications for Bitcoin and cryptocurrencies

Hayes framed the scenario as a potential catalyst for Bitcoin and risk assets. If the Fed expands its balance sheet as he predicts, liquidity would rise globally. He wrote,

“Bitcoin and quality shitcoins will mechanically levitate in fiat terms as the quantity of paper money rises.”

The former BitMEX CEO also warned of risks. Without intervention, yen weakness and high JGB yields could drive U.S. Treasury yields higher, creating deflationary pressure and hurting cryptocurrencies. Conversely, overly aggressive Fed action could cause short-term volatility in both fiat and crypto markets.

Hayes emphasized that his thesis remains a theory and depends on observing concrete evidence in Fed reports. He monitors the “Foreign Currency Denominated Assets” line to validate whether the intervention occurs.

For crypto traders, Hayes’ analysis highlights the importance of monitoring Japanese macroeconomic signals and weekly Fed balance sheet updates as potential triggers for significant market moves.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice. HODL FM strongly recommends contacting a qualified industry professional.