Bitcoin fell to its lowest level in nine months as a cascade of macroeconomic signals and geopolitical tensions triggered a broad retreat from risk assets across global markets. The selloff extended beyond cryptocurrencies, with equities, precious metals, and derivatives markets all reflecting a sharp deterioration in investor sentiment.

The world’s largest cryptocurrency dropped as much as 8.4% over a 24-hour period, touching lows near $81,118, according to CoinGecko data. At the time of publication, Bitcoin traded near $82,526, still deep in correction territory.

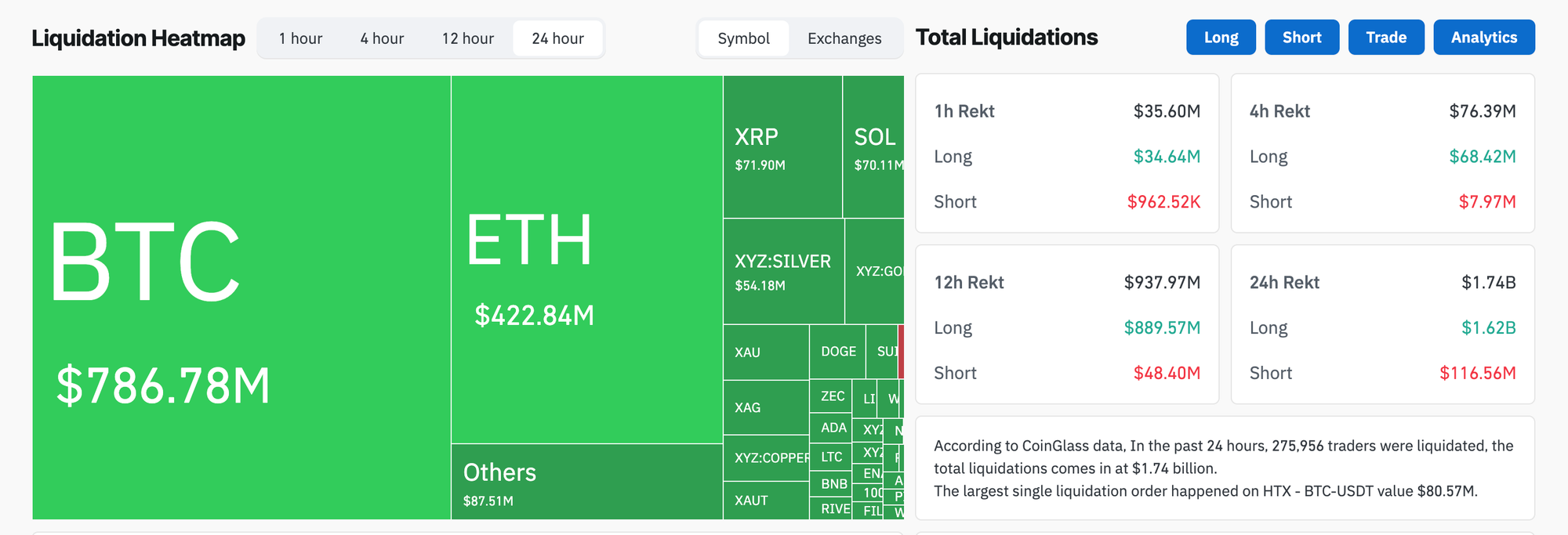

Total cryptocurrency market capitalization declined by roughly 6.7%, while leveraged positions suffered heavy losses. CoinGlass data shows $1.74 billion in liquidations over the past day, with the vast majority tied to long positions. Bitcoin alone accounted for roughly $786 million of those wiped-out bets.

Washington policy signals unsettle markets

Policy developments in the United States stood at the center of the market reaction. President Donald Trump confirmed plans to reveal his next Federal Reserve Chair nominee on Friday, a move that introduced uncertainty around future monetary policy direction.

Sources familiar with the matter told Reuters that former Federal Reserve Governor Kevin Warsh met with Trump at the White House on Thursday and reportedly “impressed” the president. There is a strong expectation that Warsh will receive the nomination.

Trump also signed an executive order declaring a national emergency that establishes a framework for tariffs on goods from countries that sell or provide oil to Cuba. The move compounded existing geopolitical stress already tied to Middle East tensions and fears of wider conflict.

Derivatives data confirms sustained selling pressure

Market structure data points to broad-based selling rather than isolated liquidation cascades. Velo data shows a sharp rise in Bitcoin open interest since Wednesday, while futures and spot cumulative volume delta both declined over the same period. That divergence indicates aggressive selling from both perpetual futures traders and spot market participants.

Options markets reflect similar caution. Sean Dawson, head of research at on-chain options platform Derive, said traders now position for deeper downside in the near term.

“Options market investors are betting on a short-term crash to the $70,000 to $75,000 range,” Dawson said in the statement. He cited a 30-day Bitcoin skew near -12%, a signal that traders pay a premium for downside protection.

“All in all, I expect a painful start to February,” he added, noting that the Clarity Act under Senate debate may offer regulatory clarity but lacks short-term price impact.

Tech selloff and shutdown fears amplify risk aversion

Weakness in U.S. technology stocks reinforced the downturn. Microsoft shares fell more than 12% after weaker earnings, marking the stock’s worst single-day decline since March 2020. The drop weighed heavily on major indices and spilled into crypto markets.

Concerns around a potential U.S. government shutdown added another layer of caution. Lawmakers failed to pass a spending package before the deadline, prompting traders to reduce exposure to volatile assets. Historical comparisons also resurfaced, as the 43-day shutdown that began in October previously coincided with a near 15% drop in Bitcoin prices.

Diverging outlooks emerge amid extreme fear

Market sentiment has deteriorated sharply. The Crypto Fear and Greed Index fell to 16, its lowest reading since December, reflecting what the index classifies as “extreme fear.”

Crypto analyst Benjamin Cowen warned that downside pressure may persist.

“Bitcoin’s likely going to keep bleeding against the stock market,” Cowen said, arguing that expectations of a rapid rotation from gold and silver into crypto remain premature.

Others see conditions for a medium-term inflection. Swyftx lead analyst Pav Hundal said that Bitcoin often lags precious metals during periods of macro stress.

“Bitcoin bottoms have historically lagged gold’s relative strength by about 14 months,” Hundal said, adding that a potential bottom could emerge within the next 40 days if historical patterns hold.

For now, Bitcoin remains near critical technical support, with macro policy signals, geopolitical risks, and liquidity conditions dictating near-term direction.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource, and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice, HODL FM strongly recommends contacting a qualified industry professional.